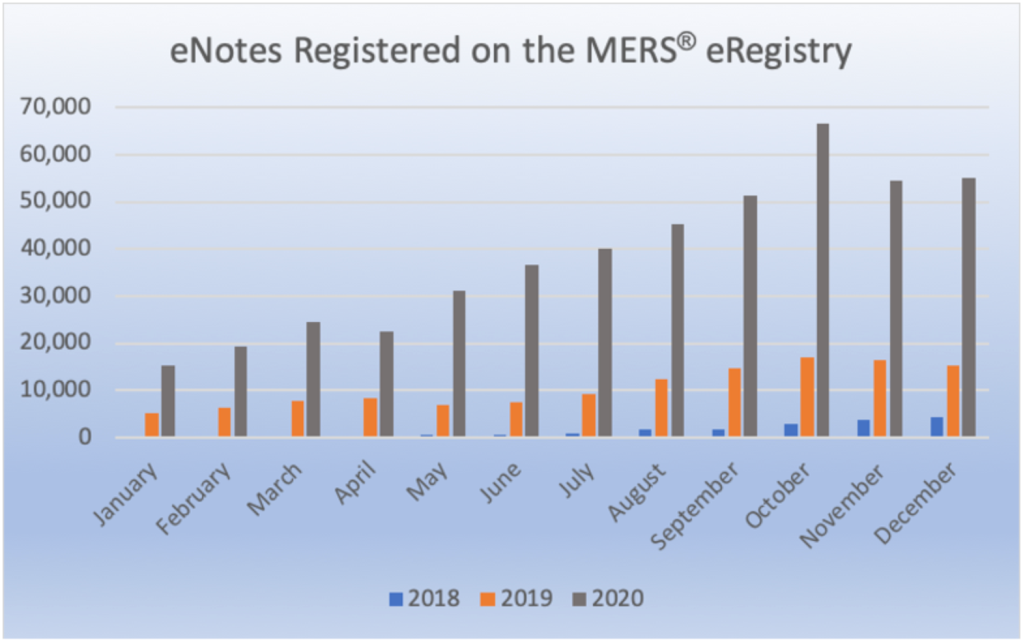

The use of eNotes registered on the Mortgage Electronic Registration Systems increased a full 261% year over year in December 2020.

The MERS eNote eRegistry is managed by MERSCORP Holdings. It is used by lenders and market participants to track the control and ownership of eNotes. The registry showed that 2020 was a record year for eNotes, with 462,671 registered on the MERS eRegistry. This shattered the previous record set in 2019 of 127,178, as the chart below shows.

In December, 55,076 eNotes were registered on the MERS eRegistry, a 261% annual increase.

This comes as no surprise – a recent survey from the American Land Title Association of major vendors working in the remote online notarization space showed adoption of remote online notarization soared 547% in 2020.

“Today, RON is being utilized most extensively in Florida, Texas and Virginia,” ALTA told its members. “Additionally, use of this technology is trending up significantly in Midwestern states. A decade ago, Virginia became the first state to enact a RON law and in 2017 Texas was the third state to approve RON legislation. Florida’s law is relatively new, having passed in 2019, but adoption there has been rapid.”

And as MISMO started its new year under its first full-time president, Seth Appleton, the company was clear that the digital mortgage will be one of its top priorities. As it moves into the digital future, MISMO also announced it is working to become more independent and pull in more income to support the organization’s efforts. The organization announced in June it would assess a new fee of 75 cents for every origination.

Leveraging eClosings to effectively manage increased loan volumes

With record-low rates and the increased loan volume, lenders must streamline workflows and accelerate time to close. Evolving to full eClosings can help lenders process more loans at a faster pace without overwhelming their resources.

Presented by: SimpleNexus

This surge in eNote usage also comes as more lenders and even government agencies begin accepting eClosings. In December, Rocket Mortgage became the first lender to use eNotes in closing a Ginnie Mae-backed loan as part of a pilot program. Now, it says the market is set to see widespread eClosings of Ginnie Mae loans by the end of this year.

And other lenders are also advancing their eClose capabilities. After Ellie Mae announced that it had agreed to be acquired by Intercontinental Exchange, ICE announced it was preparing to unleash a “fully digital mortgage ecosystem.”

In the final months of 2020, the number of companies with a MISMO RON certificate doubled. Originally introduced in April, the MISMO RON compliance certification was designed to ensure that RON tech providers met a universal set of standards including credential analysis, borrower identification, capturing and maintaining a recording of the notary process electronically, audio and video requirements, record storage and audit trails.

“There is no turning back or slowing down at this point,” First American Financial Corp. wrote on its blog. “Lenders are now experiencing the increased efficiency, lowered costs and increased compliance that can be achieved by adopting eClose. More importantly, consumers expect the mortgage lending process to be as easy for them as other types of transactions that are completely digital.

“No consumer was ever sold on the functionality of an eNote, but they do expect the convenience of being able to sign documents electronically, including a note or security instrument,” it continued. “The industry needs to be able to adapt the preferences of consumers whether they want to interact with their lender in-person, by phone, text, email, or via lending portal. They want convenience and they want options and functionality that make the mortgage lending process as easy as it can be.”