It appears the forbearance issue is already much more significant than federal decision-makers thought it would be.

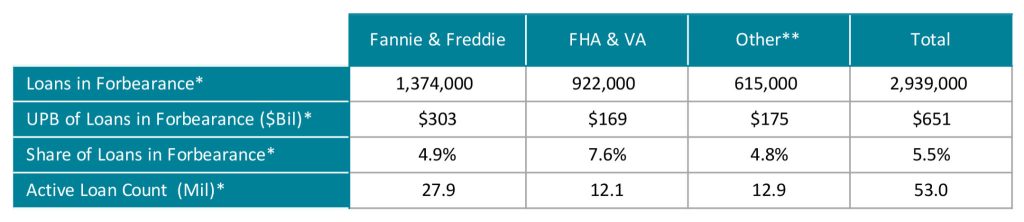

Federal Housing Finance Agency Director Mark Calabria told HousingWire last week that his expectation was that approximately 1 million GSE mortgages will be in forbearance by May, but new data from Black Knight shows that the number of GSE mortgages in forbearance already far exceeds Calabria’s projection.

According to Black Knight, nearly 1.4 million borrowers whose mortgages are backed by Fannie Mae and Freddie Mac are already in forbearance.

To ascertain this data, Black Knight reviewed a sample set of loans that represent the majority of the mortgage market and extrapolated that data across the entire mortgage landscape.

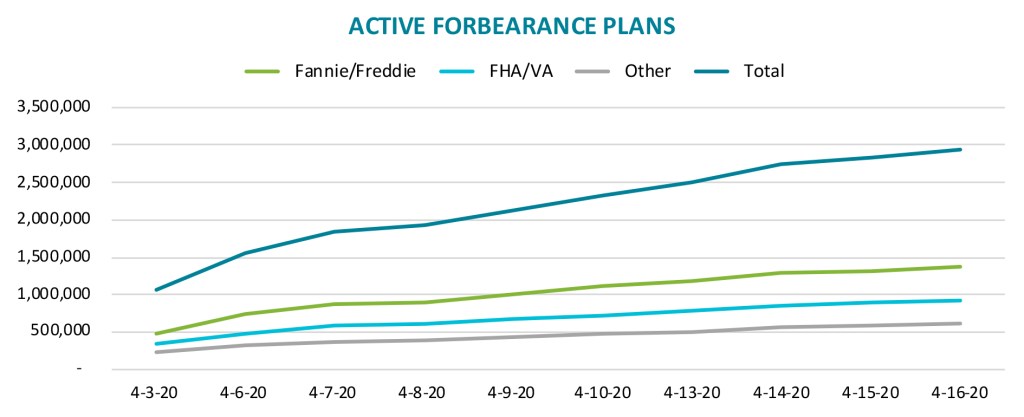

Black Knight’s data shows that overall, more than 2.9 million mortgages are in forbearance as of April 16. That figure represents 5.5% of all active mortgages.

In total, those loans represent $651 billion in unpaid principal balance.

The figure also shows just how quickly the number of borrowers needing forbearance is growing.

Data released earlier this week by the Mortgage Bankers Association showed that 3.74% of all borrowers were in forbearance as of April 5.

The data from Black Knight also shows that forbearance is more prevalent among loans backed by the Federal Housing Administration and the Department of Veterans Affairs.

According to Black Knight, 7.6% of the loans backed by the FHA and VA are currently in forbearance. Put another way, approximately 922,000 of the 12.1 million FHA and VA loans are in forbearance.

But the forbearance situation isn’t limited to GSE or government-backed loans.

According to Black Knight, nearly 5% of loans held either in portfolio or privately securitized are also in forbearance.

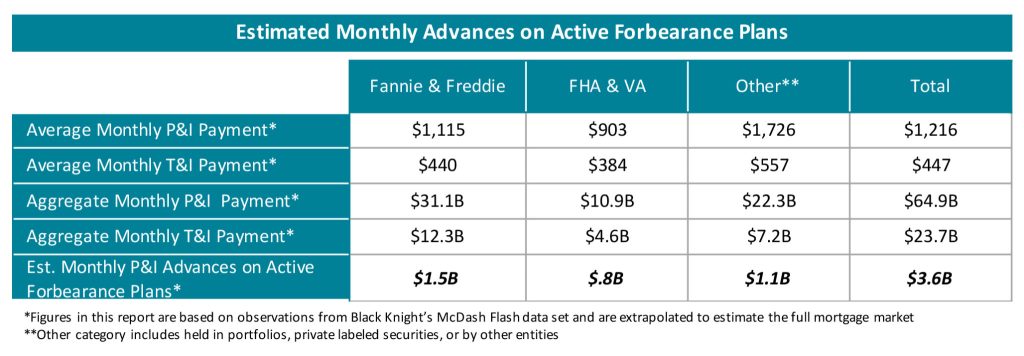

The issue of growing forbearance demonstrates the need for a solution for mortgage servicers that are required to advance principal and interest payments to investors on loans that are in forbearance.

Over the last few weeks, parties from all sides have called on the government to set up a forbearance liquidity facility for mortgage servicers.

Black Knight’s data highlights just how big of a problem that already is.

According to the report, at the current forbearance rate, mortgage servicers would need to advance $1.5 billion per month to holders of GSE-backed mortgage securities.

Beyond that, servicers on portfolio or privately-backed mortgages would need to advance another $1.1 billion per month.

And while there is a program in place to aid servicers on FHA and VA mortgages, there is no such facility set up for GSE or private mortgages, despite the growing requests for one.