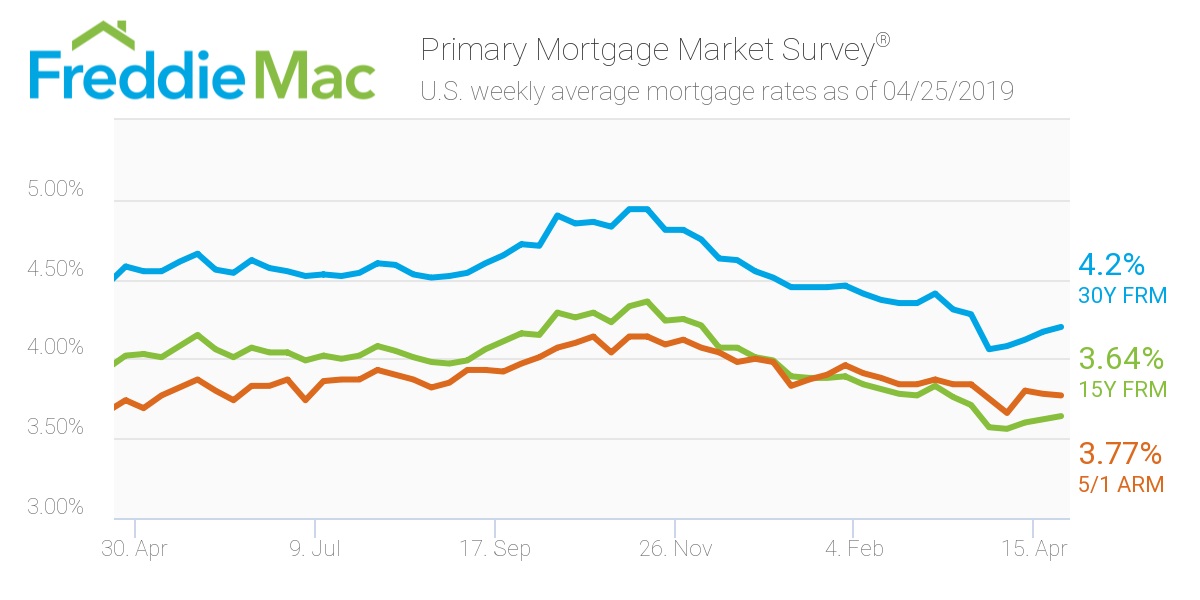

Mortgage interest rates have now risen for the fourth consecutive week, according to the latest Freddie Mac Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage averaged 4.2% for the week ending April 25, 2019, slightly up from last week’s rate of 4.17%

Notably, this week’s rate is moderately lower than last year’s rate of 4.58%.

“Despite the recent rise in mortgage rates, both existing and new home sales continue to show strength – indicating the lagged effect of lower rates on housing demand,” Freddie Mac Chief Economist Sam Khater said. “This, along with improved affordability, should push housing activity higher in the coming months.”

The 15-year FRM averaged 3.64% this week, crawling forward from last week’s 3.62%. This time last year, the 15-year FRM sat much higher at 3.74%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.77%, inching backwards from last week’s rate of 3.78. Once again, this rate remains slightly higher than the same time period in 2018, when it averaged 3.74%.

(Click to enlarge)