Freddie Mac started 2017 slightly down as the market adjusted to lower refinance volumes and rising interest rate levels in the first quarter.

The Federal Reserve began raising interest rates this year, with one hike in March and two more widely anticipated later this year.

The government-sponsored enterprise reported net income of $2.2 billion for the first quarter of 2017, compared to net income of $4.8 billion for the fourth quarter of 2016.

Additionally, the company reported comprehensive income of $2.2 billion for the first quarter of 2017, compared to comprehensive income of $3.9 billion for the fourth quarter of 2016.

Freddie Mac primarily attributed the decline in the company’s first quarter 2017 results to a reduction in market-related gains as interest rates and spreads did not change significantly in the first quarter of 2017.

Although, Freddie also noted that a continued solid business environment and it growing guarantee businesses helped offset the decline.

This quarter’s news comes after Freddie Mac posted its fifth-straight year of profits at the end of 2016.

But despite the slow start to this year, Freddie Mac CEO Donald Layton is positive on what this means for the GSE. “Our strong first quarter results, as the impact of moves in interest rates and market spreads was near zero, show how Freddie Mac is better serving its mission to responsibly provide liquidity, stability and affordability to the nation’s mortgage markets, and doing so in a taxpayer efficient manner,” said Layton.

“Our total book of guarantee business grew more than 6% in the last year to $1.9 trillion. We did this by improving the technology, products and level of service provided to our lender customers,” he said. “This enables them, in turn, to responsibly and sustainably provide more competitive pricing and terms to a growing range of homeowners and renters. At the same time, we continue to innovate in transferring mortgage credit risk to private capital markets.”

“Together, our efforts are building a better housing finance system for America’s homebuyers, renters, lenders and taxpayers. We’re proud to be a leader in this change,” he concluded.

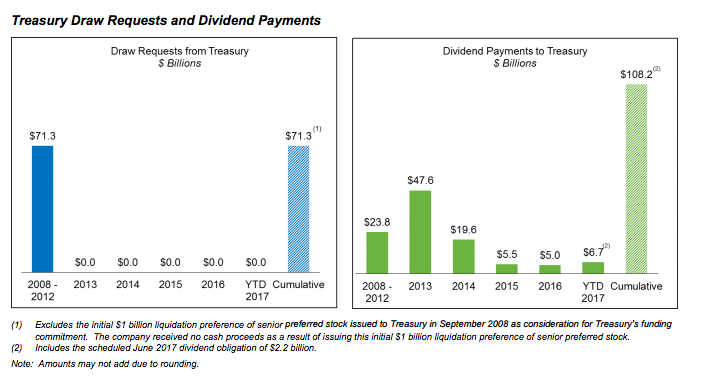

Freddie Mac’s dividend obligation to Treasury in June 2017 will be $2.2 billion, based on Freddie Mac’s net worth of $2.8 billion at March 31, 2017.

The applicable capital reserve amount is $600 million for 2017 and will be zero beginning on Jan. 1, 2018.

This brings the total to $108.2 billion in dividends paid to Treasury

The declining capital reserve is required under the terms of the Purchase Agreement, which will ultimately reach zero in 2018. Freddie Mac explained that the declining capital reserve increases the risk of it having a negative net worth and thus being required to draw from Treasury.

The chart below shows its dividend payments to Treasury sine 2008.

Click to enlarge

(Source: Freddie Mac)

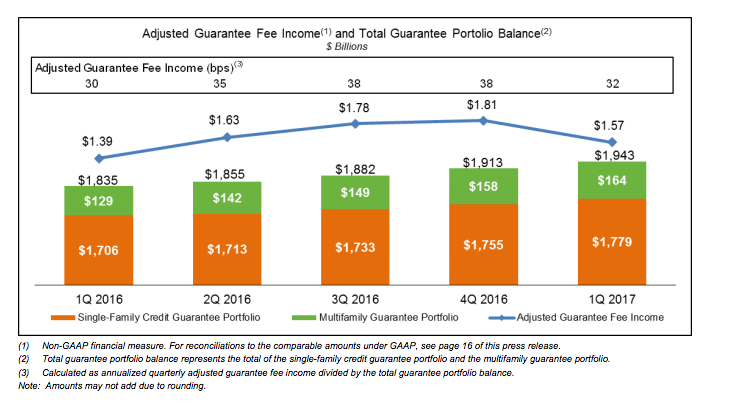

Adjusted guarantee fee income dropped to $1.6 billion, a decrease of $240 million from the fourth quarter of 2016.

Freddie Mac stated the decrease in adjusted guarantee fee income primarily reflects lower single-family revenue driven by a decline in refinancing volumes as interest rates increased. However, this was partially offset by higher average contractual guarantee fees.

The chart below shows adjusted guarantee fee income and guaranteed portfolio balance.

Click to enlarge

(Source: Freddie Mac)