Is a combination of high rents and shifting demographics driving a move from renting to buying?

The latest data from the Census Bureau shows that may be exactly what’s happening.

On Thursday, the Census released its quarterly report on residential vacancies and homeownership. And the report had some good news and bad news, depending on which industry you’re in.

For those who make their living via home buying, the news was mostly good. Homeownership held steady at 64.2%, demonstrating that there may be some underlying strength in the recent increases in homeownership.

But the news wasn’t quite so sunny in the rental world.

While the rental vacancy rate (units that remain unrented) held steady at 7%, the number of rental households fell for the fourth straight quarter.

According to the Census estimates, there were roughly 286,000 fewer renter households during the first quarter of 2018 compared to the first quarter of 2017.

Overall, there were approximately 43 million rental households in the U.S. in the first quarter, down from 43.287 million in first quarter of 2017.

Ralph McLaughlin, chief economist and founder of Veritas Urbis Economics, noted that the decrease in rental households is sign that more renters are becoming buyers.

“The fact that we now have four consecutive quarters where owner households increased while renters households fell is a strong sign households are making the switch from renting to buying,” McLaughlin said. “This is a trend that multifamily builders, investors, and landlords should take note of.”

McLaughlin went a step further, suggesting that landlords and multifamily homebuilders should be “nervous” about the seeming shift to buying. “This could lead to less demand for rental units this year, and downward pressure on rents,” McLaughlin said.

McLaughlin also noted that demographics may be playing a role in the shift between renting and buying.

“Households under 35 – which represent the largest potential pool of new homeowners in the U.S. – have shown some of the largest gains,” McLaughlin said. “While they only make up a third of all homebuyers, the steady uptick in their homeownership rate over the past year suggests their enormous purchasing power may be finally coming to housing market.”

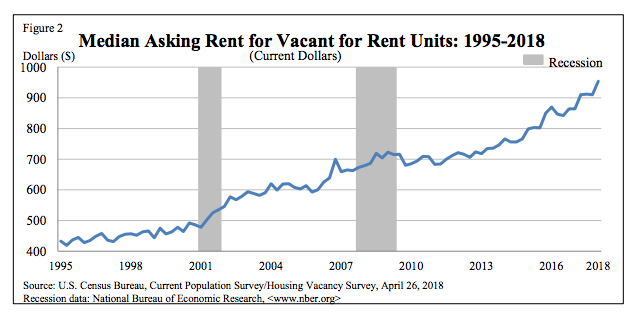

The downward pressure on rents may be needed, as the Census report showed that during the first quarter, median asking rents rose to the highest level since 1988, which is as far as back the Census data goes.

(Click to enlarge. Image courtesy of the Census Bureau.)

According to the Census report, the median asking rent was $954 in the first quarter, up $80 from the first quarter of last year. It’s also up $44 from the fourth quarter of 2017. The previous high was $912, which was recorded during the 3rd quarter of 2017.

Rent hit record levels in each of the four regions as well. In the Northeast, the median asking rent rose from $1,153 in the fourth quarter to $1,279 in the first quarter. In the same time period last year, the median asking rent was $1,057.

In the Midwest, the median asking rent climbed to $764, up from $725 in the fourth quarter and $716 in 2017’s first quarter.

In the South, the increase was much slighter, with rent rising from $906 in the fourth quarter to $907 in the first quarter. In the first quarter of last year, the rent was $847.

In the West, the increase was much more significant. In the first quarter, the median asking rent was $1,345, which was up from $1,210 in the fourth quarter and $1,132 in the first quarter of 2017.

In a note sent out after the report’s release, Matthew Pointon, property economist at Capital Economics, suggested that the rental data may actually be a little rosier than it appears.

“Given the number of existing homes for sale recently dropped to a record low, it is no surprise that the homeowner vacancy rate fell to 1.5% in the first-quarter, the joint-lowest rate for 24 years,” Pointon wrote.

“That has put a stop to what had been a gradual rise in the homeownership rate. It is also supporting rental demand. Despite a large rise in the number of rental apartments hitting the market over the past couple of years, the multifamily rental vacancy rate has held steady at just over 8% for the past six-months,” Pointon added.

Pointon said that the 7% overall rental vacancy rate is low by historical standards, and suggested that the news may show that multifamily housing is on firmer footing than it appears.

“At 8.2%, the multifamily rental vacancy rate is down marginally from 8.3% in the final quarter of last year, and suggests concerns about a large degree of oversupply of rental apartments is overblown,” Pointon said. “While a large number of apartments are being built, the lack of homes to buy is supporting rental demand. In turn, that argues against a sharp slowdown in rental growth this year.”