As we enter the second quarter of 2021, it’s time for the mortgage industry to reflect on the past 12 months and think about how to plan for the same period ahead. After all, it was mid-March of last year that the president declared a national emergency leading to school closures, the wearing of masks, and the emptying of office buildings across the country. A little over a year ago, we could have never imagined the actual implications of COVID’s impact to come on this nation, our communities, families and our business.

Take working remotely for example. In early 2020, Zoom was barely a known company in America. The impact of COVID made it a household name. By October, the market value of Zoom exceeded that of Exxon-Mobile, reflecting the dichotomy of an intransigent society staying at home and working remote. The stock value of Zoom grew 650% during this one year as many other aspects of the economy slowed or shuttered as a result of the shutdown.

But housing was the true bright spot in the economy. Low mortgage rates, driven by quantitative easing by the Federal Reserve helped fuel a boom in both mortgage refinancing and purchases, making 2020 the second-best year in U.S. history for mortgage origination volume. Augmenting the low rates was an increase in demand driven by the sudden surge of the millennials, finally now out to buy a home.

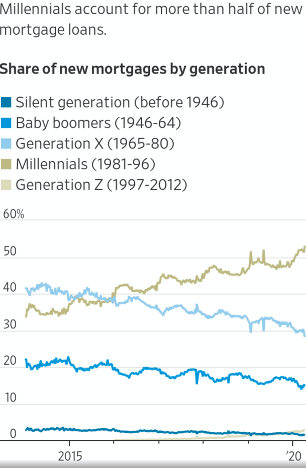

In fact, as reported in the Wall Street Journal in late August of 2020, “Millennials reached a housing milestone in 2020 when the group first accounted for more than half of all new home loans, and they consistently held above that level in the first months of 2021, the most recent period for which data are available, according to Realtor.com. The generation made up 38% of home buyers in the year that ended July 2019, up from 32% in 2015, according to the National Association of Realtors.”

Now, with the economy looking toward life past COVID, the focus is beginning to shift to a recovering economy, perhaps hotter than expected, driven by an excess in stimulus provided, and a likely end to the low single-digit mortgage rates seen over the previous year.

But a reminder to all is relevant now. Low rates are often the sign of a poor economy. As Bankrate’s Chief Economist Greg McBride, recently highlighted: “Bad economic news is often good news for mortgage rates. When concern about the economy is high, investors gravitate toward safe-haven investments like Treasury bonds and mortgage bonds, pushing bond prices higher but the yields on those bonds lower.”

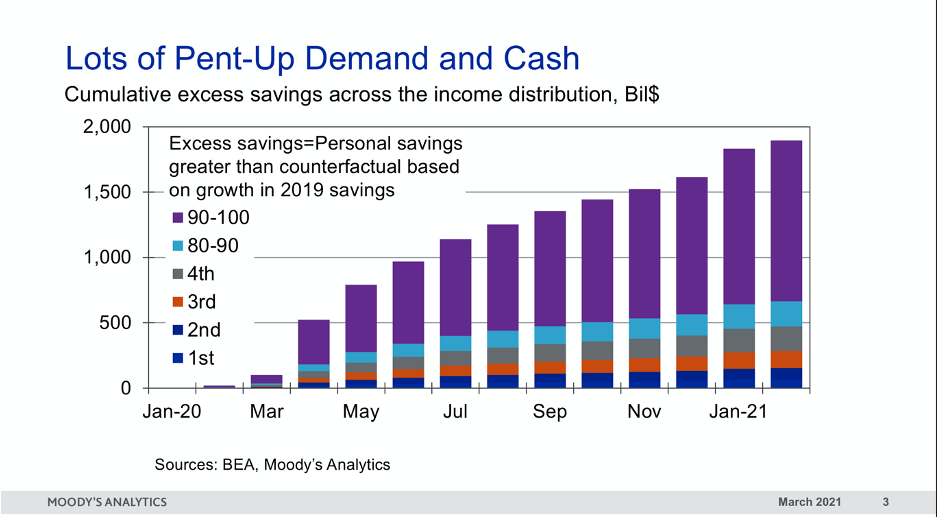

So, the good news is that the economy will survive COVID and may actually catch on fire in the rebound with GDP forecasted to grow by 6.5% this year. Job growth will be the result of increased spending across every sector — from travel to goods and services. In fact, the pent-up demand can be reflected by the growth in retained savings after expenses during COVID, as Economist Mark Zandi of Moody’s Analytics highlights.

