Continuing a trend that stretches back to one year ago, Millennials are still dominating the homebuying landscape, taking on more mortgages than previous generations.

A report from Realtor.com says that at the end of the third quarter, the Millennial share of mortgage originations increased 3% from last September, coming in at 46%.

Meanwhile, Gen X and Baby Boomer shares continued to fall, to 35% and 17% this year, from 37% and 18% last year, respectively.

As for primary home loan originations, Millennial shares increased also. In September, Millennial share was 44%, up from last year’s 40%.

Gen X shares fell from last year’s 41% to 39%, while Baby Boomer shares fell to 16% from 17% last year.

Millennials were also found to move once every two years, a study from Porch said. Gen Xers moved about every four years and baby boomers stayed in the same place for nearly six years at a time.

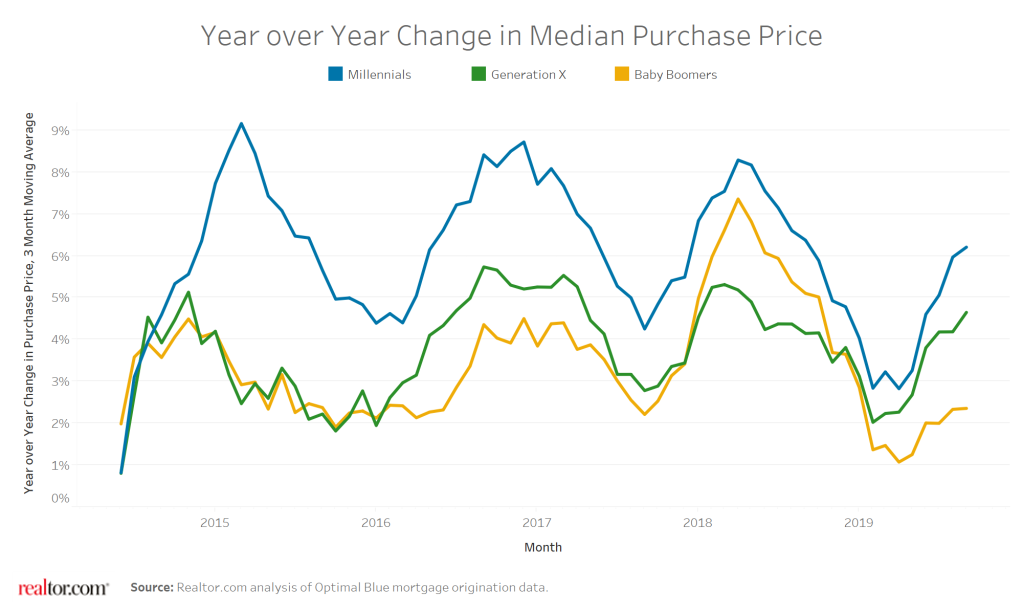

According to the report, Millennials are buying more expensive homes, too.

The median price of a primary home purchased by Millennials went up 6%, to $250,000 compared to last year. Generation X and baby boomers only increased their purchase prices by 5% and 2%, respectively.

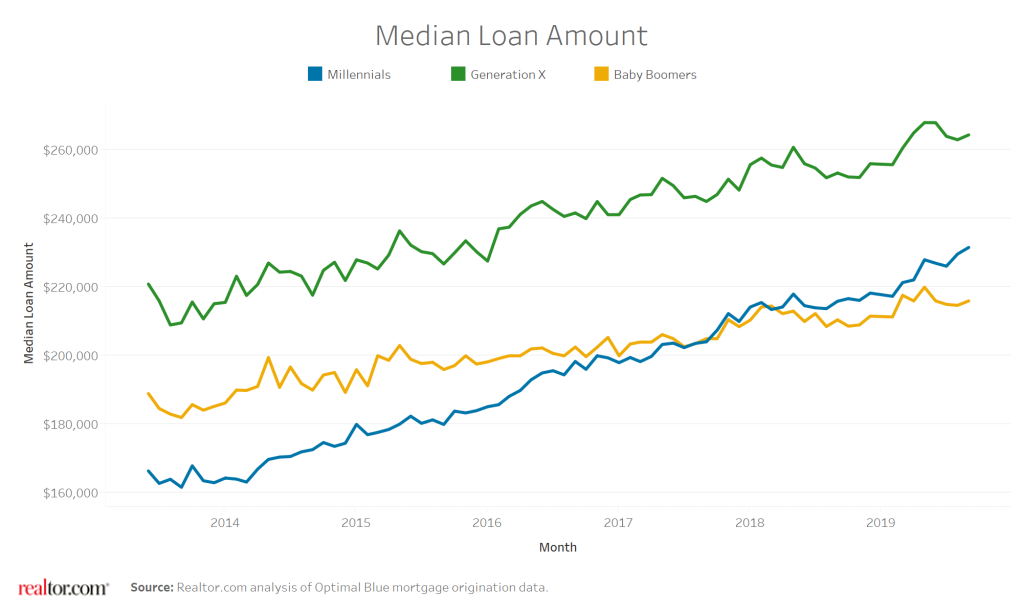

Millennials are also increasing the size of loans they are taking out to buy a home, as this generation had a median loan amount of $231,590 in September. This is 7.3% higher than last year.

This growth in mortgage debt undertaken by Millennials outpaces that of both Baby Boomers, which grew by 2.6%, and Generation X, which grew by 4.4%.