Federal regulators are proposing to increase the threshold at which residential home sales require an appraisal for the first time since 1994.

On Tuesday, the Federal Deposit Insurance Corp., the Office of the Comptroller of the Currency, and the Board of Governors of the Federal Reserve released a proposal that would increase the appraisal requirement from $250,000 to $400,000, meaning that certain home sales of $400,000 and below would no longer require an appraisal.

It’s important to note that this rule would not apply to loans wholly or partially insured or guaranteed by, or eligible for sale to, a government agency or government-sponsored agency.

That means that the appraisal exemption would not apply to loans sold to or guaranteed by the Federal Housing Administration, Department of Housing and Urban Development, Department of Veterans Affairs, Fannie Mae, or Freddie Mac.

Nevertheless, the change would have a sizable impact on the real estate market. According to the OCC, the new rules would apply to approximately 40% of home sales.

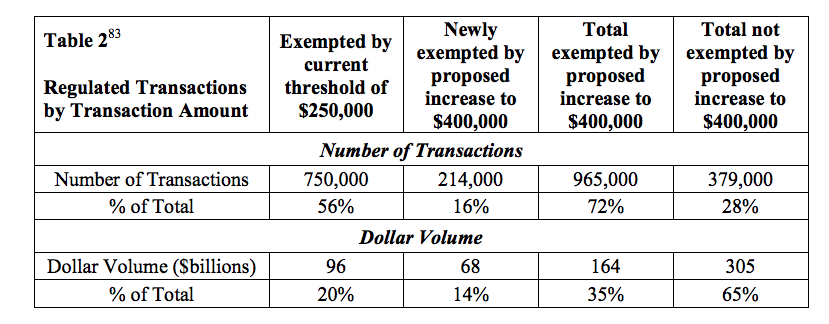

According to data provided by the FDIC, the agencies estimate that increasing the appraisal threshold from $250,000 to $400,000 would have exempted an additional 214,000 residential mortgages at regulated institutions from the agencies’ appraisal requirement in 2017, which represents 3% of total HMDA originations.

On a percentage basis, under the current rules, in 2017, there were 750,000 transactions that were exempted from the appraisal requirement (56%). As stated above, by increasing the threshold to $400,000, there would have been an additional 214,000 sales exempted from the appraisal requirement (an additional 16%).

Therefore, under the proposed rules, 72% of the eligible transactions would be exempted from the appraisal requirement, while 28% would require an appraisal (as shown in the chart below).

(Click to enlarge. Image courtesy of the FDIC)

In terms of dollar amount, $96 billion in sales were exempt from the appraisal requirement in 2017. The new rules would increase that figure by $68 billion to a total of $164 billion (or 35% of the total). Under the new rules, $305 billion in sales (65%) would still require an appraisal.

As for why a change is being proposed now, the regulators say the move is in response to “concerns raised about the time and cost associated with completing residential real estate transactions.”

The FDIC said that the move “could provide meaningful burden relief from the appraisal requirements, without posing a threat to the safety and soundness of financial institutions.”

Under the proposal, instead of requiring a full appraisal, lenders would need to obtain an “evaluation consistent with safe and sound banking practices.”

According to the regulators, “evaluations provide an estimate of the market value of real estate but could be less burdensome than appraisals because the agencies’ appraisal regulations do not require evaluations to be prepared by state licensed or certified appraisers.”

Additionally, the regulators state that evaluations are “typically less detailed and costly than appraisals,” and note that evaluations have been required for transactions exempted from the appraisal requirement by the current $250,000 residential threshold since the 1990s.

“This proposal responds, in part, to comments that the current exemption level for residential transactions had not kept pace with price appreciation in the residential real estate market,” the regulators state.

The appraisal threshold was last increased in 1994 when regulators increased the threshold from $100,000 to its current level of $250,000.

The regulators argue that increasing the threshold now will actually have less of an impact on the market than the 1994 change did.

“When the threshold was raised in 1994, the agencies estimated that the aggregate dollar volume of exempted transactions due to the threshold increase was 85% of all new home sales, and 82% of all existing home sales,” the agencies say in the official notice. “Thus, the agencies expect the proposed threshold level to have a much smaller impact on the dollar volume of transactions and, therefore would be less likely to pose a safety and soundness risk than the current threshold level did when it was introduced in 1994.”

To read the full proposal from the FDIC, OCC, and Federal Reserve, click here.