Over the past few decades, the inventory of affordable homes has been in sharp decline while home prices have risen dramatically. In fact, since 2012, the average price of a home has risen by almost 47%. As a result, affordable housing solutions like manufactured homes may be more suitable for homebuyers looking for a starter home or seeking to downsize. However, misperceptions about quality and a lack of awareness both still remain as obstacles to progress.

Research shows that Millennial and Gen Z homebuyers have significantly less buying power than previous generations did, due to high amounts of debt and a national average salary that hasn’t kept up with soaring home prices. In 2018, only 22% of new homes built were under 1,800 square feet, and larger homes often are unaffordable and may not meet the needs of younger homebuyers or empty nesters looking to downsize.

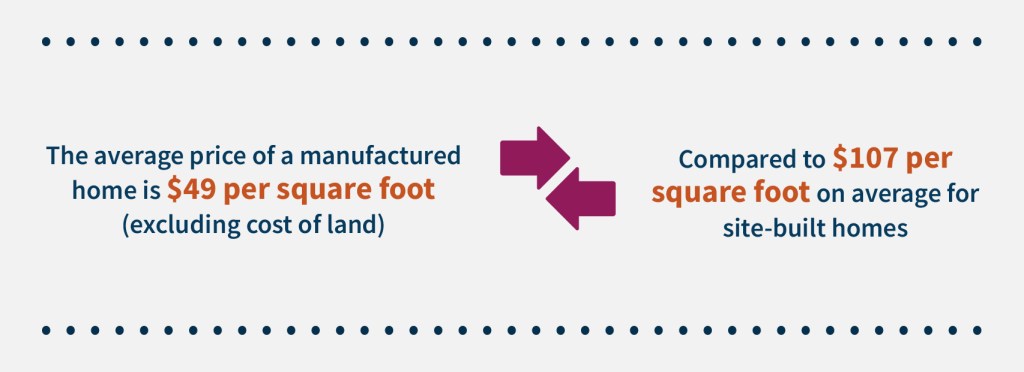

Manufactured housing could be the inexpensive option they’ve been looking for. The newest generation of manufactured homes has moved far beyond the double-wides and trailers of yesterday. In fact, most manufactured homes, once placed on land, are never moved. Excluding land cost, the average price of a manufactured home today is $49 per square foot, compared with $107 for site-built homes.

Once sited, these homes can be indistinguishable from traditional site-built homes on the same street. Low profile foundations, high-pitched roofs, front porches, driveways, energy efficiency elements, and garages or carports are just a few of the new design features available. And with Fannie Mae’s MH Advantage, financing for qualifying manufactured homes is available with as little as 3% down on a land-home, 30-year mortgage.

Despite the many benefits of manufactured homes, low awareness remains the primary hurdle. In our recent survey, only 39% of younger homebuyers were aware of manufactured housing as a potential option. But once the definition of manufactured homes was clarified, and they were shown images or video of what these homes look like, their interest increased by 31%.

Beyond manufactured housing, several other affordable housing alternatives have the potential to change the marketplace once buyers are made aware of and educated about them. For instance, among future homebuyers surveyed by Fannie Mae, only 9% showed awareness of accessory dwelling units (ADUs), which are units placed on the same plot of land as a main domicile, but generally smaller and more affordable. But, when these same future homebuyers were educated about ADUs, their interest rose by 29%.

To make housing more attainable for prospective homebuyers, we need to expand our definition of what housing is and what it could be. There are many types of housing available for those who are finding themselves priced out of the traditional market. If we work together to generate awareness of and interest in solutions beyond site-built homes, we can create more opportunities for more people.

Visit FM.FannieMae.com/Affordable and read more about our approach for making housing more affordable.

See our infographic to learn more about affordable housing alternatives.

Sources: Fannie Mae, “Future Homebuyers,” Single-Family Strategy & Insights unpublished research (November 2019). | Fannie Mae, “Manufactured Housing,” Single-Family Strategy & Insights unpublished research (December 2019). | Hickey, “2019 State of the Nation’s Housing Report: Lack of Affordable Housing,” Habitat For Humanity (2019).