The share of distressed property auction buyers who say they are owner-occupants nearly doubled over the last year, boosted by a game-changing government policy that took effect last August.

The increasing share of owner-occupant buyers is also evidence that extremely tight housing inventory is prompting more retail buyers to take on the additional challenges that come with buying a distressed property at auction. Meanwhile, innovation-driven transparency is helping to make distressed property auctions more accessible for these owner-occupant buyers as well as for local community developer buyers who, it turns out, sell most of their renovated foreclosures to owner-occupants.

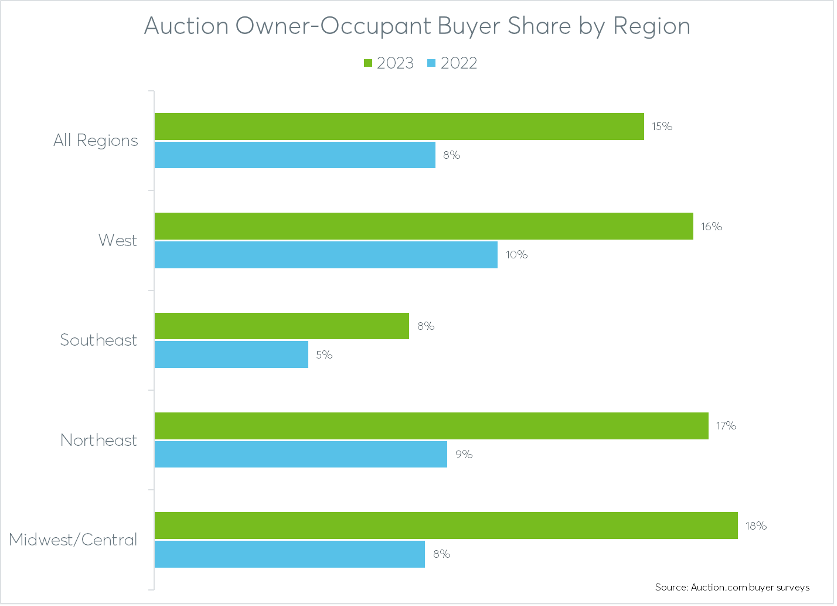

Fifteen percent of distressed property buyers described themselves as owner-occupants, according to a March 2023 survey of nearly 450 buyers using the Auction.com platform. That was nearly double the 8% of buyers who described themselves as owner-occupants in a February 2022 Auction.com buyer survey.

“My wife and I currently live in an Auction-purchased home,” said Dwayne, a survey respondent from Maryland. “We also have a very happy renter of half of our home.”

The highest share of distressed auction owner-occupant buyers was in the Central region: 18% of buyers in this region described themselves as owner-occupants, followed by the Northeast region, which includes Maryland, at 17%, and the West region at 16%. The lowest share of owner-occupant buyers was in the Southeast region, where 8% of survey respondents described themselves as owner-occupants.

The power of policy

Much of the jump in owner-occupant buyers can be attributed to a policy enacted by the U.S. Department of Housing and Urban Development (HUD) in August 2022. That policy required a 30-day “first look” auction during which only qualified nonprofits, government entities and owner-occupant buyers could bid on foreclosed properties with loans insured by the Federal Housing Administration (FHA).

“This policy change is critical as the nation continues to address the challenges of a real estate market in which home prices are high and the availability of affordable housing supply is low, making it difficult for individuals and families to achieve the dream of homeownership,” said Lopa P. Kolluri, Principal Deputy Assistant Secretary for HUD and FHA, in a press release published when the policy change was announced.

