After a winter of dire housing market forecasts, the housing market regained its footing this spring, with home prices rising month-over-month for the third consecutive month in April, according to the S&P CoreLogic Case-Shiller National Home Price Index, which was released Tuesday. These increases came after seven consecutive months of decline.

“The index tracks price changes from the months of February, March, and April of 2023, and spotlights a growing number of buyers coming to terms with higher rates and looking for a path toward homeownership,” George Ratiu, the chief economist at Keeping Current Matters, said in a statement. “Inflation has been a headlining concern for most consumers over the past year, even as price growth had moderated noticeably. At the same time, households have seen interest rates push borrowing costs higher across the board for credit cards, auto loans, and home mortgages. At the same time, the official end of the pandemic signaled a return toward a new normal, encouraging Americans to embrace their next stage of life.”

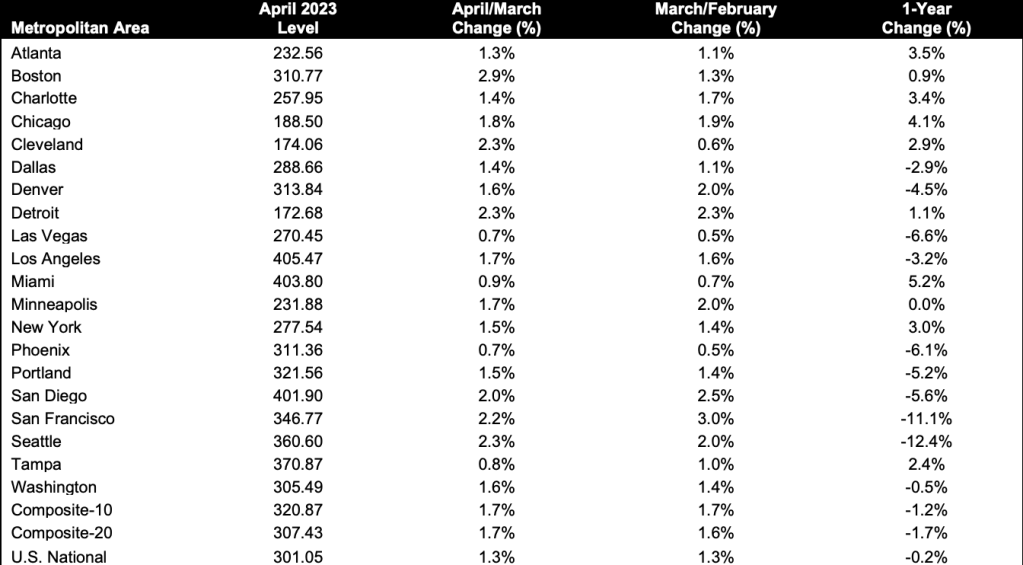

On a monthly basis, the national index was up 1.3% in April. However, on a year-over-year basis, the index was down 0.2%, compared to an annual gain of 0.7% in March.

“The U.S. housing market continued to strengthen in April 2023,” Craig Lazzara, the managing director at S&P DJI, said in a statement. “Home prices peaked in June 2022, declined until January 2023, and then began to recover.”

Just like in March, both the 10-city and 20-city composite price indexes posted annual declines but monthly gains. For the 20-city composite, after seasonal adjustment, 17 out of the 20 cities reported lower prices in the year ending April 2023 versus the year ending March 2023. Boston, San Francisco and Cleveland all showed slight increases at 0.1%, 0.1%, and 0.9%, respectively.

Data through April 2023

Miami topped the list yet again with the highest annual price gain at 5.2%, with Chicago (4.1%) and Atlanta (3.5%), rounding out the top three.

“At the other end of the scale, however, the worst eight performers are all in the Mountain or Pacific time zones, with Seattle (-12.4%) and San Francisco (-11.1%) at the bottom,” Lazzara said. “The Southeast (+3.6%) continues as the country’s strongest region, while the West (-6.9%) remains the weakest.”

Overall, the 20-city index was down 1.7% on an annual basis, but up 1.7% on a monthly basis, while the 10-city index fell 1.2% year-over-year and rose 1.7% month-over-month.

“If I were trying to make a case that the decline in home prices that began in June 2022 had definitively ended in January 2023, April’s data would bolster my argument,” Lazzara said. “Whether we see further support for that view in coming months will depend on the how well the market navigates the challenges posed by current mortgage rates and the continuing possibility of economic weakness.”