Mortgage rates rose for the third consecutive week without regaining the level they were at before a late March plunge, but rates are still well below where they were a year ago.

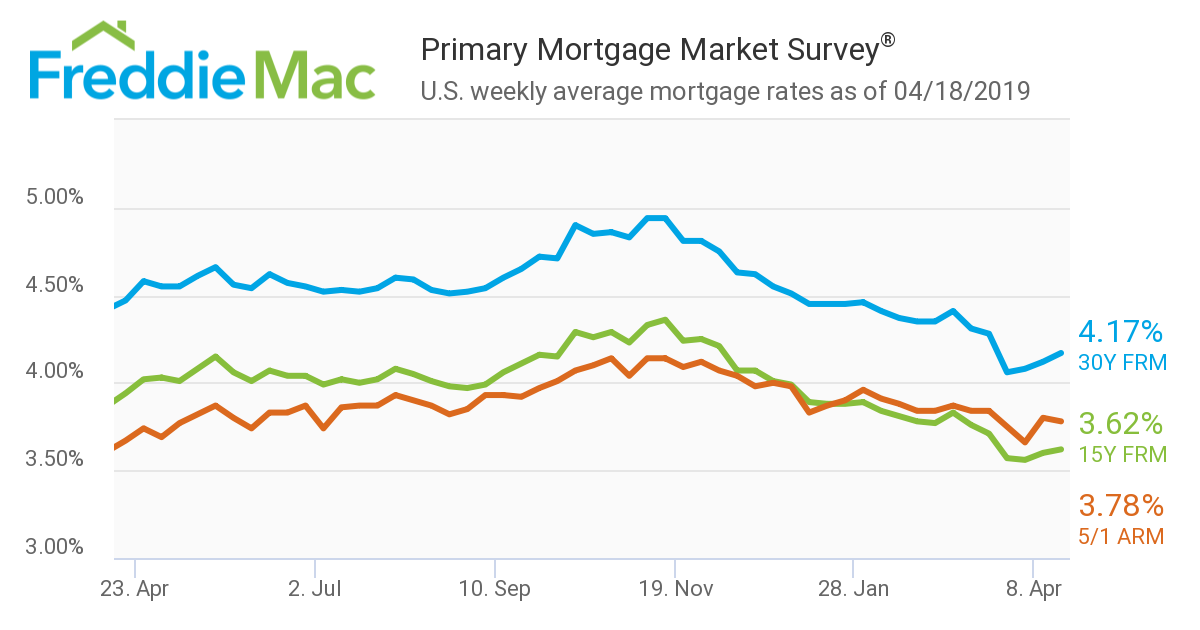

The average U.S. rate for a 30-year fixed mortgage is 4.17% this week, according to the latest Freddie Mac Primary Mortgage Market Survey. That’s up 5 basis points from last week’s 4.12%. On March 28, Freddie Mac announced mortgage rates had plunged by the most in over a decade.

“After dropping dramatically in late March, mortgage rates have modestly increased since then,” said Sam Khater, Freddie Mac’s chief economist. “While this week marks the third consecutive week of rises, purchase activity reached a nine-year high – indicative of a strong spring homebuying season.”

This week’s average rate is lower than a year ago when it was 4.47%, according to Freddie Mac.

The 15-year fixed rate averaged 3.62% this week, rising from last week’s 3.6%. A year ago, that rate was 3.94%.

The average U.S. rate for a five-year Treasury-indexed hybrid adjustable mortgage was 3.78%, down from from last week’s 3.80%. A year ago, it was 3.67%.

(Click chart to enlarge. Image courtesy of Freddie Mac)