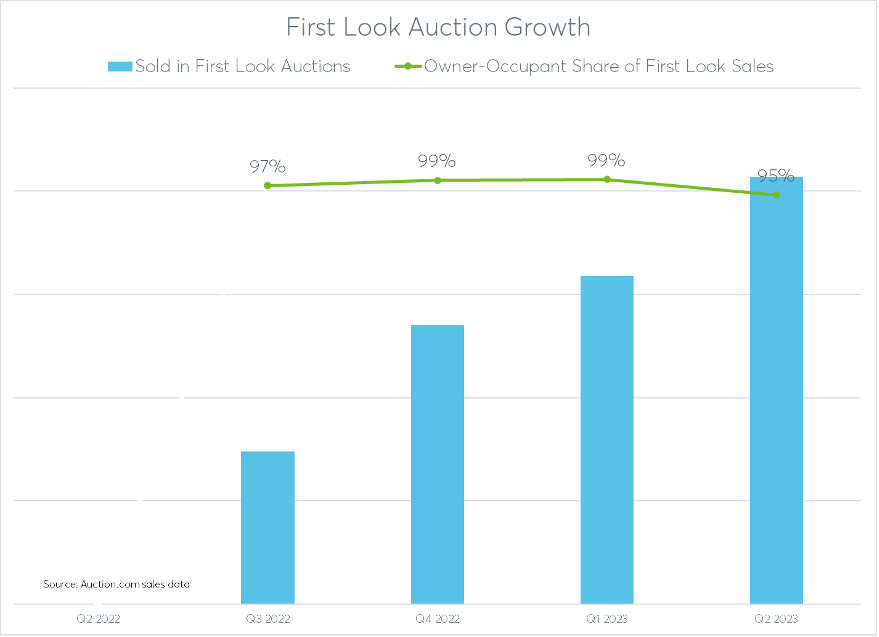

Auction.com implemented the first look auctions for FHA-insured properties in August 2022 and saw an immediate impact: from nothing to 8.2% of all properties available for the first-look auctions during the quarter.

The number of first-look auction sales nearly doubled in the fourth quarter compared to the third quarter and has increased in every successive quarter since, representing 11.5% of all available first-look properties in the second quarter of 2023.

Nearly all first-look auction sales (95%) went to owner-occupant buyers, with that share hitting as high as 99% in the fourth quarter of 2022 and the first quarter of 2023.

The power of incremental change

Most properties available for first-look auctions still end up selling to nonowner-occupant buyers after the first-look auction is over, but the incremental lift in owner-occupant buyers was anticipated by Laurie Goodman, founder of the housing finance policy center at the Urban Institute. Goodman and her colleagues recommended an expanded first-look auction program for distressed properties in a report published by the Urban Institute in February 2022.

“One could envision a first-look REO auction for properties that do not sell at foreclosure auction,” wrote Goodman and her colleagues in the report, which also recommended expanding the first-look to “mission-driven nonprofits and mom-and-pop investors who agree to provide high-quality affordable housing for low- and moderate-income families.”

The report concludes that an expanded first-look auction could, at least incrementally, lift the percentage of distressed homes sold at foreclosure auction that end up in the hands of owner-occupants.

“This would likely increase the share of homes owner-occupants who could purchase directly, or indirectly through a nonprofit or local community developer,” the report said. “Although a first-look auction may not be helpful for all distressed properties, Jakabovics and Sanchez (2021) have shown that first-look policies result in higher owner-occupancy rates, particularly in low-income minority census tracts.”

The power of a transparent platform

The report’s mention of first-look auctions not being helpful for all distressed properties is referencing the additional obstacles buyers often face when purchasing a distressed property: extremely poor property condition, the lack of traditional financing and the difficulty of dealing with current occupants. Those obstacles make distressed property purchases problematic for some owner-occupant buyers.

Despite these obstacles, innovation-driven transparency in the distressed auction marketplace is helping more owner-occupant buyers to feel comfortable with the process — especially given the more affordable prices available.

“The homes are reasonably priced for the normal family,” said Jennifer, an Auction.com survey respondent from Wisconsin who described herself as an owner-occupant buyer. “The online bidding experience was simple and safe process and I highly recommend Auction.com to other buyers.”

The power of local community developers

The innovation-driven transparency on sites like Auction.com is not just attracting more owner-occupant buyers; it’s also helping to attract local community developer buyers who are willing and able to take on the distressed properties that may not be a good fit for owner-occupants. They are able to pay with cash, take on bigger renovations and provide current occupants with a graceful exit.

