Freddie Mac reported Tuesday it posted a comprehensive income of $2.4 billion in the second quarter of 2018.

This income is up slightly from the first quarter this year, when the company reported comprehensive income of $2.2 billion, and up even more from the second quarter of 2017, when it saw a comprehensive income of $2 billion.

The company explained this increase was due to strong business revenues as well as a $334 million favorable litigation judgement against Nomura Holding America involving non-agency mortgage-related securities.

“Freddie Mac’s transformation continued in the second quarter, with good business results and similarly good financial performance,” Freddie Mac CEO Donald Layton said. “In business operations, our guarantee book grew significantly, credit quality was high, and we are generating a consistent stream of new innovations for our customers.”

“On the financial side, we produced strong earnings with a growing track record of quarterly stability,” Layton said. “These together provide the foundation necessary so Freddie Mac can effectively deliver on all aspects of its mission and, more broadly, improve America's housing finance system.”

The company reported its new origination volumes grew by 29% from last year to $84 billion. Unsurprisingly, refinance activity dropped about 7%.

Through its credit risk transfer program, the government-sponsored enterprise announced it transferred risk on a total of $1 trillion in single-family mortgages outstanding.

The company’s net income came in at $2.5 billion for the quarter, down from $2.9 billion in the first quarter this year.

Net income in the fourth quarter of 2017 was driven down by a write-down in net deferred tax asset due to tax reform. Because of this reform, both GSEs were even allowed to regain their capital reserves and withhold $3 billion from the Department of the Treasury.

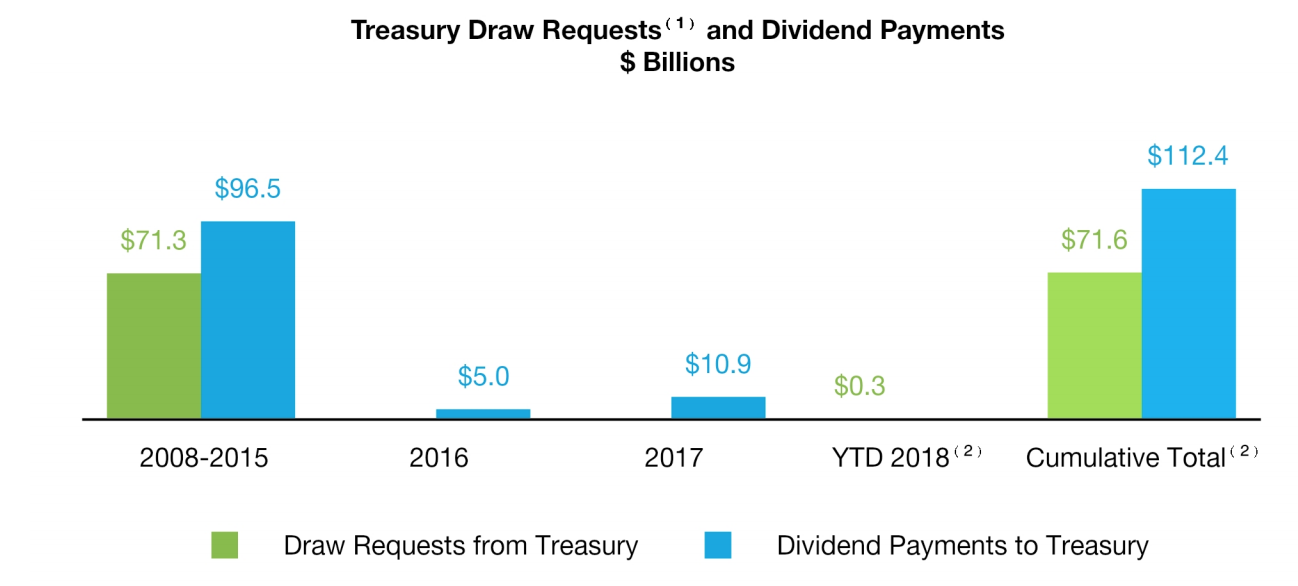

Because of this, the company will pay $1.6 billion dividend to the Treasury in September, based on its net worth as of June 30, 2018 of $4.6 billion. This will bring the total cash dividends paid to the Treasury to about $40.8 billion more than the cumulative cash draws received from the Treasury of $140.2 billion.

The chart below shows how much the company has given back to U.S. taxpayers since the beginning of its conservatorship by the Federal Housing Finance Agency in 2008.

Click to Enlarge

(Source: Freddie Mac)