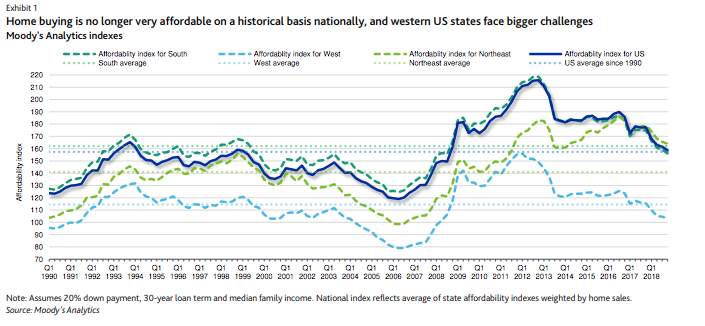

It’s official: The era of unusually affordable housing has ended. Well, according to a recent Moody’s Investors Services analysis.

The organization claims that America’s housing affordability has returned to average historical levels, therefore impacting credit quality across numerous housing-related sectors.

“Homes are no longer relatively cheap on a national basis, and certain market segments are in worse shape, reflecting supply-and-demand imbalances stemming from the 2007 through 2012 housing slump, as well as demographic changes and the long U.S. economic expansion and its unevenly spread benefits,” Moody writes. “Reduced affordability is also a lingering issue in the rental market, where the effects are in some ways more severe.”

According to Moody’s, some issuers are mostly exposed to the broad effects of reduced affordability in the housing market, while others face more discrete challenges and opportunities that reflect specific pockets of weakness.

For example, the report states that softening industry conditions have ignited an increased focus on lower-priced home construction for the nation’s homebuilders.

And Moody’s is right, because even the latest Housing Market Index produced by the National Association of Home Builders and Wells Fargo indicates that although homebuilder confidence rose to 63 points in April, many homebuilders still cite affordability as a cause of concern.

“Builders report solid demand for new single-family homes, but they are also grappling with affordability concerns stemming from a chronic shortage of construction workers and buildable lots,” NAHB Chairman Greg Ugalde said.

But, even if America’s home building and real estate sectors are experiencing financial setbacks, that doesn’t mean the entire housing industry is suffering.

According to Moody’s report, residential mortgage-backed securities, banks and mortgage insurers are thriving. This is because weakening origination quality and slower home price appreciation represent only modest risks for this sector.

Furthermore, state and local housing finance agencies are likely to benefit from increased demand for mortgages from homebuyers and developers of affordable apartments, according to Moody’s.

“There should be greater demand, for example, for private mortgage insurance that allows for low down payments,” Moody’s writes. “Similarly, nonbank lenders are benefiting from more demand for FHA, VA and non-prime loans. Meanwhile, lenders with branch-based origination businesses may have the potential to win market share from online lenders to the degree that the online lenders are unable to convince consumers and real-estate agents that they can manage more challenging underwriting.”

This image highlights America's waning housing affordability: