Freddie Mac’s financial results remained steady in the second quarter, as it reported net income of $1.7 billion for the second quarter of 2017, which is slightly down from net income of $2.2 billion for the first quarter of 2017.

The company also reported comprehensive income of $2 billion for the second quarter of 2017, compared to comprehensive income of $2.2 billion for the first quarter of 2017.

According to the government-sponsored enterprise, market-related impacts remained low as market spreads were relatively unchanged and the implementation of hedge accounting offset most net losses arising from changes in interest rates.

This is compared to the first quarter when Freddie Mac attributed its decline in the company’s first quarter 2017 results to a reduction in market-related gains.

Donald Layton, Freddie Mac CEO, commented on the stability of the GSE, saying, “Our continued very solid financial results and strong business fundamentals reflect the company’s transformation into a well run commercial enterprise.”

“This transformation is enabling us to better deliver on the mission that is our purpose – to provide liquidity, stability and affordability to the American primary mortgage market. We’re doing that by helping lenders of all sizes compete which, in turn, expands affordable housing opportunities for borrowers and renters nationwide,” he said.

“Additionally, through our award-winning credit risk transfer programs, we’re fulfilling our mission with much less risk to taxpayers than in the past,” said Layton. “We at Freddie Mac are proud of the work we're doing and proud of the success we're having in making home possible for millions of Americans and in building a better housing finance system.”

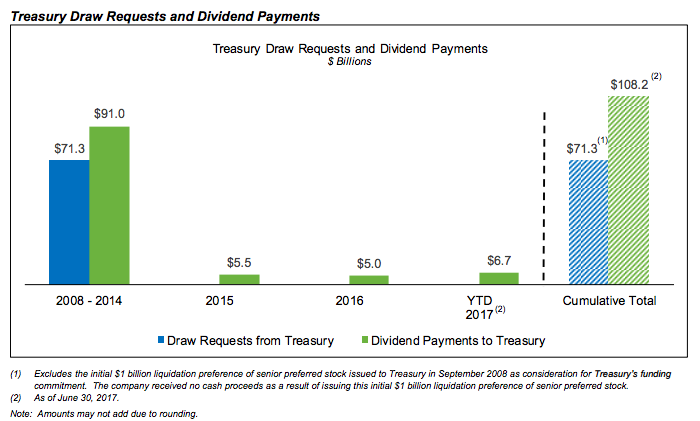

Freddie Mac’s dividend obligation to Treasury in September 2017 will be $2 billion, based on Freddie Mac’s net worth of $2.6 billion as of June 30, 2017 and the Capital Reserve Amount of $600 million in 2017.

Once again, the applicable capital reserve amount is $600 million for 2017 and will be zero beginning on January 1, 2018.

The declining capital reserve is required under the terms of the Purchase Agreement, which will ultimately reach zero in 2018. Freddie Mac cautioned that the declining capital reserve increases the risk of it having a negative net worth and thus being required to draw from Treasury.

The chart below shows the aggregate cash dividends paid to Treasury.

Click to enlarge

(Source: Freddie Mac)

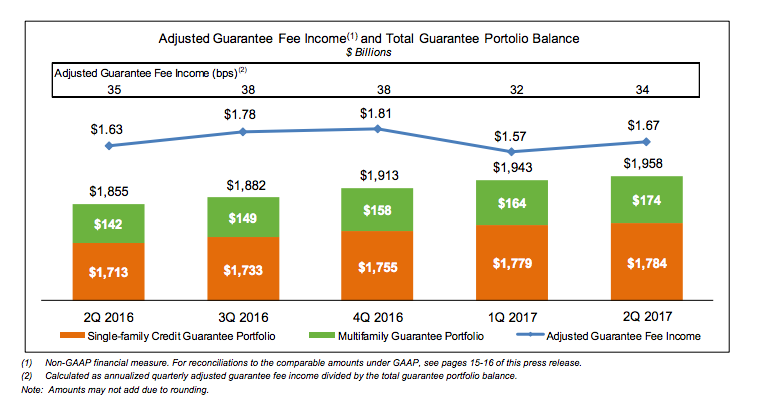

Adjusted guarantee fee income grew to $1.67 billion, an increase of $99 million from the first quarter of 2017 and $43 million from the prior year.

Freddie Mac attribute the increase in adjusted guarantee fee income from the prior quarter to higher amortization of single-family upfront fees driven by an increase in loan prepayments during the second quarter of 2017.

Also, adjusted guarantee fee income increased slightly when compared to the prior year driven by continued growth in the total guarantee portfolio.

The chart below shows adjusted guarantee fee income and guaranteed portfolio balance.

Click to enlarge

(Source: Freddie Mac)