Mortgage lending is largely about the numbers. The process of originating a mortgage is logical, mathematical and should, therefore, be predictable.

From a homeseeker perspective, the process of searching for and purchasing a home is both logical and emotional. The logical side of the process often means a long list of requirements like square footage, number of bedrooms and baths, school quality, proximity to work and shopping, etc.

But for those searching for a home, there is a fair deal of emotion that factors into their decision to make an offer. Who hasn’t fallen in love with a property and conjured up visions of what life could be in a new home? This is likely one of the reasons real estate agents are known to say, “Marry the home, date the rate.”

Once the homeseeker has found that dream home, it’s now time for them to figure out how they are going to pay for it. And while you might think that this is when the homeseeker flips the switch from emotion to logic, our recent research suggests that there is a strong emotional component to the financing of a home. Keep in mind that, for most, going through the mortgage application is something that happens a small handful of times in their lives.

Earlier this year, CreditXpert fielded a national survey of those that had recently purchased a home, refinanced a mortgage or anticipated being in the market for a home in 2023. Through this survey we wanted to better understand how consumers think about their credit, the process of applying for a mortgage and what they thought about CreditXpert’s predictive analytics tool that gives them the precise steps they need to take to reach a target credit score.

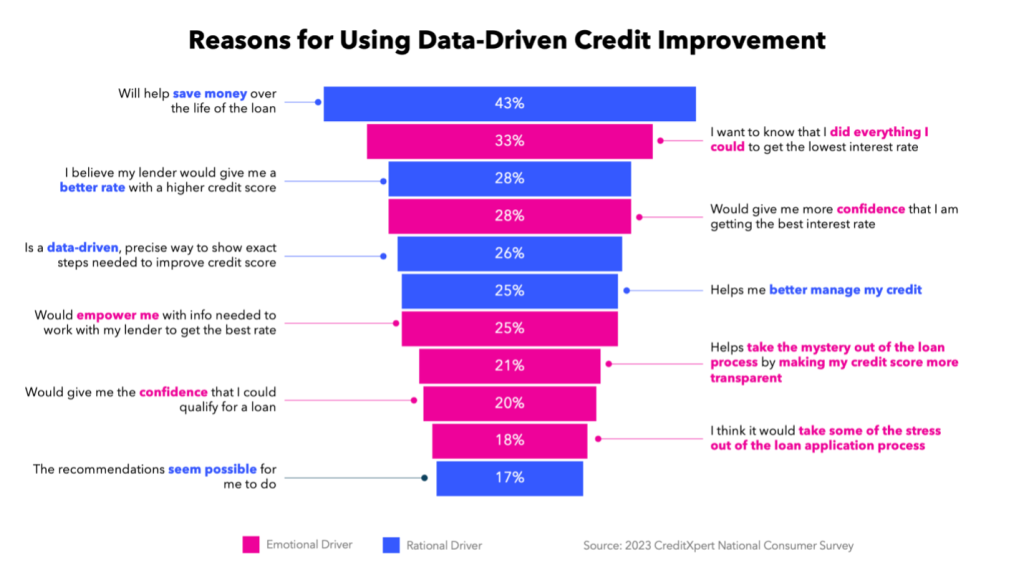

After showing the participants the tool, we asked them to share the top three reasons they would use CreditXpert to improve their credit score. The number one reason (“will help me save money over the life of the loan”) was clearly logical and not much of a surprise to our team. But subsequent reasons caught us by surprise and clearly pointed to the emotional side of the mortgage application process.

The pink bars in the chart below clearly spell it out. Homeseekers cited more confidence that they were getting the best interest rate (28%), felt empowered to work with their lender (25%), took the mystery (fear) out of the process (21%), gave them more confidence (there’s the confidence word again!) they could qualify (20%) and took some of the stress out of the process (18%).

The mortgage application process is stressful, meet your borrowers where they are

All borrowers start out hopeful and get excited when they see a home that’s nearly perfect. As the deal gets closer to the closing table, applicant anxiety begins to enter the red zone. There are always one or two reasons for the applicant to panic before it’s all signed and then, when it’s all over, they swiftly go from elation to exhaustion, as they realize how much this process took out of them.

For the loan originator, the mortgage is a transaction. For the borrower, the mortgage makes a life-changing event possible.

Not to put too fine a point on it, the chart makes clear that for the mortgage borrower the housing/mortgage transaction is much more emotional than logical.

Building empathy to build applicant trust

The perfect example of by-the-numbers mortgage lending is the refinance transaction. If it makes sense, it’s clearly visible in the numbers for everyone to see. There is little emotion for the homeowners either, as they are only in the deal to get a better rate and term.

A purchase mortgage transaction is different.

New homebuyers are strapped into an emotional roller coaster and once they make the offer, they are in a desperate rush to the closing table.

Demonstrating empathy and understanding towards your borrowers is crucial for building trust. When people feel genuinely heard, understood and cared for, trust builds.

The simple act of helping your borrowers improve their credit score helps build that trust by empowering them, building their confidence, taking the mystery out of the transaction and overall reducing their stress. In a highly competitive market, that’s a recipe for closing more loans.

For those that need help qualifying for a mortgage, improving their score can be lifechanging. For those that are well qualified, improving their score could help you make a more competitive offer and lower their cost of homeownership. And for those where an improved score would not result in a better outcome, the simple act of showing them that you are shaking the trees and working hard for them will increase transparency, build trust and help you close more loans.

To learn more about CreditXpert, click here.