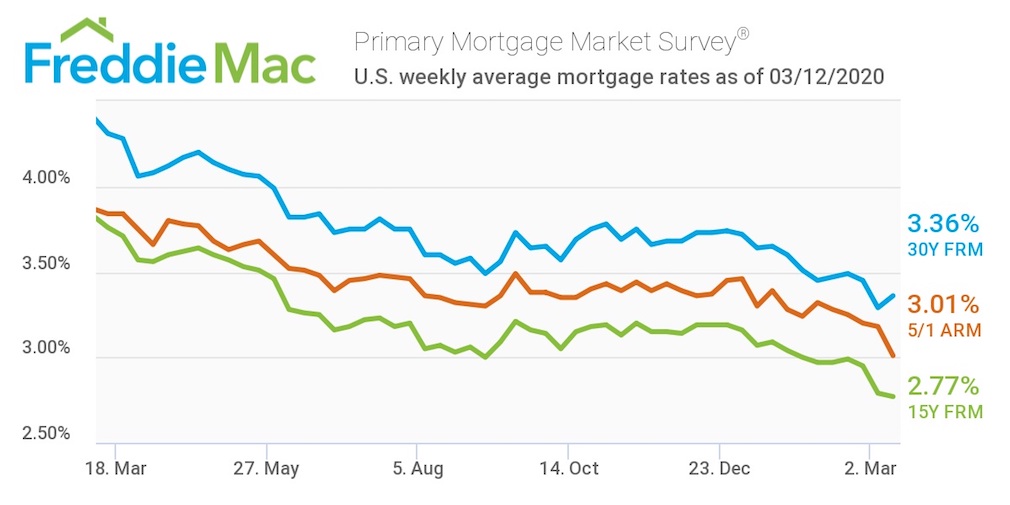

The average U.S. fixed rate for a 30-year mortgage rose to 3.36% this week, reversing course from last week’s all-time low of 3.29%.

Although the rate is 7 basis points above the previous week’s level, it’s almost a percentage point below the 4.31% of the same week a year ago, according to Freddie Mac.

Mortgage applications soared 55% last week from the prior week and demand for refinancings rose to an almost 11-year high as borrowers responded to the historically low rates, according to the Mortgage Bankers Association.

“As refinance applications continue to surge and lenders work to manage capacity, the 30-year fixed-rate mortgage ticked up from last week’s all-time low,” said Freddie Mac’s Chief Economist Sam Khater. “Mortgage rates remain at extraordinary levels and many homeowners are smartly weighing their options to refinance, potentially saving themselves money.”

According to the survey, the 15-year FRM averaged 2.77% this week, sliding from last week’s rate of 2.79%. This time last year, the 15-year FRM came in at 3.76%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.01% this week, down from last week’s rate of 3.18%. Last year, the 5-year ARM averaged 3.84%.

As home loan-rates remain near historic lows due to the economic impact of COVID-19, the MBA projects purchase and refinance demand will continue to climb, said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

“Taking into account the current economic situation and how much rates have fallen, MBA is nearly doubling its 2020 refinance originations forecast to $1.2 trillion, a 37% increase from 2019 and the strongest refinance volume since 2012,” Kan said. “As lenders handle the wave in applications and manage capacity, mortgage rates will likely stabilize but remain low for now. This, in turn, will support borrowers looking to refinance or purchase a home this spring.”

The image below highlights this week’s changes:

[Correction: This article is updated to reflect the correct time period for the mortgage application data.]