The U.S. single-family rental market is still strong, but the pace of rent increases has cooled significantly over the past year. The market is looking more like 2019 than the price spikes witnessed during the pandemic.

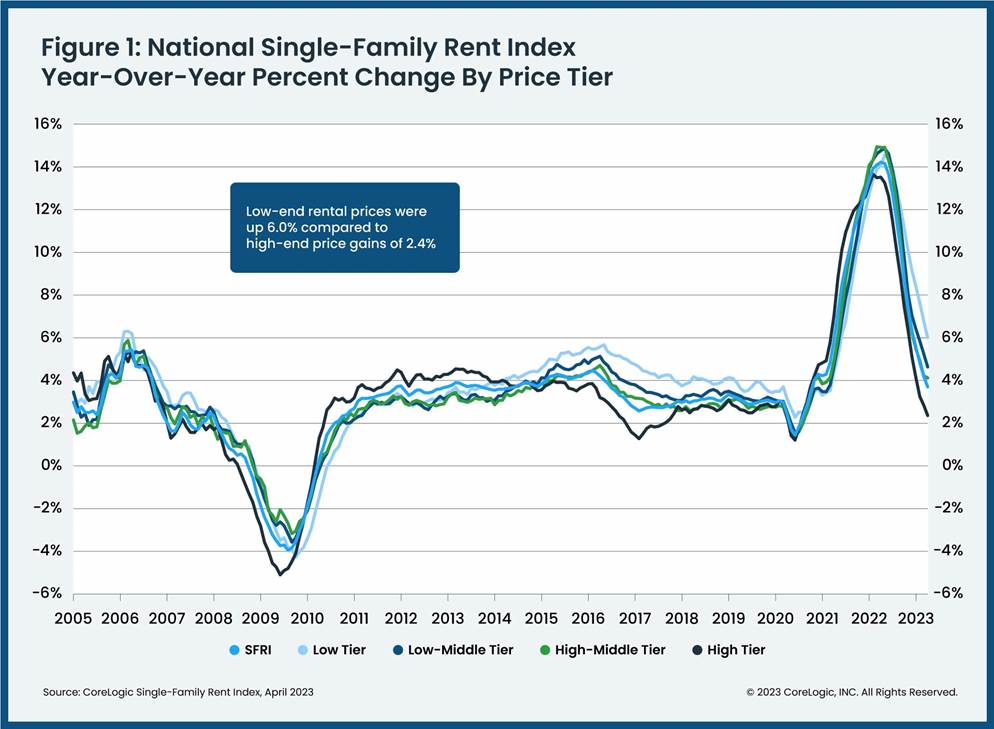

U.S. single-family rent increases in April 2023 registered a 3.7% gain, compared to the 14.2% growth observed in the same month in 2022, according to Corelogic’s Single-Family Rent Index (SFRI). The index, which analyzes single-family rent price changes nationally and across major metropolitan areas, dropped on an annual basis for the 12th consecutive month in April.

