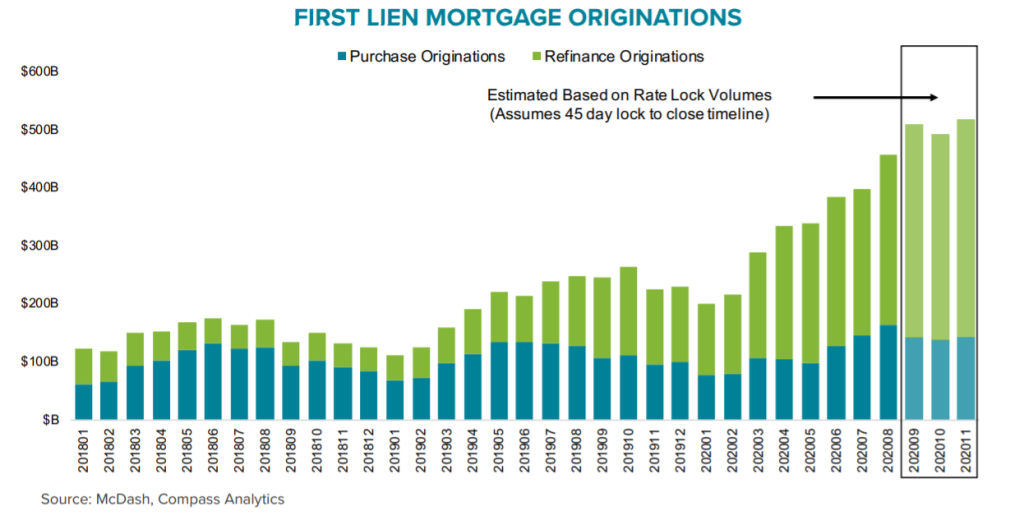

New rate lock data suggests 2020 will end with over $4 trillion in mortgage origination volume, easily a record.

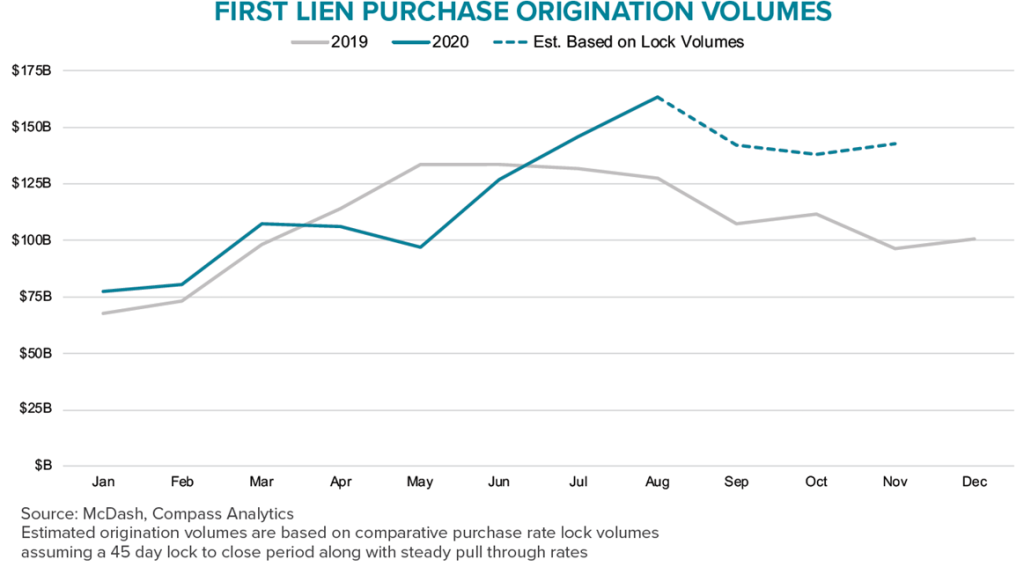

The data, from Black Knight’s “Mortgage Monitor” report, shows that rate lock activity in the first half of October was up 4% from September, with purchase locks up 6% and refinance locks up 3%. Add low mortgage rates to the recipe and quarterly mortgage origination volume is expected to reach record levels across both purchase and refi.

This trend portends increased mortgage origination volume moving into Q4, remaining at peak levels through at least November, according to Ben Graboske, president of data and analytics at Black Knight.

“This suggests that origination and prepayment activity will likely remain elevated well into Q4 2020,” he said in a statement. “September lock activity held relatively level with August, but through October 19, lock activity overall is up 4% from the month prior – with purchase locks up 6% and refinance locks up 3% thus far. Interest rates setting new record lows in mid- and late October will likely continue to fuel lock activity in coming weeks.”

Graboske said underlying 45-day rate locks suggest that refinancings in the third quarter could increase by 25% from the second quarter, while purchase mortgage origination volume could spike by 35% or more.

“This would push 2020 purchase lending to the highest level since 2005 and both refinance lending and total origination volumes to their highest levels ever,” Graboske said. “Indeed, total lending in 2020 is well on its way to easily eclipse the $4 trillion mark for the first time in history.”

