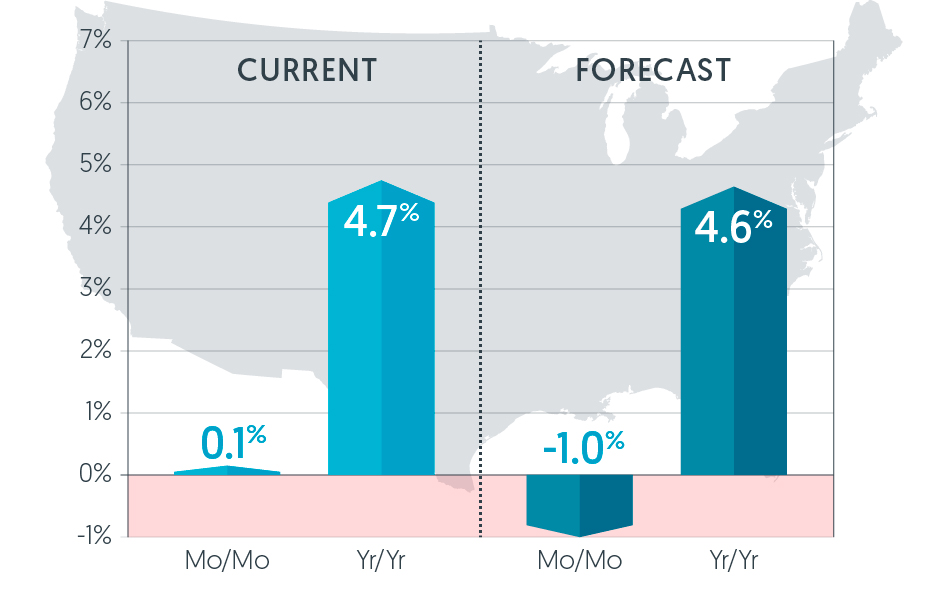

In December 2018, home prices climbed 4.7% from December 2017, according to CoreLogic’s latest Home Price Forecast.

According to the CoreLogic’s data, home prices only increased 0.1% from the previous month and are now projected to increase by 4.6% come December 2019.

The CoreLogic HPI projects future home price growth based on several economic variables and measures the number of owner-occupied households in each state.

The image below highlights CoreLogic's home price projections:

(Click to enlarge; image courtesy of CoreLogic)

CoreLogic’s Chief Economist Frank Nothaft said higher mortgage rates slowed home sales and price growth during the second half of 2018.

“Annual price growth peaked in March and averaged 6.4% during the first six months of the year,” Nothaft continued. “In the second half of 2018, growth moderated to 5.2%. For 2019, we are forecasting an average annual price growth of 3.4%.”

In fact, CoreLogic's recently released Case-Shiller report points to a continual slowdown nationwide.

S&P Dow Jones Indices Managing Director and Chairman of the Index Committee David Blitzer said home prices are still rising, but more slowly than in recent months.

“The pace of price increases are being dampened by declining sales of existing homes and weaker affordability,” Blitzer continued. “Sales peaked in November 2017 and drifted down through 2018. Affordability reflects higher prices and increased mortgage rates through much of last year.%.”

Freddie Mac’s January Forecast indicated that despite lackluster home price appreciation results, the housing market will continue to hold its ground.

“Despite the weakening of the housing market in 2018, early 2019 data signals a possible turnaround for the year to come,” Freddie Mac Chief Economist Sam Khater said. “This recent uptick in activity proves that homebuyers are very sensitive to changing interest rates and will likely respond positively if mortgage rates remain below 5%.”