With 916,000 jobs created in March, many economists are bracing for what might be a spending spree from a nation that has been locked away for far too long and now recovering at a record pace. With summer on the horizon, look for the pace of spending to only grow with tourism augmenting what would already be a robust growth spree.

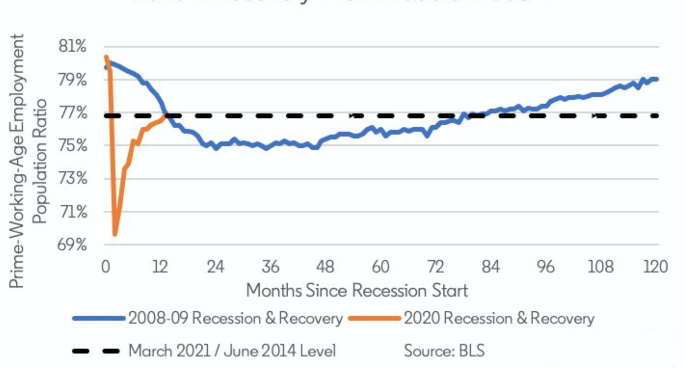

In fact, the recovery from the COVID pandemic is in stark contrast to that of the 2008 Great Recession. The fact that this recession was brought on by a virus versus weakening economic variables is key to the distinction. If you compare the employment growth between the two recessions there is truly no comparison.

Low interest rates, the demand surge from the millennials that are now reaching peak buying years, significant stimulus brought on by three large recovery bills, not to mention a potential infrastructure package, and massive pent-up demand from the lack of spending over the past year should have everyone simply bracing for lift off from the U.S. economic engine as it fires up.

So mortgage rates will likely continue to rise modestly as the Fed tapers from its intervention in the MBS (mortgage backed security) supply, which will slow refinancing and thus reduce mortgage volume overall in the market. Clearly, mortgage forecasts from the MBA and others reflect the expectation that overall volume will slow, but purchase activity will continue to grow.

For those that have focused on purchase lending, they will see less of a drop in total volume. But for those that have overly depended on refinancing, the impact will be more severe. Fortunately for lenders that were already more purchase-focused, the impact will be far less than many other refinance dependent operations given the strong purchase to refinance mix.

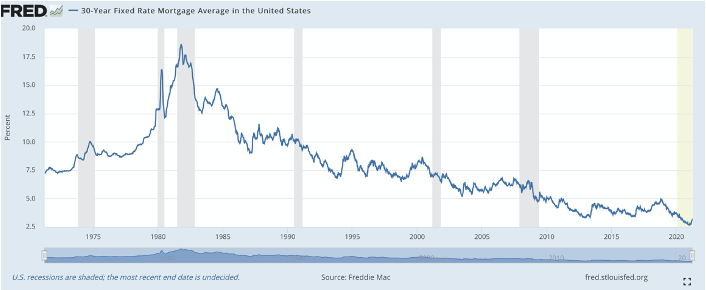

And one last perspective is important for everyone. The graph below from the Federal Reserve of St. Louis is the most important point about perspective. Look at 30-year mortgage rates as they stand today compared with any time going back decades when these rates were even captured on an aggregate basis. Rising mortgage rates will certainly be tolerated by the market.

In fact, small hikes in mortgage rates can lead to panic-buying periods which can drive small volume surges. Mortgage rates have never been this low and yet through previous cycles home sales have continued. In fact, the largest home purchase year in this nation’s history was 2005 when rates were near 7.5%.

The nation’s greatest obstacles ahead will come from the shortages in available single family home inventory across the county. But as America returns to work, supplies for builders will return to needed production levels, new home construction will continue to rise, and ultimately the supply-demand imbalance will rectify itself. The current proposed infrastructure bill includes funding for over 100,000 affordable housing units among many other housing initiatives, reflecting the recognition of the need to address access and supply to affordable homes.

For those in the mortgage banking industry, market corrections are part of the business. But in the year ahead, while having less mortgage volume overall, it will be met with a strengthening economy, a healthier nation, and enormous demand for home ownership. How lenders re-tool for this shift to a stronger economy and a purchase-dominated mortgage market will be the most important variables in long-term success. For companies that prepare for this, the market shift will be far less impactful compared to so many others.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com