The average homeowner gained $6,400 in home equity in 12 months’ time as of the first quarter of the year, according to the latest CoreLogic data.

While on its face that might seem like a solid return for zero work, a brief look at historical gains reveals that, well, maybe not so much.

In the previous quarter, the annual gain for the average homeowner totaled $9,700. And in the three prior quarters, the gain was $12,400, $16,153 and $16,300. Clearly, home equity returns are slipping, a direct result of slowing home-price growth.

CoreLogic’s latest report shows that homeowners with mortgages, which accounts for about 63% of all properties, saw their homes' equity increase 5.6% year over year in Q1.

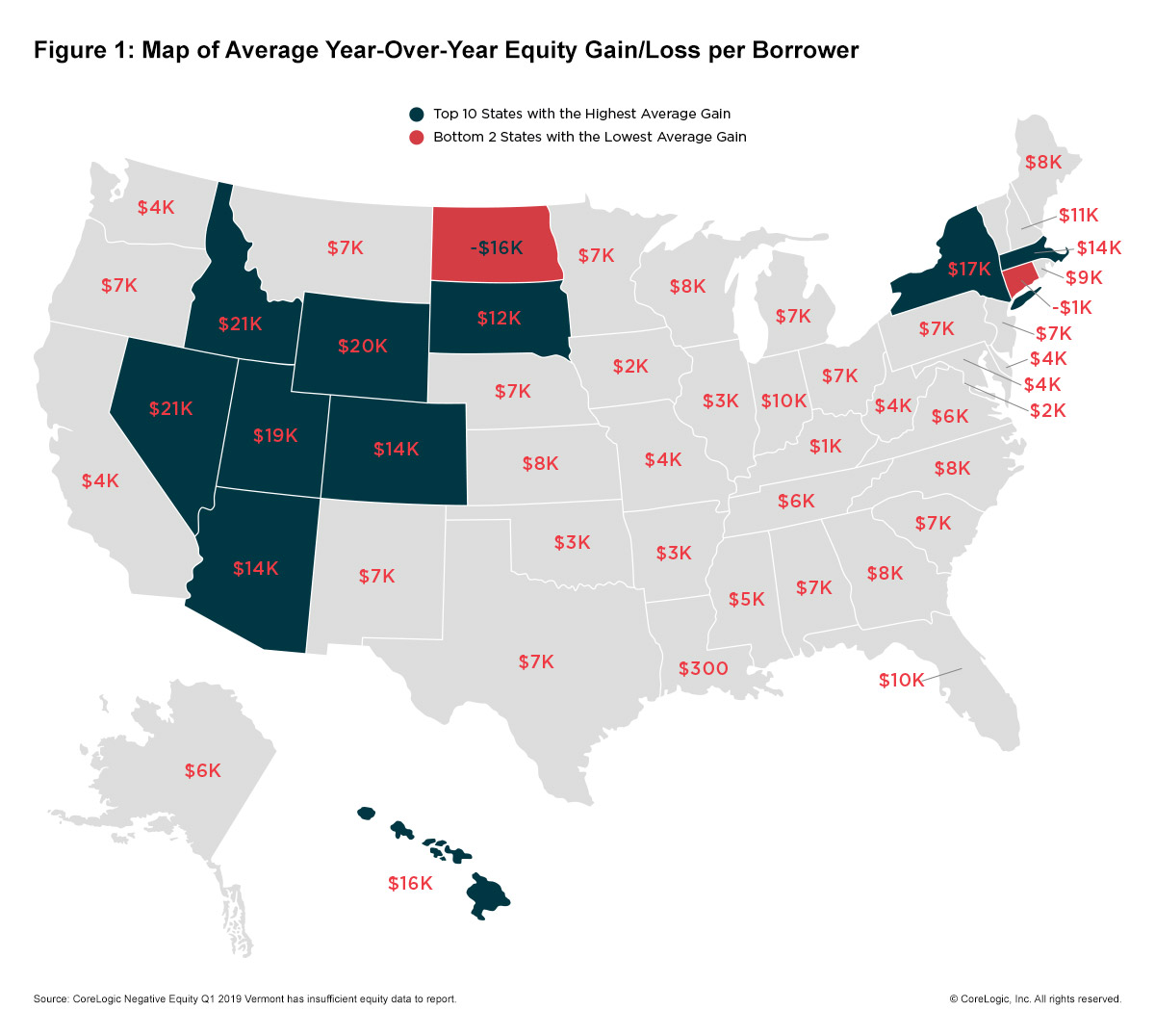

Some states fared much better than others. In Nevada, gains totaled $21,000, while in Idaho they averaged $20,700 and in Wyoming they were approximately $20,300. (See the map below for a breakdown of home equity gains and losses by state. Click to enlarge.)

“A moderation in home-price growth has reduced the gains in home-equity wealth and will likely slow the growth in home-improvement spending in the coming year,” said CoreLogic Chief Economist Frank Nothaft, adding that some homeowners are still opting to tap into this source of wealth to finance home renovations.

“For larger remodeling projects, homeowners often choose to cash-out some of their home equity through a first-lien refinance or placement of a second lien,” Nothaft added.

CoreLogic President and CEO Frank Martell said that while the gains may not be as substantial as before, they are still a strong sign of continued economic growth

“The country continues to experience record economic expansion as illustrated by these increases in home equity,” said Martell. “We expect home equity to continue increasing nationally in 2019, albeit at a slower pace than in recent years.”