The national homeownership rate reached its highest level since the fourth quarter of 2014, increasing slightly in the last quarter of 2017, according to the Quarterly Residential Vacancies and Homeownership report from the U.S. Census Bureau.

The homeownership rate remained statistically unchanged, inching up to 64.2% in the fourth quarter. This is up from 63.7% the year before and 63.9% in the third quarter.

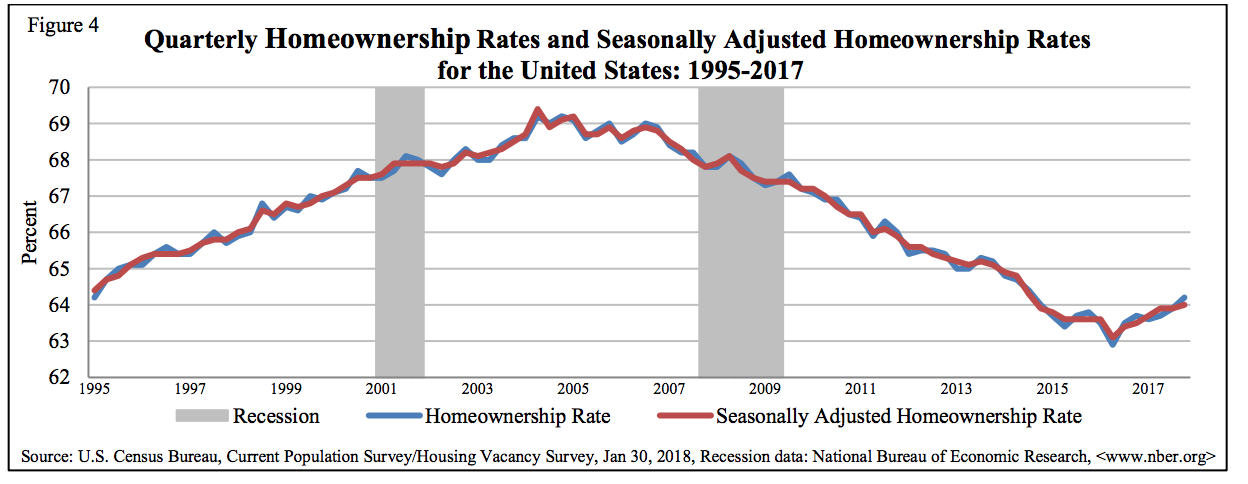

The chart below shows the homeownership rate has been steadily rising since 2016, however it remains historically low.

Click to Enlarge

(Source: U.S. Census Bureau)

“After bouncing around near 50-year lows for the past few years, the national homeownership rate finally seems to be gaining sustainable, meaningful upward momentum,” Zillow Senior Economist Aaron Terrazas said. “The fourth quarter of 2017 was unseasonably strong, driven by buyers determined to make a deal in a highly competitive market.”

“And for would-be buyers struggling to save for a down payment or figuring out how to make the monthly mortgage math pencil out, changes in the tax code that potentially put more money in their pockets could be the push they need to move out of an apartment and into a first home,” Terrazas said.

Among Millennials, the homeownership rate ticked up slightly from 35.6% to 36%. Among older generations, the homeownership is significantly higher at 75.3% for those aged 55 to 64 years and 79.2% for those aged 65 years and older.

“What's even more positive news for the housing market is that much of the increase in the homeownership rate over the past year has come from 18 to 44-yearolds,” Trulia Chief Economist Ralph McLaughlin said.

“Increases in homeownership amongst these two cohorts are a sign that the scars of the Great Recession are finally starting to heal, and provide a source of optimism that the owner-occupied segment of the housing market will continue to grow throughout the remainder of this economic cycle,” McLaughlin said.

Among the non-Hispanic white population, the homeownership rate increased from 72.5% in the third quarter to 72.7% in the fourth quarter. However, homeownership rates for other ethnicities are much lower.

The black homeownership rate increased 0.1 percentage point, but remains far below average at 42.1% in the fourth quarter. The Hispanic homeownership rate saw the highest increase, rising .5 percentage points to 46.6%.

This growth among the Hispanic population continues the trend outlined last year by the National Association of Hispanic Real Estate Professionals which showed the Hispanic homeownership rate accounted for 74.9% of the total net growth in the overall homeownership rate in the U.S.

The national homeowner vacancy rate decreased 0.2 percentage points from last year at 1.6%, while the national vacancy rate for rental housing remained unchanged at 6.9%.