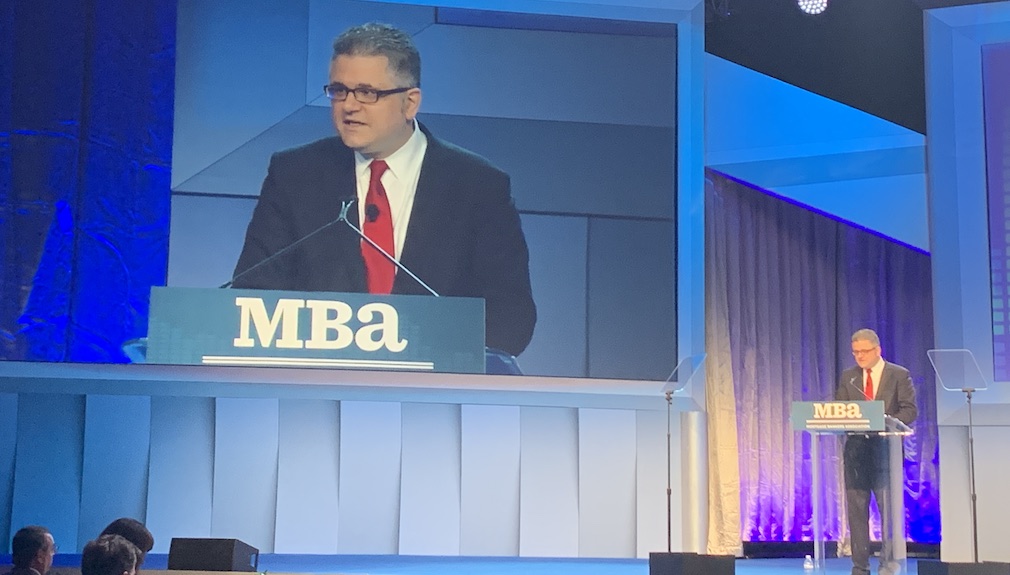

In a keynote speech at the Mortgage Bankers Association’s annual convention in Austin, Federal Housing Finance Agency Director Mark Calabria explained the agency is preparing to help Fannie Mae and Freddie Mac exit conservatorship.

On Monday morning, the FHFA released its annual Scorecard for the government-sponsored enterprises, outlining the goals its regulator will use for judging their performance in 2020. There were three goals for the GSEs this year, including, “Prepare for transition out of conservatorship.”

But in order to exit conservatorship, the mortgage giants will need to begin to build capital.

At the end of September, the FHFA announced it would allow Fannie and Freddie to rebuild a portion of their capital reserves to a total of $45 billion combined.

Calabria explained in his keynote speech that after just one quarter of retention where Fannie and Freddie profits weren’t swept back, the companies doubled the capital.

“I’m not sure I can keep up that pace,” Calabria said, drawing laughs from the audience.

But before they were able to hold their capital, Fannie and Freddie had a leverage ratio of 1,000 to one. Now, that has been decreased to 500 to one. The GSEs still have a ways to go, as currently the nation’s largest banks operate at an average ratio of 10 to one.

“Delinquency rates for Fannie and Freddie have slipped a little, but when you’re leveraged 500 to one it doesn’t matter if every loan is the best quality,” Calabria said. “Fannie and Freddie will move forward thoughtfully, but this does not mean moving slowly.”

The enterprises will continue to support access to credit through low down payment mortgages. They have affordable housing goals and will continue to meet those, but Fannie and Freddie have a different model than the fully taxpayer-backed FHA.

For example, Fannie and Freddie’s risk must be supported by private capital, their activities are expected to earn a reasonable economic return, and they must be able to withstand an economic downturn and their loans must be sustainable through the cycle.

By better defining these differences as the GSEs prepare to leave conservatorship, reducing “irresponsible and needless competition” between the enterprises and FHA also strengthens and stabilizes the FHA fund, Calabria said.

“When the enterprises stretch credit guidelines to ‘skim the cream’ from FHA, they not only put themselves at risk, but they also undermine the pooling of risks across a broad range of credit necessary for FHA to function,” he said.

And Department of Housing and Urban Development Secretary Ben Carson agreed roles should be clearly defined in order to reduce overlap.

“To ensure the GSEs have well-defined boundaries in the housing market and avoid overlapping roles, we suggest the FHFA and the FHA collaborate,” Carson said during his keynote speech at the conference.

“Now is the time to address the long-term future of Fannie Mae and Freddie Mac, and we’re pleased to hear that meaningful progress is being made to prepare for a responsible end to their conservatorships,” MBA President and CEO Robert Broeksmit said.

But as exiting the conservatorship moves closer, Calabria explained he will ensure that it is done right.

“I will not end the conservatorship unless I am confident that once Fannie and Freddie leave, they will never have to return,” Calabria said.