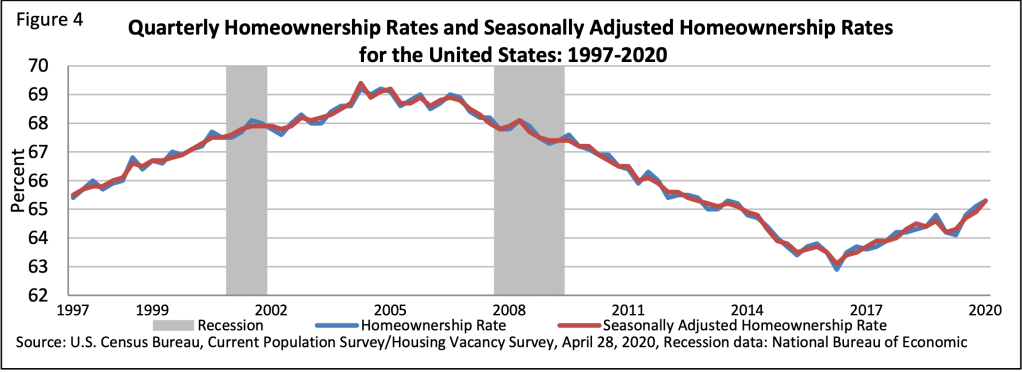

The homeownership rate in the U.S. continued rising in the first quarter, reaching the highest level since the third quarter of 2013, before the coronavirus shut down much of the country.

The share of people in the U.S. who own their home rose to 65.3%, an increase of 1.1% over the first quarter of 2019 and an increase of 0.2% over the fourth quarter of last year, the Census Bureau said on Tuesday.

The increase continued a positive overall trend in homeownership that stretches back to third quarter of 2016.

That growth could be undone by the impact of COVID-19 on the country’s economy, said Mortgage Bankers Association Chief Economist Mike Fratantoni. The nation began shutting down in the second half of March, leading to tens of millions of job losses and millions of people needing forbearance on their mortgages.

“Data for the first quarter of 2020 continue to reflect the extremely strong housing market prior to the current COVID-19 pandemic and subsequent economic crisis,” Fratantoni said. “Without a doubt, the rapid deterioration of the job market this spring will cause second quarter numbers to reverse course.”

In addition to the high numbers for homeownership, other data in the report showed improvement, he said.

“Homeowner vacancy rates dropped to the lowest level in more than 40 years, and the rental vacancy rate also remained quite low,” Fratantoni said.

The homeowner vacancy rate, the share of houses that are empty and for sale, fell to 1.1% in the first quarter. That’s lower than in any quarter in more than four decades.

The economic fallout from COVID-19 might hit younger people the hardest, said realtor.com Senior Economist George Ratiu.

“The homeownership rate for people under the age of 35 – while the lowest across generations – posted the strongest gain over the past 12 months,” Ratiu said. “An upward trend in homeownership would indicate rising economic well-being, especially for younger homebuyers who are more likely to feel the hit of current unemployment trends.”

Broken out by region, the homeownership rate was highest in the Midwest (69.2%), followed by the South (67.6%), the Northeast (62.4%) and the West (60.1%).

The homeownership rates in the Northeast, Midwest, and South were all higher than the rates in the first quarter 2019, while the homeownership rate in the West was not statistically different from the rate in first quarter 2019.

The first quarter homeownership rate was highest for those aged 65 years and over (78.7%), followed by those 55 to 64 years old (76.3%), 45 to 54 years old (70.3%), and 35 to 44 years old (61.5%).

Meanwhile, as Ratiu noted, the homeownership rate was lowest for those under 35 years of age (37.3%).

As the March new home sales data showed, the market has been deeply impacted over the last month and a half. Ratiu, however, believes that the circumstances of the last six weeks could lead to increased interest in home buying when the pandemic dissipates.

“The coronavirus pandemic is impacting not only the economy and real estate markets, but also shifting consumer preferences,” Ratiu said.

“As Americans have lived, worked, taught, studied, cooked and exercised at home over the past month, we have a new-found appreciation for bigger homes, with more outdoors space, updated kitchens and access to amenities,” said Ratiu.

“These preferences hold across generational cohorts, pointing to a favorable outlook for homeownership,” he said. “The main challenge over the next two years will be a critical shortage of available homes for sale and access to financing.”