Freddie Mac reported an increase in earnings from the fourth quarter, which was driven down significantly due to tax reform, but remained steady from the first quarter of 2017.

The company announced a comprehensive income of $2.2 billion for the first quarter of 2018. This was up from a loss of $3.3 billion from the fourth quarter.

However, the fourth quarter of 2017 was driven down by a write-down in net deferred tax asset due to tax reform. Because of this reform, both GSEs were even allowed to regain their capital reserves and withhold $3 billion from the Department of the Treasury.

But even that wasn’t enough to cover the loss, and both Fannie Mae and Freddie Mac were forced to draw from the Treasury after announcing their fourth-quarter earnings.

Excluding the write down of net deferred tax asset in the fourth quarter, Freddie Mac’s earnings came in at $5.4 billion. In the first quarter of 2017, the company reported a comprehensive income of $2.2 billion.

But now, Freddie Mac claims tax reform is working in its favor, giving it a $0.4 billion benefit from the reduced corporate tax rate, which dropped from 35% to 21% in the first quarter of 2018.

“Freddie Mac delivered $2.2 billion of comprehensive income this quarter, despite a major change in interest rates,” Freddie Mac CEO Donald Layton said. “In a period with no significant items and little impact from legacy asset dispositions, this demonstrated the increased stability of our earnings.”

“We also continued our impressive record of innovation-through a steady stream of real improvements by all three business lines,” Layton said. “In short, our results this quarter provide a particularly clear view of our earnings capacity and the progress we’ve made in fulfilling our mission by creating a better housing finance system for lenders, investors, families and taxpayers.”

During the first quarter, Freddie Mac announced it provided $80 billion in liquidity to the mortgage market, and funded 282,000 single-family homes and 152,000 multifamily rental units.

This quarter, the company will not make a payment to the Treasury as its continues to work to rebuild its $3 billion capital buffer.

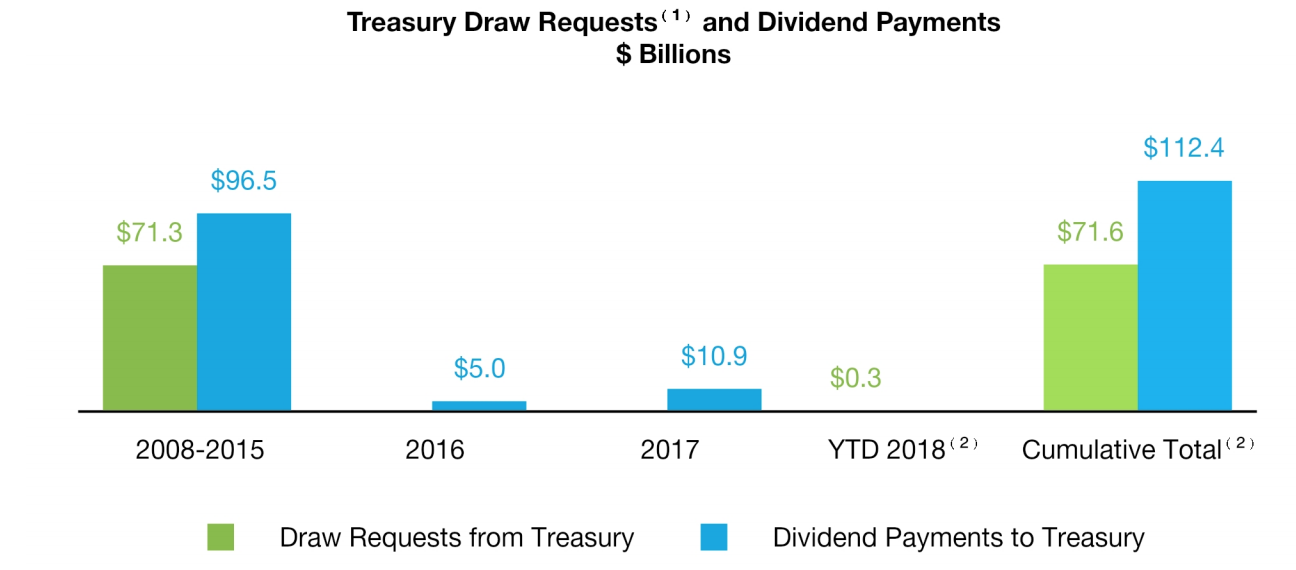

The chart below shows how much the GSE has paid back to the Treasury, compared to what it paid in total withdraws dating back to 2008.

Click to Enlarge

(Source: Freddie Mac)