With mortgage rates recently dropping to all-time lows and lenders currently working to keep up with the surging demand from borrowers, the Mortgage Bankers Association now expects this year to see the highest volume of mortgage refinances in eight years.

The MBA announced Tuesday that it is doubling its refi forecast for 2020. The trade group’s economists now believe there will be $1.232 trillion in refis this year, twice as many as the group originally expected.

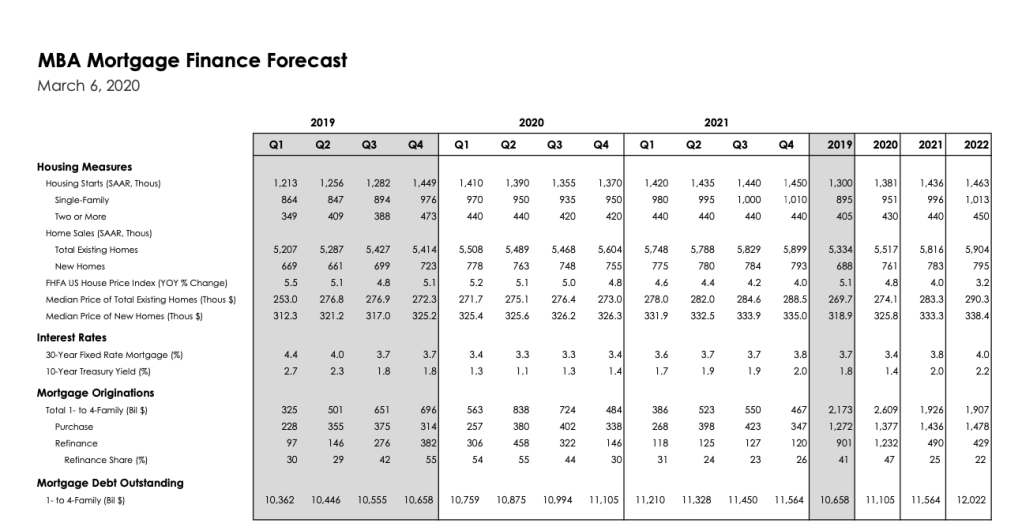

Overall, the MBA now expects there to be $2.609 trillion in total mortgage originations in 2020, which would be a 20.1% increase from last year.

Last year, by the way, saw a 12-year high in mortgage originations thanks to the falling interest rates that began to occur halfway through the year.

And now, the MBA expects total originations to top last year’s record-breaking figure.

If that comes to pass, 2020 will end up being the best year for the mortgage business since 2006, when there was $2.726 trillion in total originations.

The MBA originally forecasted refi originations to fall precipitously over last year, but no one anticipated the panic over the coronavirus driving mortgage rates lower than they’ve ever been.

“Lower rates have led us to estimate significantly higher mortgage refinance volume, and we now anticipate an increase in refinancing in 2020, compared to the previously forecasted decline,” said MBA Chief Economist Mike Fratantoni.

It should be noted that if the MBA is right, 2020 would only be the highest refi volume since 2012, when there were $1.456 trillion in refis.

The reason that this year is now expected to be the best overall year since 2006 is the strength of the purchase market. In 2012, there were only $588 billion in purchase originations.

The MBA now expects there to be $1.377 trillion in purchase originations this year, an increase of 8.3% over last year.

The MBA also expects interest rates to stay low throughout the year, driving continued demand for mortgages all year long. The MBA now projects that interest rates will stay around 3.3% in both the second and third quarter, before rising slightly to 3.4% in the fourth quarter.

Interest rates at that level will lead to $838 billion in mortgage originations in the second quarter and $724 billion in originations in the third quarter. Those two quarters alone would nearly equal all the mortgage business done in 2018.

The MBA also now expects interest rates to rise to 3.8% over the course of 2021, leading to declines in mortgage lending in both 2021 and 2022. Although it should be noted that in both of those years, the MBA expects overall volume to approach $2 trillion. That’s a far cry from 2012, when there were only $1.261 trillion in originations.