The Federal Housing Administration (FHA) announced new guidance for FHA mortgage appraisals on Wednesday, aimed at both the forward and reverse mortgage programs and designed to limit instances of racial bias in the valuation of homes seeking FHA mortgage financing. This is according to the publication of Mortgagee Letter (ML) 2021-27 released on Wednesday.

“The ML reinforces the Department of Housing and Urban Development (HUD) and FHA’s commitment to preventing racial bias in the valuation of single-family properties by clarifying the requirements for the compliance with the Fair Housing Act requirements, which relate to the appraisal process for properties that will serve as security for FHA-insured financing,” FHA said in an announcement of the new ML.

The new guidance is designed to clarify the expectations FHA maintains for appraisers and mortgagees, emphasizing that they “are to comply with all applicable anti-discrimination laws, including the Fair Housing Act as they relate to appraisals for FHA Single Family Title II forward and reverse mortgage programs.”

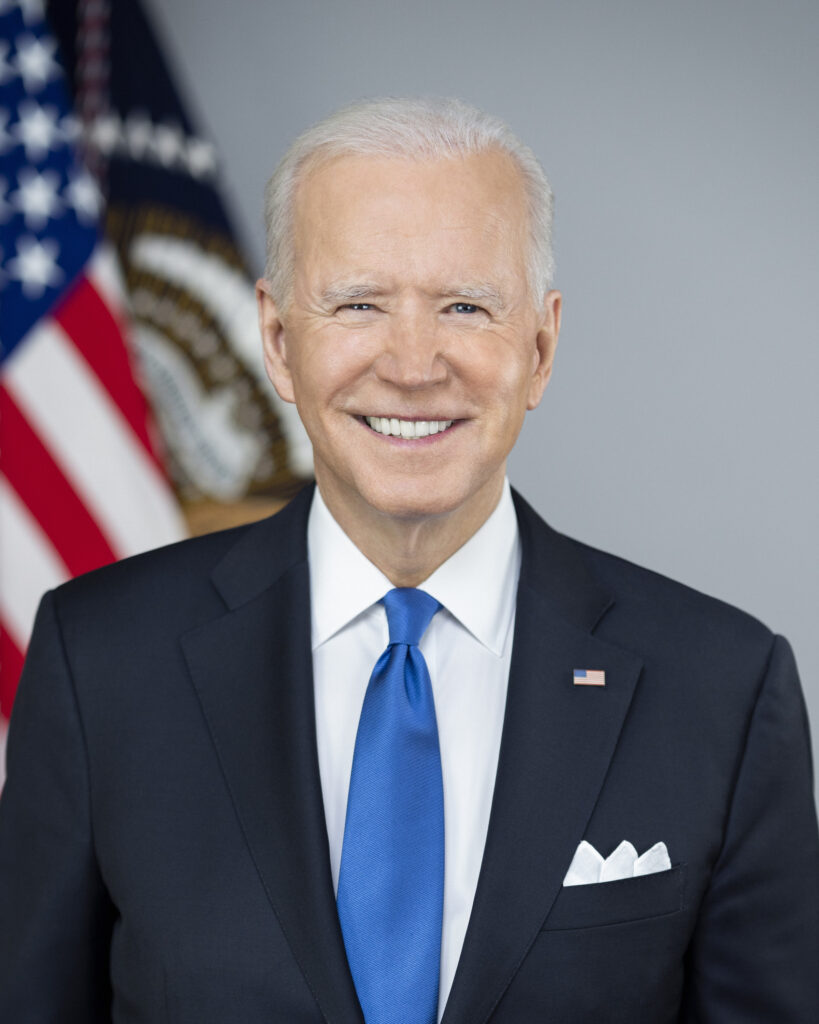

A priority of the Biden administration

The publication of the new ML follows up on ideas and themes expressed by President Joe Biden in June when he followed in the footsteps of his predecessors to declare that month as “National Homeownership Month.”

“Today, for people across the United States, the desire to own a home burns as brightly as it ever has,” the president said in his June proclamation. “Yet the stark reality is that, for too many, the dream of homeownership is becoming more difficult to realize and sustain. This is especially true in the wake of the economic devastation inflicted by the COVID-19 pandemic.”

It is also true for people of color, who continue to face housing discrimination that can affect their ability to secure a mortgage, have a home appraised or live in neighborhoods of their choice, the president said.

The same day the president issued that proclamation, he announced the creation of an interagency initiative to address inequity in home appraisals, called the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE).

“[PAVE] seeks to harmonize across federal agencies to root out discrimination and bring about systemic change in the appraisal and homebuying process,” the new ML reads. “As one effort to address discrimination in the appraisal process, this [ML] clarifies FHA’s existing requirements for Appraisers and Mortgagees regarding compliance with Fair Housing laws related to the appraisal of properties that will serve as security for FHA-insured mortgages.”

Unlike other updates to the Single Family Housing 4000.1 handbook explicitly related to the HECM program, which will be implemented sometime in 2022 after a recently-extended review process, the guidance contained in this ML is effective immediately for both FHA-insured forward and reverse mortgage programs, the ML explains. However, the updates will be codified into the handbook in a forthcoming update.

Expected areas of compliance

In its efforts to strengthen the housing market and bolster the economy while protecting consumers, this new guidance from FHA and HUD is designed to reflect the actions of the federal government’s housing arm to comply with President Biden’s Executive Order 13985 issued on the day of his inauguration.

“Federal fair housing requirements flow from the 1968 passage of the Fair Housing Act and its subsequent amendments, in addition to other civil rights laws,” the ML reads. “As noted in Executive Order 13985, ‘[a]ffirmatively advancing equity, civil rights, racial justice, and equal opportunity is the responsibility of the whole of our Government.’ Promotion of economic opportunity and fair housing is at the core of HUD and FHA’s role.”

In its effort to advance equity for people who have been “historically underserved, marginalized, and adversely affected by persistent poverty and inequality,” HUD expects all parties engaged in FHA’s mortgage insurance programs “to eliminate all considerations of race, color, national origin, religion, sex, familial status, or disability from the appraisal process,” the ML reads.

“[This includes] considerations of race or national origin of the homeowner, homeowner’s neighbors, and the racial composition of neighborhoods where comparable properties are identified,” the guidance says. It lists relevant provisions of applicable law that should be observed including Title VIII of the Civil Rights Act of 1968 as signed into law by President Lyndon B. Johnson; the Fair Credit Reporting Act; and the Equal Credit Opportunity Act.

Key changes

The ML contains three specific updates to current policy which reflect the priorities as outlined. The section regarding “Appraisers Post-Approval Requirements” has been reworded to emphasize compliance with all applicable federal, state and local anti-discrimination laws including the Fair Housing Act.

The “Quality of Appraisal” section has been changed to emphasize the requirement for the mortgagee to “ensure the appraisal complies with all applicable laws including the Fair Housing Act and all other federal, state, and local anti-discrimination laws,” the ML reads.

Finally, the “General Appraiser Requirements” section has been restructured into a new series of subsections, clarifying guidance as it relates to FHA guidelines regarding appraiser conduct, and clarifying specific non-discrimination guidance.

“Stakeholders must review and familiarize themselves with the changes outlined in this ML to ensure they are in compliance with the Fair Housing Act and other anti-discriminatory laws,” the ML announcement said. “The policy updates noted in today’s ML will be incorporated in a future version of Handbook 4000.1.”

Read ML 2021-27 at HUD.