Mortgages in any stage of delinquency decreased in July, along with foreclosure inventory, which dropped below 1%, according to the Loan Performance Insights Report from CoreLogic, a property information, analytics and data-enabled solutions provider.

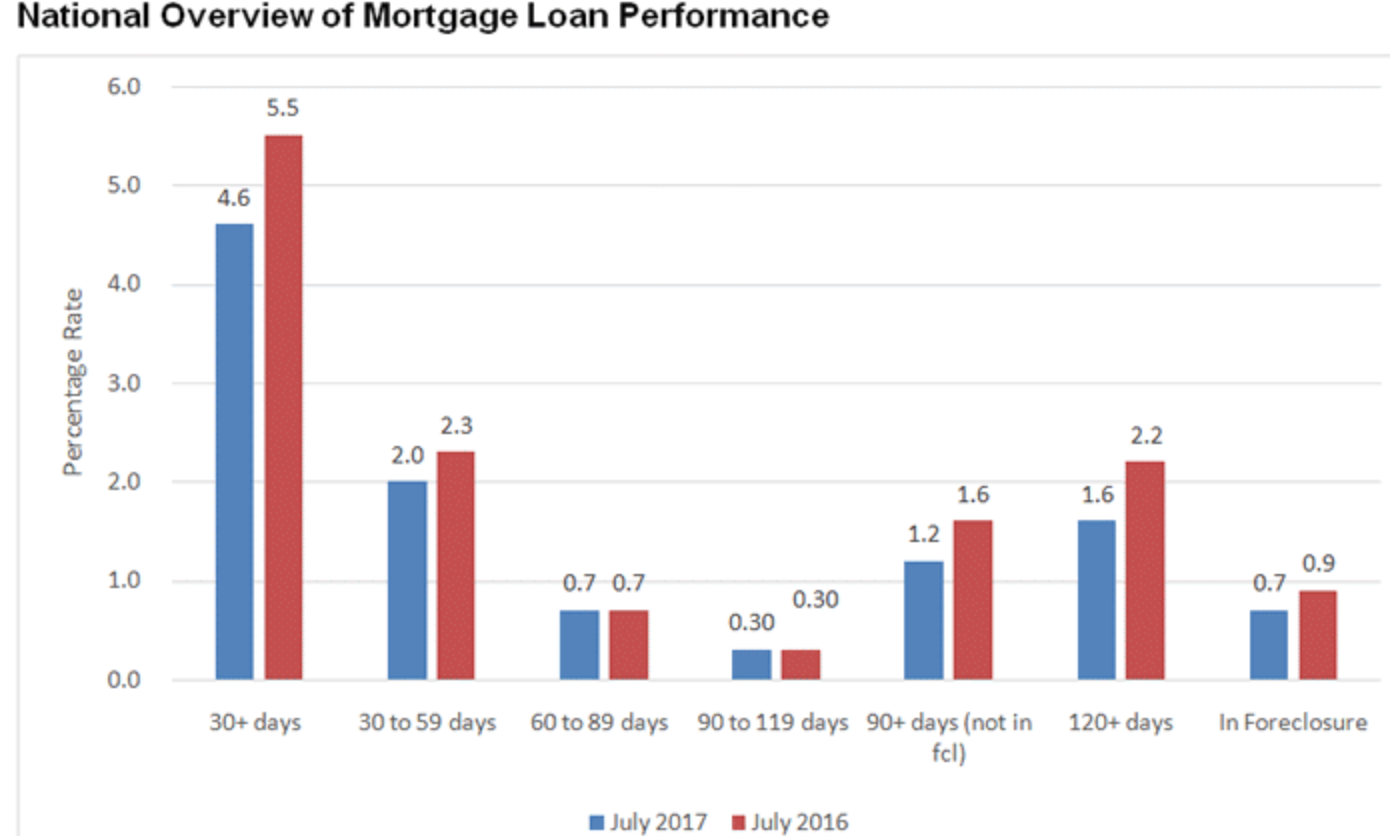

During July, the share of mortgages in some stage of mortgage delinquency, from 30 days past due to those in foreclosure, decreased to 4.6%. This is a decrease of 0.9 percentage points from 5.5% in July 2016, however it is up slightly from 4.5% in June.

Click to Enlarge

(Source: CoreLogic)

“While the U.S. foreclosure rate remains at a 10-year low as of July, the rate across the 100 largest metro areas varies from 0.1% in Denver to 2.2% in New York,” CoreLogic Chief Economist Frank Nothaft said. “Likewise, the national serious delinquency rate remains at 1.9%, unchanged from June, and when analyzed across the 100 largest metros, rates vary from 0.6% in Denver to 4.1% in New York.”

The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, hit 0.7% in July. This is down from 0.9% last year, and the lowest since July 2007, when the rate was also 0.7%.

According to CoreLogic, measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

Early stage delinquencies, those 30 to 59 days past due, dropped from 2.3% in July 2016 to 2% in July this year. The chart above shows these early stage delinquencies hold the highest share of mortgages.

Less mortgages are transitioning out of 30 days past due and into 30 to 59 days past due. Mortgages in transition was 0.9% in July, down from 1.1% in July last year. For comparison, the 30-day transition rate was 1.2% in January 2007 and peaked at 2% in November 2008.

“Even though delinquency rates are lower in most markets compared with a year ago, there are some worrying trends,” CoreLogic President and CEO Frank Martell said. “For example, markets affected by the decline in oil production or anemic job creation have seen an increase in defaults. We see this in markets such as Anchorage, Baton Rouge and Lafayette, Louisiana where the serious delinquency rate rose over the last year.”