Americans are better now at paying their mortgages on time than they have been at any point in the last 20 years, a new report from CoreLogic shows.

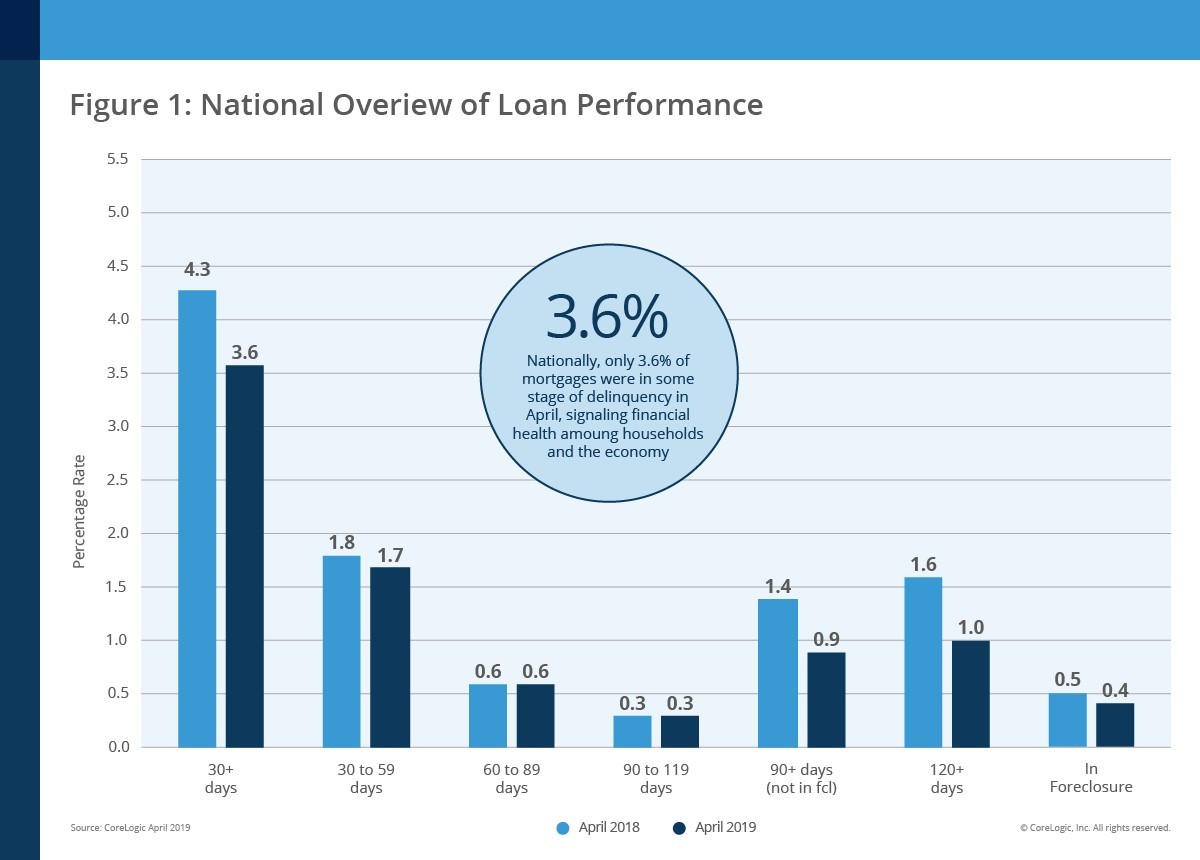

According to CoreLogic’s latest monthly Loan Performance Insights Report, the national delinquency rate (mortgages that are in some stage of delinquency, meaning those that 30 days or more past due and including loans in foreclosure) sat at 3.6% in April.

That’s the lowest national delinquency rate in more than 20 years, CoreLogic said.

It’s also a significant decline from the same time period last year, when the delinquency rate was 4.3%.

The decline in April continues a trend that stretches back more than a year.

According to CoreLogic’s report, the nation's overall delinquency rate has fallen on a year-over-year basis for the last 16 consecutive months.

(Click to enlarge. Image courtesy of CoreLogic.)

Frank Nothaft, chief economist at CoreLogic, said there’s a combination of factors driving the improvement in mortgage performance, but Nothaft cautions that the news is not universally good.

“Thanks to a 50-year low in unemployment, rising home prices and responsible underwriting, the U.S. overall delinquency rate is the lowest in more than 20 years,” Nothaft said.

“However, a number of metros that suffered a natural disaster or economic decline contradict this national trend,” Nothaft added. “For example, in the wake of the 2018 California Camp Fire, the serious delinquency rate in the Chico, California, metro area this April was 21% higher than one year ago.”

According to the report, in April 2019, 10 metropolitan areas saw an increase in the serious delinquency rate, defined as 90 days or more past due, including loans in foreclosure.

The highest gains came from the parts of the Southeast recently affected by hurricanes (Florida, Georgia and North Carolina), and in Northern California, where the Camp Fire hit last year.

Overall, the rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.7% in April 2019, down from 1.8% in April 2018. The share of mortgages 60 to 89 days past due in April 2019 was 0.6%, unchanged from April 2018. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.3% in April 2019, down from 1.9% in April 2018.

According to the report, April’s serious delinquency rate of 1.3% was the lowest for any month since August 2005, when it was also 1.3%.

But Frank Martell, president and CEO of CoreLogic, cautioned that some areas of the country could see an increase in delinquencies as a result of the recent flooding in the Midwest.

“The U.S. has experienced 16 consecutive months of falling overall delinquency rates, but it has not been a steady decline across all areas of the country,” Martell said. “Recent flooding in the Midwest could elevate delinquency rates in hard-hit areas, similar to what we see after a hurricane.”