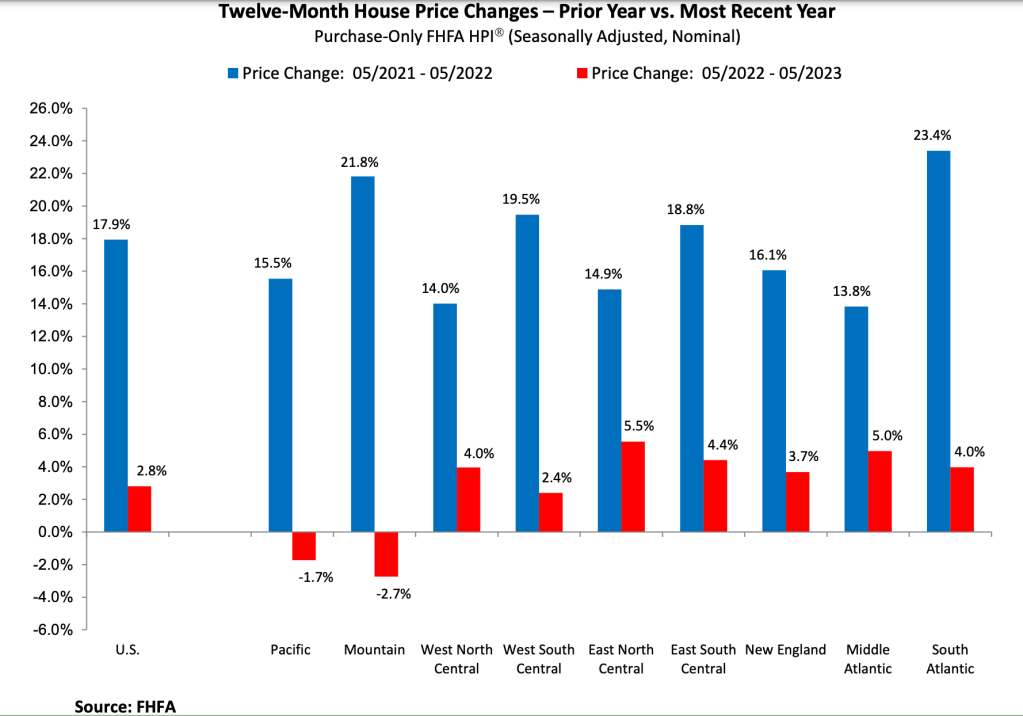

U.S. house prices rose slightly in May, up 0.7% from April, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI). On a year-over-year basis, prices rose 2.8% from May 2022 to May 2023. But that only tells part of the story.

“U.S. house prices increased moderately in May, continuing the trend of the last few months,” said Nataliya Polkovnichenko, supervisory economist at the FHFA. “However, house prices in some regions of the country remained below the levels seen one year ago.”

For the nine census divisions, seasonally adjusted monthly price changes varied from April 2023 to May 2023. They ranged from -0.5% in the New England division to +1.7% in the Pacific division. The 12-month changes ranged from -2.7% in the Mountain division and -1.7% in the Pacific division, to +5% in the Mid-Atlantic division and +5.5% in the East North Central division (Illinois, Indiana, Michigan, Ohio and Wisconsin).

Also released on Tuesday, the S&P CoreLogic Case-Shiller National Home Price Index indicated that home prices rose month-over-month for the fourth consecutive time in May.

However, this decade-long rally in U.S. home prices could finally come to an end, said Robert Shiller, professor of economics at Yale University yesterday on CNBC. That is if the Federal Reserve stops its rate-hiking cycle.

“The fear of interest rate increases has influenced people’s thinking — it’s not just the homeowners, it’s new buyers who wanted to get in before the interest rates went up even more,” Shiller said on CNBC’s Squawk Box. “They wanted to lock in. So that’s been a positive influence on the market. But it’s coming to an end.”