Fannie Mae reported an increase of net income in the second quarter to $3.2 billion and comprehensive income of $3.1 billion.

The company’s net income increased from last year’s $2.9 billion and from $2.8 billion last quarter. The company's earnings per share held steady wtih last year's $0.01 per diluted common share.

The GSE will now pay out $3.1 billion to the U.S. Treasury if the Federal Housing Finance Agency agrees to a dividend in this amount. In June, Fannie Mae paid out $2.8 billion to the Treasury, bringing the total amount paid out to the Treasury to $162.7 billion through the second quarter this year.

“Our results reflect the strength of our business model and the momentum of our strategy,” said Timothy Mayopoulos, Fannie Mae president and CEO. “We are focused on helping lenders save time and money, making the mortgage process easier, and expanding access to credit in ways that make sense.”

“We will continue to deliver innovative solutions that help our customers succeed, improve the mortgage process, and create safe and sustainable opportunities for families to own or rent a home,” Mayopoulos said.

Net revenues, which consist of net interest income, fees and other income, decreased slightly to $5.4 billion in the second quarter, down from last quarter’s $5.6 billion and last year’s $5.5 billion.

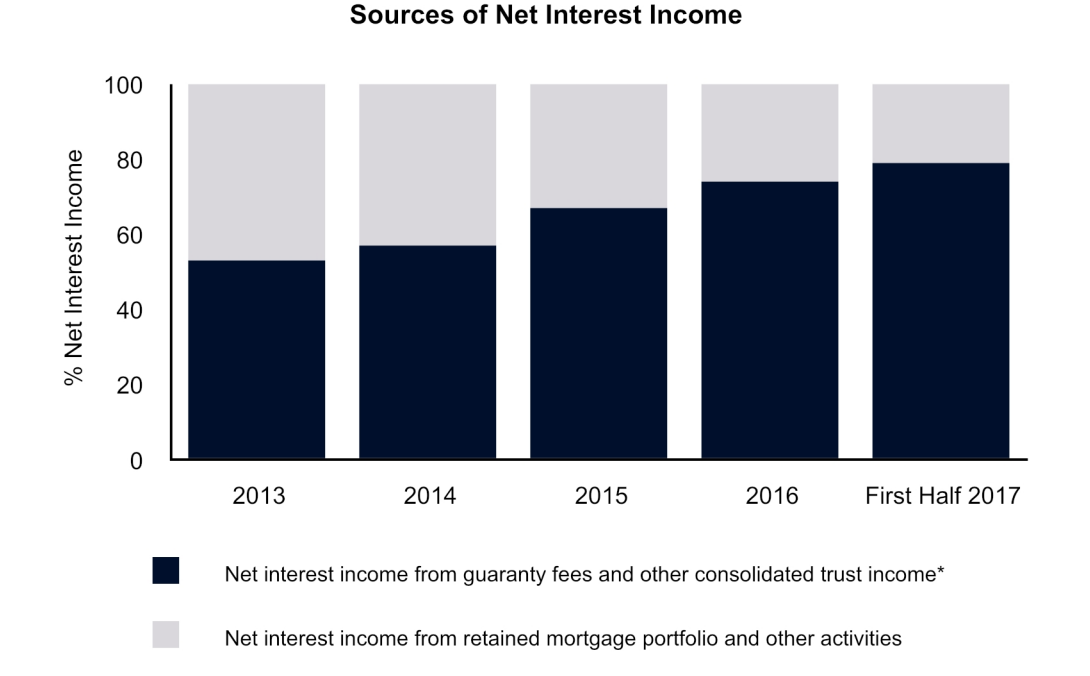

The company has two primary sources of net interest income: the guaranty fees it receives for managing the credit risk on loans underlying Fannie Mae mortgage-backed securities held by third parties; and the difference between interest income earned on the assets in its retained mortgage portfolio and the interest expense associated with the debt that funds those assets.

Over the past few years, income from guaranty fees and other consolidated trust income has played an increasingly important role, as seen from the chart below.

Click to Enlarge

(Source: Fannie Mae)