The Urban Institute, a well-known think tank in Washington, D.C., has a Housing Finance Policy Center that does a significant amount of research and analysis on the housing market. They also produce a monthly chart book that is packed with amazing data about the market. Today, we want to share some key observations from the March Monthly Chartbook.

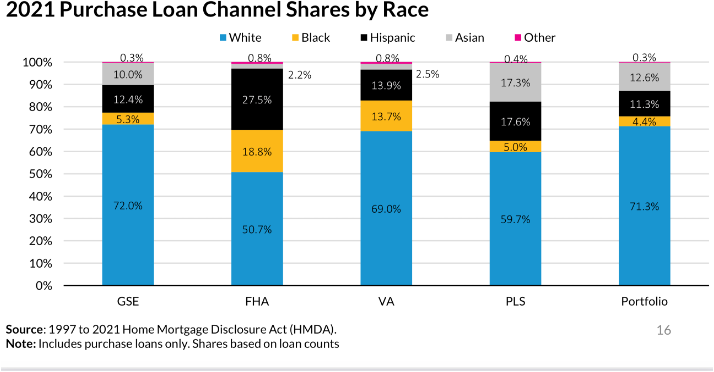

The data we will share with you today highlights two things. First, the FHA program does more loans to minorities than any other agency or private label lending source — so much so that it dwarfs the GSEs, VA, and others.

Second, if it weren’t for independent mortgage bankers (IMBs), the opportunity to get into homes for first-time homebuyers would be significantly constrained.

Let’s start with the basics. In looking at full year 2021, 49.3% of FHA’s purchase transactions were provided for minority home loans.

That compares to only 28% for both GSEs combined. To be clear, the FHA remains the primary provider of mortgage financing for minorities in this country. And, if you read the report, you will see toward the end that even with the improvements in LLPAs for high LTV/Low FICO borrowers, FHA remains better execution for borrowers below a 740 FICO. Which means, all this pricing effort from the GSEs to sweep in more minority homebuyers is likely for naught.

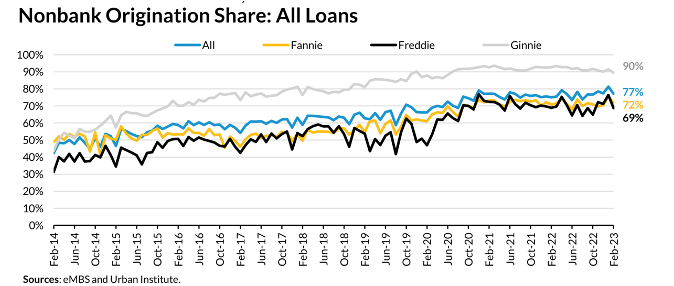

But who does the FHA loans today? This is where you cannot help but recognize the incredible value that IMBs bring to the mortgage market.

In fact, in looking at Urban’s view of the percent of the market that IMBs fill in the chart above, the top grey line making up Ginnie Mae issuance, is dominated by IMBs that make up 90% of total volume. And yes, while IMBs are the majority of all originations in all categories, the Ginnie Mae concentration stands out and is one that policy leaders in housing should be discussing.

With IMBs contributing 90% of the loans where the highest concentration of minority purchase transactions are, it raises the question as to why are these same policymakers so focused on attacking this channel? Yes, liquidity concerns exist, but there are solutions that simply require focus and leadership here.

A former member of the National Economic Council in the White House and current Urban Institute Fellow Jim Parrott, along with the renowned chief economist from Moody’s Analytics Mark Zandi, recently penned a paper published in economy.com in defense of the FHLB system. The paper does a great job pointing out the important role the FHLB’s play and dismantling some of the arguments against their role in the market.

But Parrott and Zandi make a point to call for expansion of membership to give access to IMBs. This is important as the FHLB system could significantly reduce liquidity risk concerns in the nonbank marketplace.

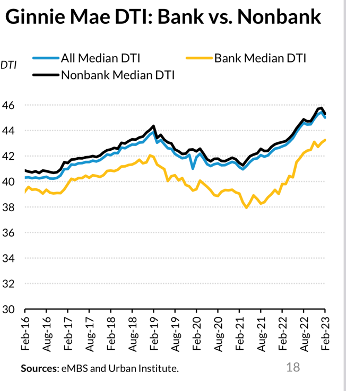

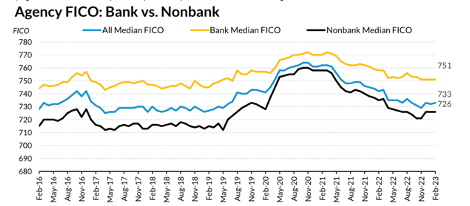

One must ask, why are the IMBs so effective with Ginnie Mae lending? The answer is simple: they don’t add the credit overlays that banks generally do.

As the two graphics below show, IMBs do higher DTIs and lower FICOs than banks. And they do this while staying well within the guidelines of the various agency programs.

Look, every lender has the right to put any overlay that they choose when originating a mortgage. But when you are looking to expand credit access and opportunity and meet the needs of more first-time homebuyers, especially minority first-time homebuyers, it is the IMB that is making this all happen.

So, the conclusion is simple really, all made clear by the Urban Institute’s Monthly Chartbook. The FHA is the program that has the vast majority of minority purchase loans, and IMBs do approximately 90% of these mortgages. And they do this much simply because they use the entire credit set provided by FHA and the other programs, thus allowing lower FICOs and higher DTIs than banks.

We find ourselves continually needing to show why the IMB is so critical to the nation’s housing. And despite the many “yeah, but” responses we get, we end up more confounded as to why policymakers and housing advocates are not making a bigger point of this.

It’s the IMB that is filling the gap that was created by banks being conservative and reducing their participation in these programs. And make no mistake, banks have served a big role in providing jumbo mortgages for wealthier homebuyers, but when it comes to expanding affordability and access, it’s simply the Independent Mortgage Banker that fills this role.

David Stevens is CEO of Mountain Lake Consulting. He has served as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the MBA.

Scott Olson is the Executive Director of the Community Home Lenders of America (CHLA).

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the authors of this story:

Dave Stevens at dave@davidhstevens.com

Scott Olson at scottolson@communitylender.org

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com