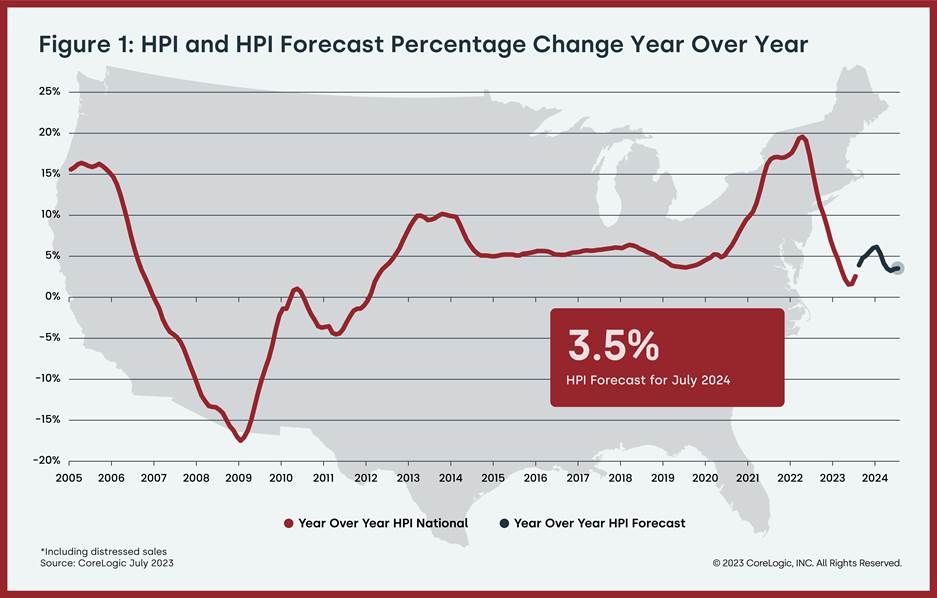

U.S. home price gains rose 2.5% year over year in July to mark the 138th straight month of annual growth. The annual acceleration reflects six consecutive monthly gains, which drove prices about 5% higher compared to the February bottom, according to CoreLogic‘s Home Price Index.

“Annual home price growth regained momentum in July, which mostly reflects strong appreciation from earlier this year,” said Selma Hepp, chief economist for CoreLogic. “That said, high mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

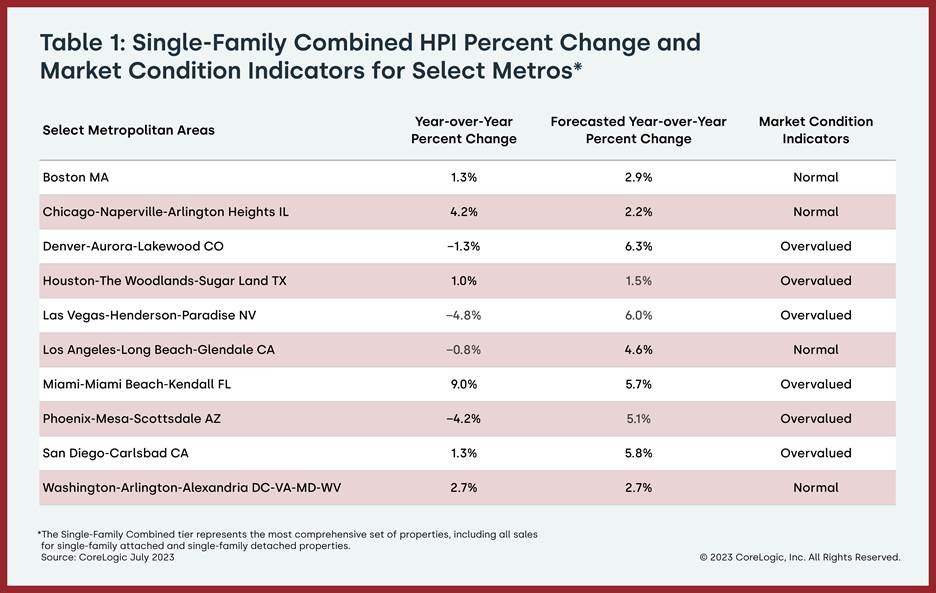

The 11 states that saw home price declines were all in the West – Idaho (-5.7%), Nevada (-4.2%), Montana (-3.6%), Washington (-3.3%), Arizona (-2.9%), Utah (-2.8%), Oregon (-1.2%), Colorado (-0.6%), Texas (-0.6%), Wyoming (-0.5%) and California (-0.3%).

But since many of those markets continue to struggle with inventory shortages, that trend may be short-lived, and recent buyer competition will cause prices to heat up again.

“The projection of prolonged higher mortgage rates has dampened price forecasts over the next year, particularly in less-affordable markets,” Hepp said.

“But as there is still an extreme inventory shortage in the Western U.S., home prices in some of those markets should see relatively more upward pressure.”

All states that saw year-over-year losses in July will begin posting gains by October, CoreLogic projected.

CoreLogic expects that year-over-year U.S. home price gains will reach 3.5% by July 2024.

Vermont ranked first for annual appreciation in July (up by 8.5%), followed by New Hampshire and New Jersey (both up by 7.3%)

Miami posted the highest year-over-year home price increase of the country’s 20 tracked metro areas in June, at 9%. St. Louis saw the next-highest gain (4.8%), followed by Detroit (4.5%).