The sun is shining as I write this today and the forecast is for warmer weather. While others might think of restarting outdoor activities or working in the garden, our industry is gearing up for a strong spring housing market – and the first step in what MBA is forecasting will be a record-breaking year of purchase origination volume.

Demand for homes will be bolstered by an improving job market, favorable demographic trends, and mortgage rates that, while rising, are still low from a historical perspective. The unemployment rate, which was at 6.2% in February, is expected to drop to 4.7% by the end of the year, with hiring accelerated by a surge of consumer spending as pandemic restrictions are lifted.

Another positive sign impacting MBA’s spring housing market forecast: more than 15% of the U.S. population has received at least one vaccine dose at this point, and recent announcements from the Biden administration indicate that the pace will only increase from here.

The improving economic picture is putting upward pressure on mortgage rates, which have moved above 3% in recent weeks for 30-year fixed-rate loans. MBA is forecasting that the Freddie Mac survey rate will reach about 3.5% by the end of 2021. I am asked this a lot and it’s important to remember: Freddie Mac’s weekly rate only includes purchase loans – not refinances and the accompanying cost of the current adverse market fee.

So long as rates stay in this neighborhood and do not quickly climb above 4%, potential homebuyers will likely not be dissuaded by the modest increase. Meanwhile, refinance demand will certainly cool as the year progresses.

Making housing more affordable by bridging the affordable supply gap

In the last few years, the number of existing single-family homes for sale has decreased. But home prices have increased. To make homeownership a possibility for everyone, there needs to be a higher supply of affordable homes.

Presented by: Fannie Mae

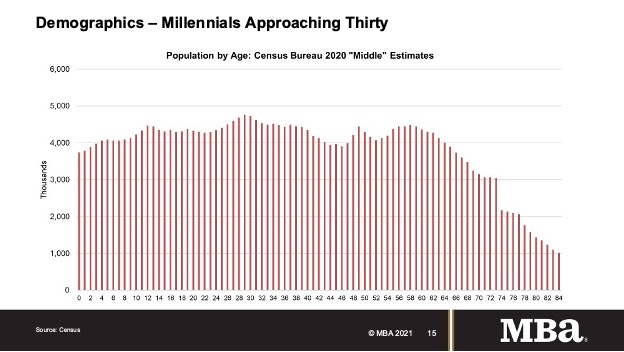

Adding fuel to the rebounding economy and rising buyer demand is the fact that that most millennials are rapidly approaching peak first-time homebuyer age. The largest cohort of millennials are now 29, and historically, peak first-time homebuyer age is 32 or 33. The MBA is forecasting that this wave of young homebuyers will support the purchase market for at least the next few years.

Interestingly, the National Association of Home Builders’ fourth quarter 2020 survey of prospective homebuyers showed that 27% of millennial respondents planned to buy a home in the next 12 months, up from 19% in the prior year’s survey.

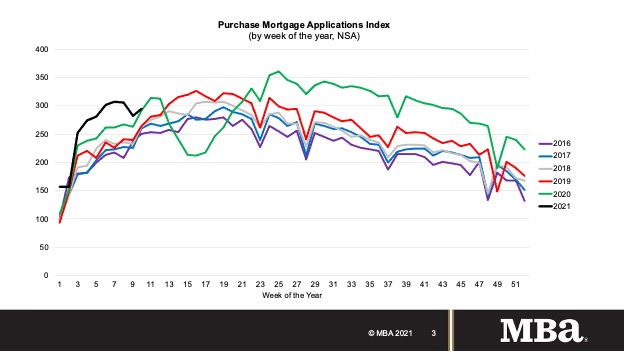

The strong demand for homes is seen in the robust year-over-year growth in purchase applications — up by double-digit percentage points in most weeks so far this year — and in the strong pace of home sales, with existing sales at their highest level in 15 years.

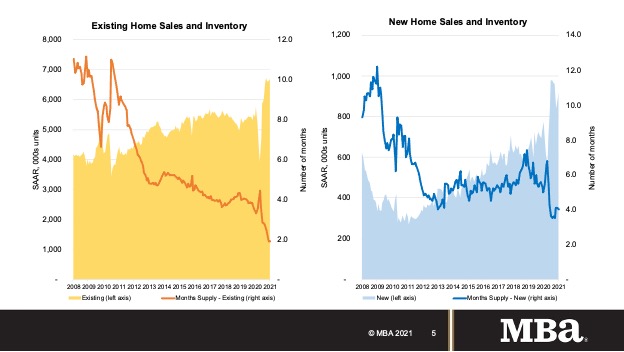

However, as industry participants know well, the challenge has been the lack of supply in the housing market. According to National Association of Realtors data, there was only 1.9 months supply at the current sales pace, and just over 1 million homes on the market across the country at the end of January.

Newly built housing inventory is rising, up to about four months supply at the current strong pace. Homebuilders have increased the pace of construction, but continue to struggle with supply chain issues, with a sharp rise in input costs. Lumber prices have increased more than 180% since last spring, and the costs of other inputs have gone up even faster. According to NAHB, these jumps in input costs have caused the price of building a new home to increase by more than $24,000 over the past year.