This record mortgage origination volume is occurring despite increased volatility in the financial markets and the adverse market refinance fee the GSEs have implemented, which is set to take effect on Dec. 1.

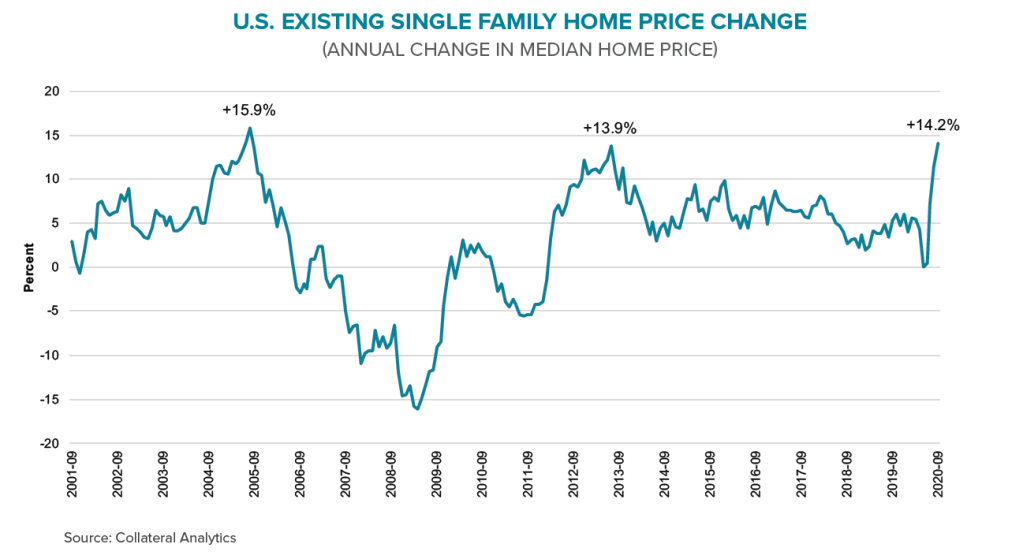

Black Knight’s report also found that home price appreciation has risen dramatically since May, attributed to historically low interest rates and limited inventory. According to daily home price tracking data from Black Knight, homes appreciated in value by 11.5% in August and then hit 14.2% growth in September, the highest rate in over 15 years.

The improving economy resulted in a 3.10% drop in delinquencies in September, while the prepayment rate increased 12.7% from August. There are now roughly 821,000 home owners that are a single month behind on payments, down almost 20% from pre-pandemic levels, and the lowest rate since at least 2000, according to Black Knight.

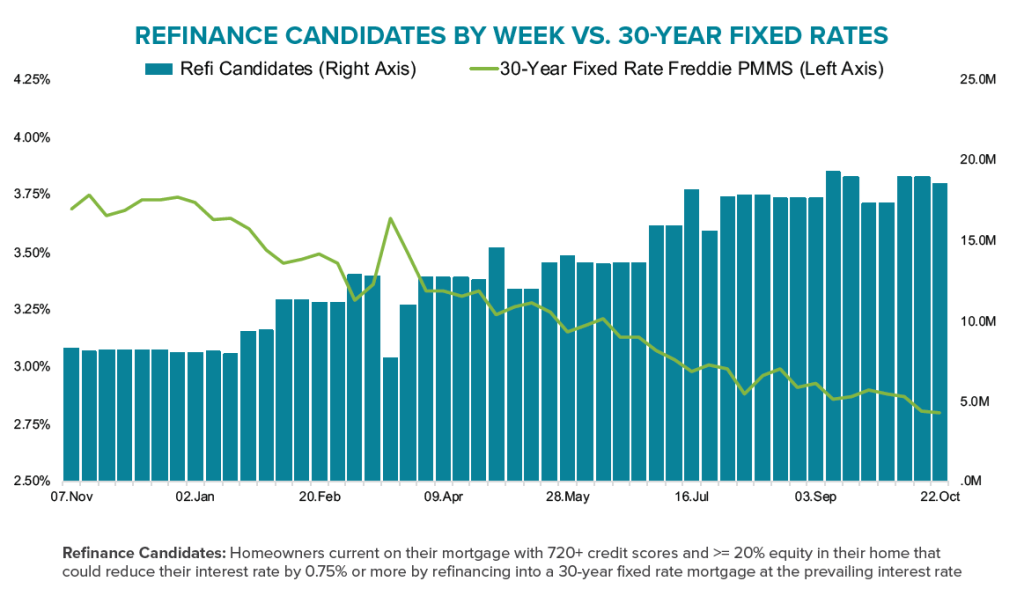

Roughly 18.5 million home owners still meet broad-based underwriting criteria to shave about 75 basis points off their mortgage through a refinancing. That’s about 10.4 million more homeowners eligible than at this time last year. Per Black Knight, the average homeowner could save $304 a month with a new home loan at today’s rates.