Beginning Oct. 9, 2019, certain home sales of $400,000 and under will no longer require an appraisal.

Under previous rules that have been in place since 1994, appraisals were not required on all home sales of $250,000 and below, but last year, federal regulators proposed increasing the appraisal threshold for the first time in 25 years.

Last November, the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Board of Governors of the Federal Reserve released a proposal to increase the appraisal requirement from $250,000 to $400,000, citing the home price appreciation that’s taken place since the threshold was last increased in 1994.

Last month, the agencies all approved the rule. And Tuesday, the rule was published in the Federal Register, making the appraisal threshold increase effective the following day, Oct. 9, 2019.

That means that certain home sales of $400,000 and below will no longer require an appraisal as of Oct. 9, 2019.

Now, it’s important to note that the new rules do not apply to loans wholly or partially insured or guaranteed by, or eligible for sale to, a government agency or government-sponsored agency.

What that means is that loans sold to or guaranteed by the Federal Housing Administration, Department of Housing and Urban Development, Department of Veterans Affairs, Fannie Mae, or Freddie Mac will still require an appraisal, per each agency or companies’ rules.

Put simply, the loans that are affected by this rule are either held in portfolio by lenders or sold to secondary market investors via the private-label securitization market.

In August, the FDIC and OCC signed off on the rule, while the Fed approved the rule late last month. With the Fed approving the rule, the increase became official, but the rule could not go into effect until it was published in the Federal Register.

That’s done now, and the rule goes into effect on Wednesday.

The change will likely have a sizable impact on the real estate market, as according to regulators, the new rules will apply to approximately 40% of home sales.

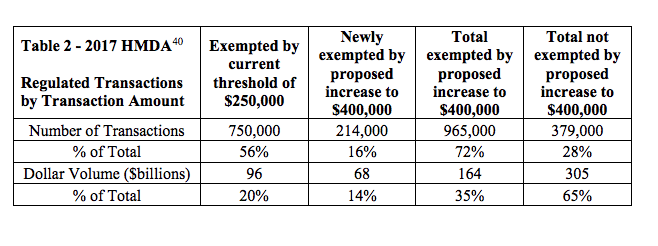

The agencies estimate that increasing the appraisal threshold from $250,000 to $400,000 would have led to an additional 214,000 residential mortgages that did not require an appraisal in 2017, representing 3% of total HMDA originations.

Under the previous rules, there were 750,000 transactions in 2017 that were exempted from the appraisal requirement. By increasing the threshold to $400,000, there would have been an additional 214,000 sales exempted from the appraisal requirement in 2017.

Under the new rules, 72% of the eligible transactions would have been exempted from the appraisal requirement, while 28% would still have required an appraisal.

It’s also important to note that the rule does not entirely exempt the relevant home sales from any type of appraisal-type action. According to the agencies, the final rule “requires institutions to obtain an evaluation to provide an estimate of the market value of real estate collateral.”

The agencies state that the evaluation must be “consistent with safe and sound banking practices.” To that point, the rule establishes that an evaluation “should contain sufficient information and analysis to support the regulated institution’s decision to engage in the transaction.”

According to the agencies, many of the comments they received suggested that evaluations are “appropriate substitutes for appraisals and institutions as having appropriate risk management controls in place to manage the proposed threshold change responsibly.”

For more details on the evaluation portion of the rule, click here to read the rule in full.

“The appraisal threshold was last changed in 1994,” the federal agencies said in a joint statement. “Given price appreciation in residential real estate transactions since that time, the change will provide burden relief without posing a threat to the safety and soundness of financial institutions.”

Again, to read the full rule, click here.