Not surprisingly, the lack of inventory in the housing market has led to sharp increases in home prices across the country, with the most recent read of the FHFA’s home-price index showing a 10.8% year-over-year gain at the national level, with signs of further acceleration in recent months. Price appreciation was even faster in some of the hottest markets in the Mountain West and Northwest, but overall, the robust rate of appreciation in several markets is far above income growth.

Again, not surprisingly, housing is strongest in those markets with the strongest fundamentals, particularly when it comes to demographics. The top five fastest-growing states in terms of population last year were Idaho, Arizona, Nevada, Utah and Texas. Also last year, almost 795,000 of the 990,000 single-family housing starts nationally were in the fast-growing South and the West Census regions.

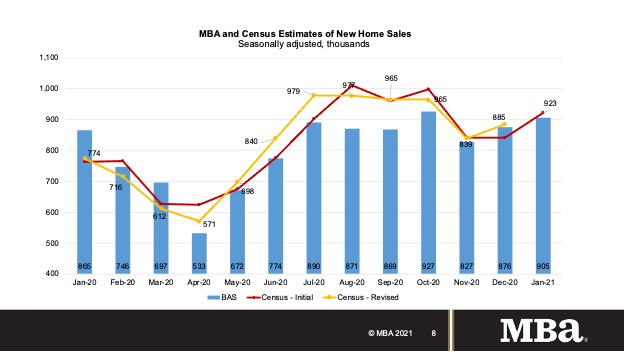

Given the lack of inventory in the housing market, we will be watching the pace of home construction particularly closely this year. Fortunately, in addition to the U.S. Census Bureau data, we conduct our own survey of the new home market, with the release every month of MBA’s Builder Application Survey (BAS). MBA’s better-known Weekly Applications Survey tracks both refinance and purchase application volumes. However, the purchase component is dominated by mortgages to buy existing homes, as the level of existing home sales tends to be six to seven times the level of new home sales.

With that in mind, MBA’s BAS, launched in July 2013, looks solely at the volume of applications for new home purchases. The sample consists of MBA members who are affiliated with home builders — accounting for more than 30% of the new home market. The monthly results are typically published mid-month, in advance of the Census Bureau’s monthly New Residential Sales release.

As shown in Exhibit 4, the BAS results are a good predictor of the Census’ results, and regular revisions to Census data often move the two series even closer together.

In addition to keeping a close eye on the new home market, we will also be looking for any sign that the rapid rise in home prices is leading to affordability challenges in different housing markets. If home prices continue to increase at rates three to four times the rate of income growth, it will slow the purchase market – especially for price-sensitive, first-time buyers. Even with rates expected to stay low, an early warning sign would be a sustained drop in purchase application volume.

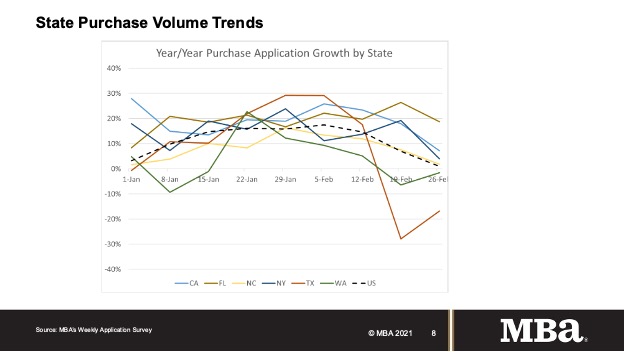

Exhibit 5 shows state-level trends in purchase application volume thus far in 2021, with observations from some of the larger states. (Note the dip in activity in Texas due to the severe winter storm in February.) In 2020, we were able to use the state-level data to track the differential growth in those states that first relaxed pandemic restrictions.

We are just beginning to see new changes being announced with respect to relaxation of restrictions on business activities, and these might well lead to differential growth in purchase activity once again for this year’s spring housing market.

Exhibit 5

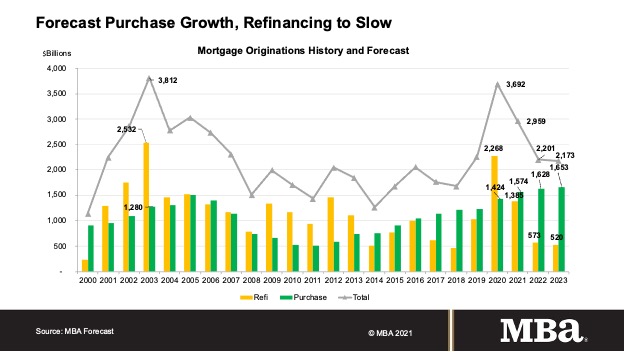

All in, the combination of robust demand in the housing market, constrained but growing supply, and rapidly rising home prices will result in a strong spring housing market and a record level of purchase volume for the year, according to MBA’s forecast.

Just as the first tree buds signal the start of a bountiful spring, a meaningful jump in the supply of newly built homes will be a telling sign of housing supply conditions and subsequent home sales activity. MBA is predicting as of February that the mortgage industry this year will originate just shy of $3 trillion in total volume, with the majority – $1.57 trillion – in home purchases.