Mortgage delinquency rates slipped slightly in June, according to the monthly Loan Performance Insights report from CoreLogic, a property information, analytics and data-enabled solutions provider.

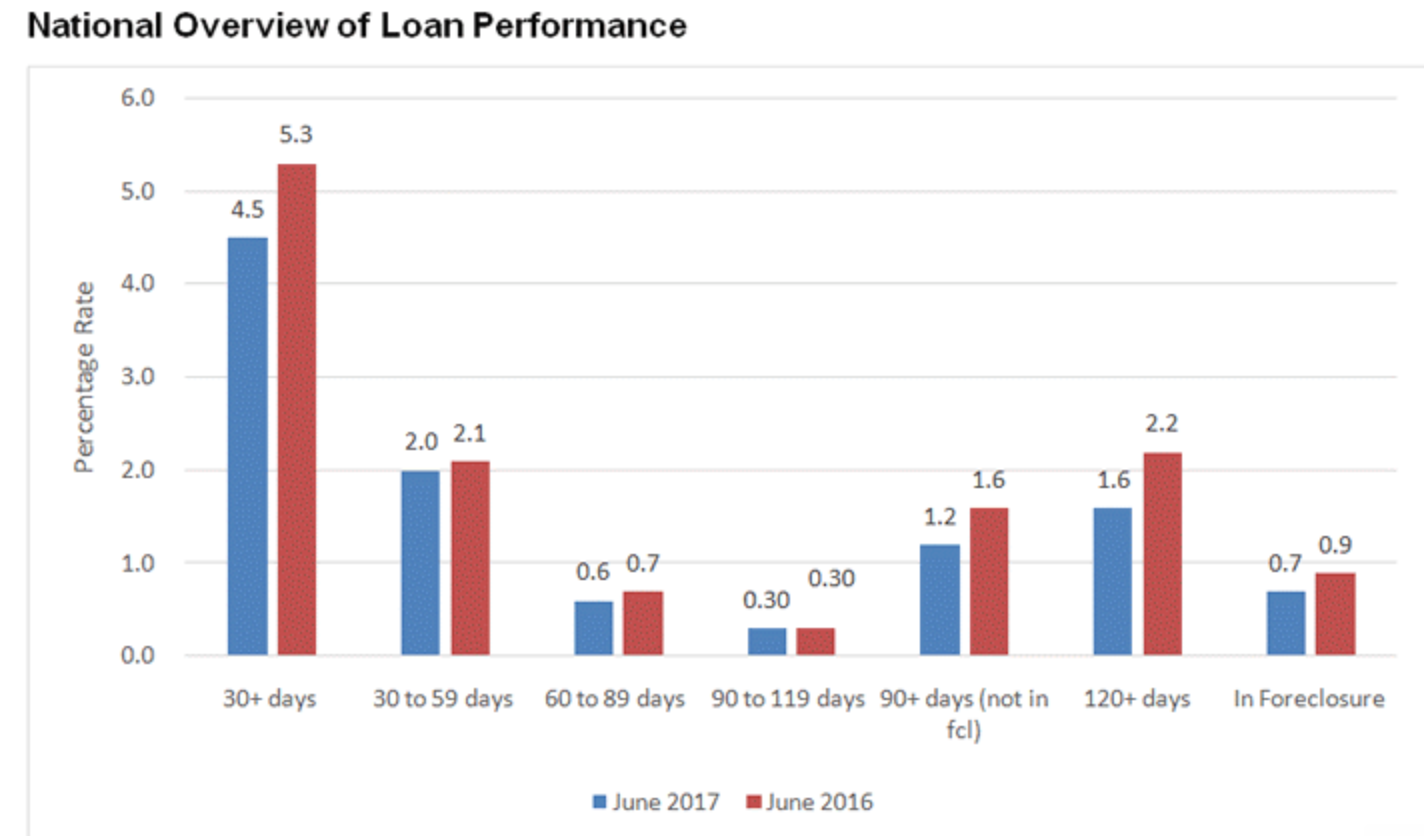

Mortgage delinquencies slipped to 4.5% nationally in June, down 0.8 percentage points from last year when it was 5.3%.

“The CoreLogic Home Price Index increased 6% and payroll employment grew by 2.2 million jobs in the year ending June 2017, supporting further declines in delinquency rates,” CoreLogic chief economist Frank Nothaft said. “The forecast for the coming year includes 5% home-price appreciation and further job growth, putting renewed downward pressure on mortgage delinquency rates.”

The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, dropped two percentage points annually to 0.7% in June. This represents the lowest level since July 2007 which the rate was also 0.7%.

Early stage delinquencies are important for analyzing the health of the mortgage market. Mortgages defined as 30 to 59 days past due, declined from 2.1% last year to 2% in June while mortgages 60 to 90 days past due decreased 0.1 percentage point to 0.6%.

The chart below shows the mortgage delinquency rates for mortgages in each stage:

Click to Enlarge

(Source: CoreLogic)

“After peaking at 3.6% in December 2010, June's 0.7% foreclosure rate was the lowest in 10 years,” CoreLogic President and CEO Frank Martell said. “Across the 100 most populous metro areas, the foreclosure rate varied from 0.1% in Denver-Aurora-Lakewood to 2.2% in New York-Newark-Jersey City.”