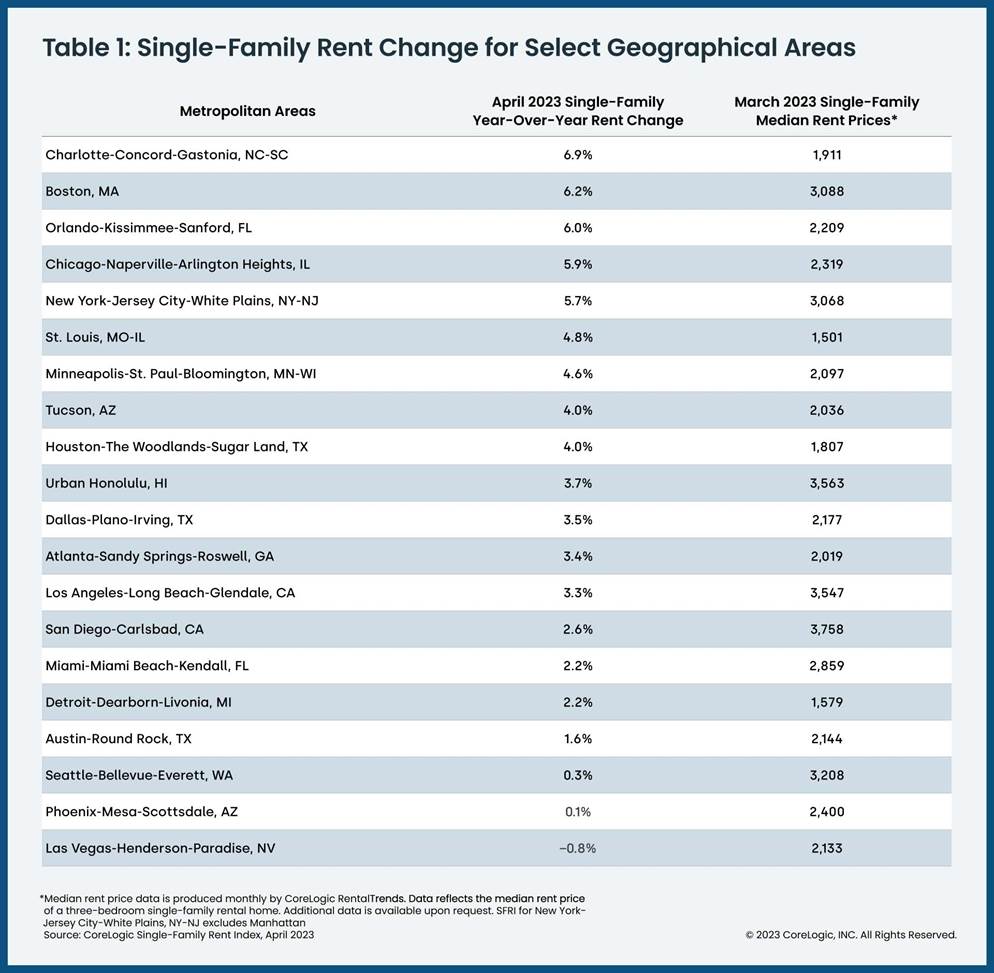

For most of the metro areas, single-family rent growth grew in single-digit annual increases, with the exception of Las Vegas, which recorded a decline of less than 1%.

“Single-family rent growth has slowed for a full year, and overall gains are approaching pre-pandemic rates,” said Molly Boesel, principal economist at CoreLogic. “Prior to 2020, single-family rent gains increased in the range of 2% to 4% for nearly a decade. However, even though growth has slowed over the past year, rents have increased by 26% since February 2020.”

Boesel also noted that rent growth is “bottoming out,” meaning that increases in single-family rents over the past three years are more or less permanent. At lower price levels, this challenges affordability and causes tenants to devote a larger share of their monthly budget to rent.

CoreLogic examined four tiers of rental prices: lower-priced (75% or less than the regional median), lower-middle priced (75% to 100% of the regional median), higher-middle priced (100% to 125% of the regional median) and higher-priced (125% or more than the regional median), and and two property-type tiers, attached versus detached. For the lower-priced category, growth was up 6% compared to 4.6%, 4.1% and 2.4% for the three other categories. Detached rental prices were up 2.6% compared to attached price gains of 4.6%.

Of the 20 metro areas studied, Charlotte, North Carolina posted the highest year-over-year increase in single-family rents in April 2023, at 6.9%. Boston and Orlando, Florida registered the next highest annual gains, a respective 6.2% and 6%. Annual rent prices fell -0.8% in Las Vegas, the worst performing market. Rents in the phoenix metro only grew 0.1% annually in April and 0.3% in the Seattle metro.

Correction: An earlier version of this story incorrectly stated rental growth data was for May 2023; it was for April 2023.