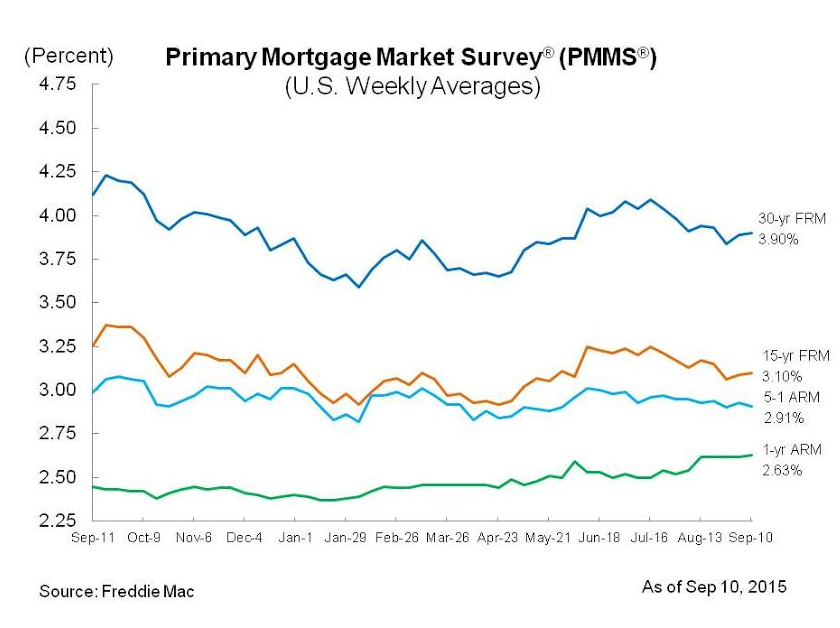

Mortgage rates barely wavered following Labor Day weekend, the latest Freddie Mac Primary Mortgage Market Survey said. This comes after two weeks of volatile swings due to uncertainty in China.

The 30-year fixed-rate mortgage averaged 3.9% for the week ending Sept. 10, 2015, up from last week when it averaged 3.89%. A year ago at this time, the 30-year FRM averaged 4.12%.

The 15-year FRM also moved higher, averaging 3.1%, slightly up from last week when it averaged 3.09%. A year ago at this time, the 15-year FRM averaged 3.26%.

Meanwhile, 5-year Treasury-indexed hybrid adjustable-rate mortgage dipped and fell to 2.91% this week, down from last week when it averaged 2.93%. A year ago, the 5-year ARM averaged 2.99%.

The 1-year Treasury-indexed ARM averaged 2.63% this week, up from last week when it averaged 2.62%. At this time last year, the 1-year ARM averaged 2.45%.

Click to enlarge

(Source: Freddie Mac)

“Following a shortened week, mortgage rates were virtually unchanged, inching up 1 basis point to 3.9%,” said Sean Becketti, chief economist with Freddie Mac.

“The employment report released last Friday provided mixed signals, adding one more note of uncertainty prior to the Fed’s September meeting,” he continued.

Looking at last Friday’s employment numbers, total nonfarm payroll employment increased by a mere 173,000 in August, while the unemployment rate edged down to 5.1% because of people dropping out of the workforce, bringing the labor participation rate down to a 38-year low.