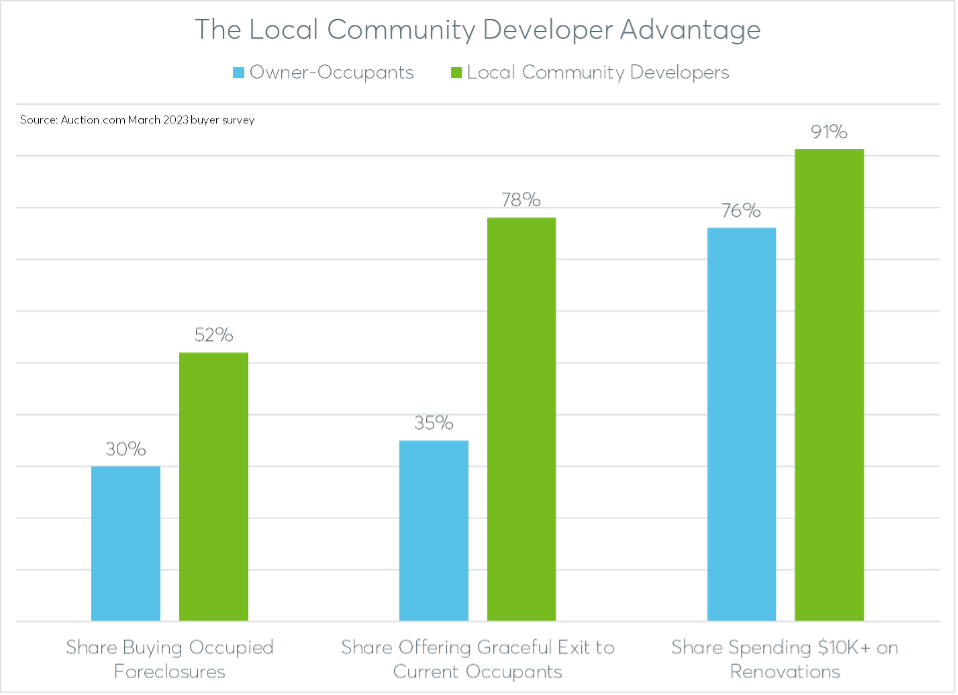

More than three-quarters (77%) of all Auction.com buyers surveyed in March described themselves as local community developers. Among those respondents, 91% said they budget at least $10,000 on renovations while 71% said they budget at least $20,000. By comparison, 75% of owner-occupant buyers surveyed said they budget at least $10,000 for renovations while 52% said they budget at least $20,000.

Local community developers are also more willing than owner-occupants to buy occupied properties and to offer current occupants a graceful exit.

According to the March 2023 Auction.com survey, 30% of owner-occupant buyers said they were willing to purchase an occupied property compared to 52% of local community developers.

Furthermore, among the owner-occupant buyers who purchased an occupied property, 35% said they offered the current occupant a graceful exit in the form of transition assistance, a leaseback option or a buyback option. By comparison, 78% of local community developers who purchase occupied properties said they offer the current occupant a graceful exit.

“I rented back to the previous owner, and they are still the tenant. It has been five years,” said Han Zhang, an Auction.com buyer in Southern California, relaying the story of one of his Auction.com purchases. “I keep the rent low so he is comfortable with the rent. … The return rate is still very good.”

Multiple paths to owner-occupancy

Even though some local community developers hold and rent the properties they purchase — sometimes back to the current occupant as Zhang did — most distressed properties purchased at auction end up in the hands of owner-occupants after they have been renovated.

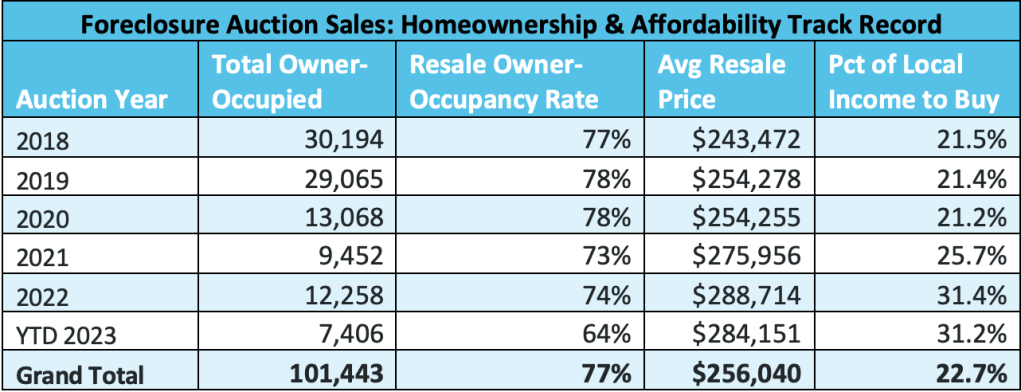

An Auction.com analysis of public record data for more than 175,000 properties sold on the Auction.com platform since 2018 shows that 77% of those that were renovated and resold went to owner-occupants. Combined with the properties sold directly to owner-occupants, that adds up to more than 101,000 previously distressed homes that are now owner-occupied. More than 40,000 of those owner-occupied homes are in low-income or minority Census tracts.

The renovated foreclosures are selling, mostly to owner-occupants, at affordable prices. The average resale price of a renovated foreclosure was $256,040 over that five-and-a-half-year span. The estimated monthly mortgage payment — including property taxes and insurance — required just 22.7% of the median family income in the surrounding Census tract on average.

And while the percentage of income to buy a renovated foreclosure increased to just over 31% in 2022 and so far in 2023, that share of income to buy is still well below the 36.4% of income to buy an averaged-priced home nationwide, according to Black Knight’s June 2023 Mortgage Monitor report.