The reverse mortgage market continues to adjust to a new normal after the downturn in the refinance boom and the exit or consolidation of multiple top 10 lenders in the space.

Home equity conversion mortgage (HECM) endorsements fell in January to 2,489, a drop of about 10.7%, according to Reverse Market Insight (RMI) data. December 2022 previously marked the lowest total monthly endorsements in the last three years (excluding the pandemic-related April 2020 decline), but January 2023 is now the lowest month in the last three years for endorsements.

The production of new HECM-backed securities (HMBS) continued its downward momentum in January, according to data compiled by New View Advisors. New HECM-backed securities production declined to $523 million last month from $742 million the month prior.

While last year’s issuance was higher than the total seen in 2021 — and marked a new full-year record — it is unlikely this trend will continue in 2023, according to Ginnie Mae data and New View.

Endorsements: Expectation vs. reality

The drop was not unexpected — and aligns with the expectations of RMI President John Lunde.

“We’ve seen a consistent drop in case numbers issued in recent months, which suggested we had at least another few months of weak endorsement data to come after November’s case number data,” Lunde said. “We’ve now seen that transpire.”

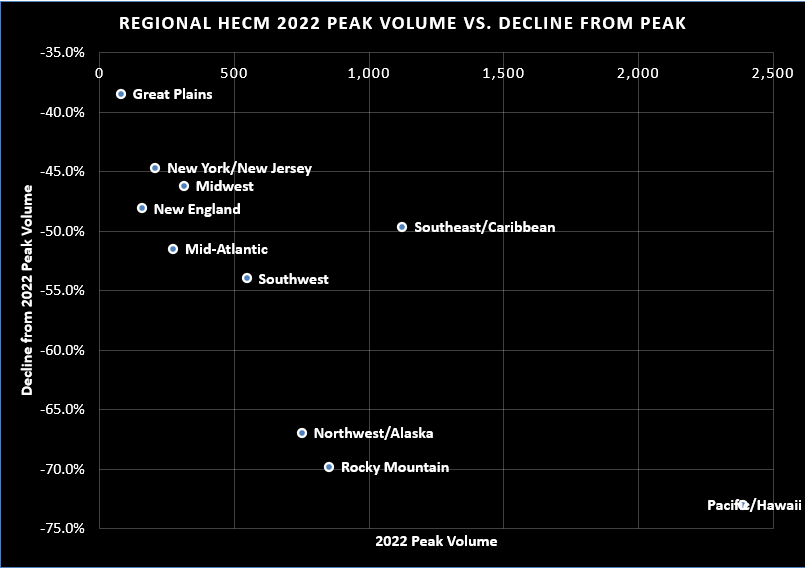

The data from the time following the HECM-to-HECM refinance boom appears to show that the regions of the country with the highest refi volume also have the largest endorsement drops, Lunde said.

The trend warrants a call-out, Lunde said, to better contextualize where and why the industry has softened.

“Given the end of the refi boom we saw in 2022, and the resulting weakness in the market, it seemed like a good moment to look at how that had played out across the regions,” he said. “We found mostly what we expected: the regions with the highest volume peaks in 2022 (which effectively coincide with those benefiting most from refi volume) also saw the steepest declines.”

One exception to the trend is the Southwest/Caribbean region. RMI is unsure of what caused this exception, but will take a closer look at that regional data to determine why it may be an outlier.

Finding the bottom

When asked about what the bottom is for the industry — and when it may see an uptick, Lunde said, “I do think we’re close to the bottom, as some of our earliest indicators of volume are showing a bounce. We also have almost no refinance volume left in the recent numbers so that part of the decline has already worked itself out. We certainly weren’t doing enough in the summer and probably early fall to find new borrowers, but hopefully by now everyone is firmly focused on them.”

The industry would do well to find borrowers who have not previously engaged with the reverse mortgage industry, Lunde said.

“RMI has developed a couple of tools, like our product qualification API, that quickly sifts through existing forward loan borrowers and provides all the key information needed for a first marketing/sales approach,” he said. “We think it’s the right tool at the right time for the industry to capitalize on a perfect moment to grow the mainstream adoption of reverse mortgages.”

Either way, Lunde is looking ahead to 2023 — which could end on a brighter note than 2022, he said.

“Call me an optimist, but January is already looking like we’re in for a much better 2023 than last year,” he said. “I can’t wait to see how the year unfolds.”

HMBS issuance: In line with expectations

When asked if the drop on the HMBS side conformed to expectations, New View partner Michael McCully said it did in large part. It’s still unclear as to whether the bottom has been found on the HMBS side.

“The drop is in line with expectations, primarily due to the rise in interest rates and the end of the refinancing wave that occurred during 2022,” McCully said. “It’s too soon to tell [if issuance has reached the bottom]. The fallout from the RMF bankruptcy is not fully known. But assuming the recent rally in rates holds, and home price appreciation doesn’t fall precipitously, volume will pick up as the year progresses.”

Prior to year-end, Ginnie Mae assumed control of RMF’s servicing portfolio. When asked whether that had a discernible impact on the health of the HMBS market, McCully said it was only part of the story.

“Losing RMF’s tail volume explains some of the drop, but the big story is the drop in January’s original first participation volume,” he said. “$347 million is a tally we haven’t seen in years.”

It’s also too soon to tell what, if anything, the takeaway from the HMBS issuance trend should be for the industry, McCully said. Whether the industry will absorb the new-issue volume from RMF that was lost in the bankruptcy remains to be seen.

Read the January HECM Lenders report at RMI and the January HMBS Issuance report at New View Advisors.