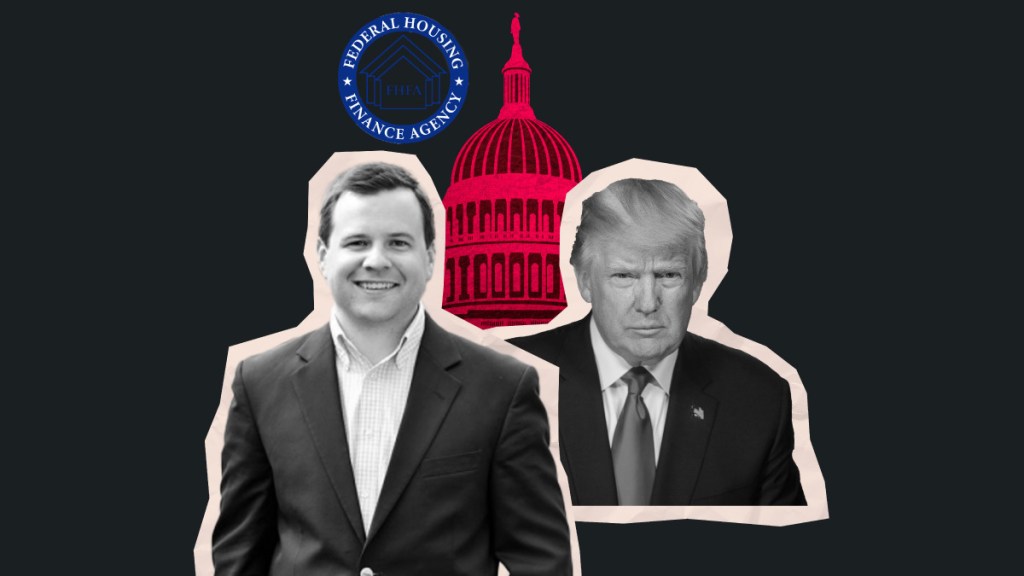

Bill Pulte, a private equity professional, philanthropist and grandson of the late homebuilding icon William Pulte, will be Donald Trump‘s nominee to lead the Federal Housing Finance Agency (FHFA), according to reports from multiple outlets on Thursday.

Trump confirmed the nomination on his Truth Social account.

“I am pleased to announce that Bill Pulte will serve as the next Director of the Federal Housing Finance Agency,” Trump wrote. “Bill needs no formal introduction to the Great Citizens of our Country, because they have seen, and many have experienced, his philanthropy firsthand. He believes in the incredible potential of our Nation, and will help us restore the American Dream FOR ALL.”

If Pulte is confirmed by the Senate, he would succeed Sandra Thompson as the head of the FHFA, which oversees the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. Thompson announced last week that she would step down from her post on Jan. 19, the day before Trump’s inauguration.

The Community Home Lenders of America (CHLA) issued a statement of support in response to the nomination.

“CHLA congratulates Bill Pulte on the announcement that he will be nominated for FHFA Director. We look forward to working with him on the critical priorities of homeownership affordability and protecting smaller IMBs in any plan in which Fannie Mae and Freddie Mac exit conservatorship,” the statement read.

In November, The New York Post reported that Pulte was under consideration for the role of secretary at the U.S. Department of Housing and Urban Development (HUD). But less than two weeks later, Trump nominated former Texas state representative and White House official Scott Turner for the HUD post. Turner was in the middle of his own Senate confirmation hearing on Thursday when Pulte’s nomination was announced.

In 2011, Pulte founded Pulte Capital Partners LLC, which focuses on construction investments in “middle-market companies and lower-priority divisions of national companies,” according to the company’s website.

His nomination comes at a critical time for the FHFA and the GSEs as the second Trump administration has renewed a push to release Fannie and Freddie from federal conservatorship, where they have been since the housing market crash in 2008. Earlier this month, the U.S. Treasury and the FHFA took key steps for returning the GSEs to the private sector by amending their Preferred Stock Purchase Agreements (PSPAs).

Bob Broeksmit, president and CEO of the Mortgage Bankers Association (MBA) — which has previously expressed its support for bringing the GSEs out of conservatorship — also issued a statement that included support for Pulte.

“We look forward to working with him and the FHFA staff on policies and programs that boost housing supply and create affordable opportunities for our nation’s homebuyers and renters while protecting taxpayers and ensuring a robust secondary mortgage market and Federal Home Loan Bank system for single-family and multifamily lenders,” Broeksmit said.

“The conservatorship of Fannie Mae and Freddie Mac (GSEs) was never intended to be permanent. MBA stands ready to work with the Administration and Congress to ensure that the transition to a post-conservatorship era for the GSEs is done the right way, including the critical step that Congress approves an explicit federal backstop for the GSEs’ mortgage-backed securities, to prevent severe market disruptions.”

The GSEs have been criticized in the past for stepping outside their core mission to provide affordable financing. A prime example occurred in 2024 when the FHFA approved a Freddie Mac pilot program for purchasing up to $2.5 billion closed-end, second-lien mortgages.

But Mat Ishbia, president and CEO of United Wholesale Mortgage (UWM), said he is supportive of the GSEs rolling out new programs.

“I like the innovation from Fannie and Freddie,” Ishbia told HousingWire in an interview on Thursday. “I think we need more of that, not less of that. I think we need them to try to impact and help more consumers, fill voids.”

Ishbia also touched on the “micro-level” impacts to consumers — including the costs of appraisals, credit reports and title insurance — as areas the FHFA can improve upon to meaningfully increase access to purchase and refinance loans.

“There’s a lot of costs that could be looked at, that I think Fannie and Freddie could be innovative around, with the green light from FHFA,” he said. “But I think they’ve been kind of unable to do that in this past administration. … Those are the things that the industry would be happy about and consumers would be happy about.

“I think it’s innovation and technology, making lending essential to everybody, and at the same time, making sure rates are great and doing different things to support consumers.”

Editor’s note: This story has been updated with comments from the Mortgage Bankers Association and United Wholesale Mortgage.