According to its first-quarter earnings, Fannie Mae posted net income of $2.8 billion for the first quarter of 2017, down a net income of $5 billion for the fourth quarter of 2016. It also recorded a comprehensive income of $2.8 billion for the first quarter of 2017.

The government-sponsored enterprise attributed the drop in net income to significantly smaller increases in interest rates in the first quarter of 2017 as compared with the fourth quarter of 2016.

When longer-term interest rates reported large increases in the fourth quarter of 2016, it resulted in substantial fair value gains on the company’s risk management derivatives for the quarter as well as credit-related expenses that partially offset these gains.

However, in 2017, interest rates increased only slightly in the first quarter.

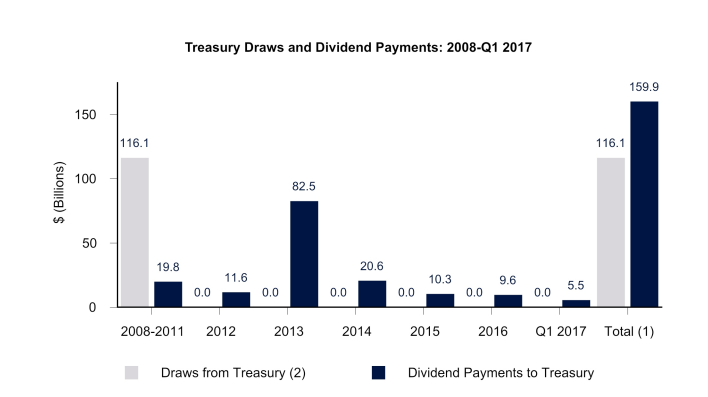

Fannie Mae also reported a positive net worth of $3.4 billion as of March 31, 2017, less the current capital reserve amount of $600 million, which will be zero beginning on Jan. 1, 2018. As a result, the company expects to pay Treasury a $2.8 billion dividend in June 2017.

The chart below shows its dividend payments to Treasury sine 2008.

Click to enlarge

(Source: Fannie Mae)

Although the company’s loss reserves have declined in recent years, it expects a smaller decline in its loss reserves in 2017 than the decline in 2016.

“Across our business, we are creating new ways to help our customers make the mortgage process easier and safer, and provide options that are affordable to more borrowers,” said Timothy Mayopoulos, president and CEO. “Both the market and our operations continued to strengthen, and our progress was reflected in another profitable quarter. We look forward to advancing our vision to create a digital mortgage process, and make new strides in our efforts to encourage the creation of affordable multifamily housing.”