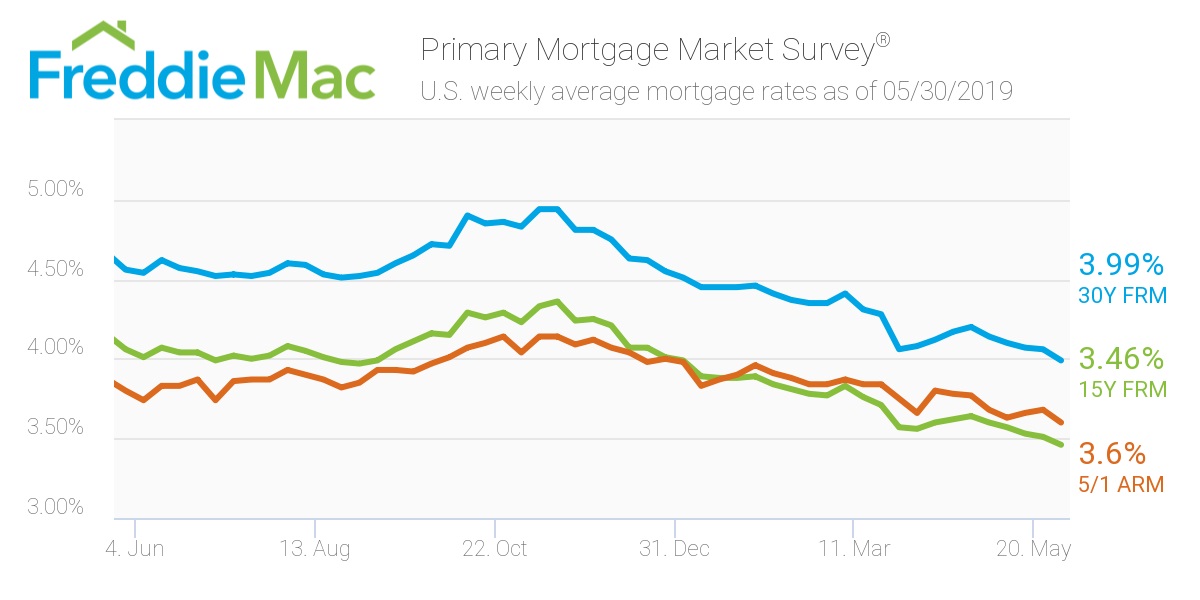

As economic tension continues to mount, mortgage rates fell below 4% this week to the lowest level since January 2018, according to the latest Freddie Mac Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage averaged 3.99% for the week ending May 30, 2019, down from last week’s rate of 4.06%. A year ago, the rate was 4.56%.

“While economic data points to continued strength, financial sentiment is weakening with the spread between the 10-year and the 3-month Treasury bill narrowing as fears of the impact of the trade war with China grow,” Freddie Mac Chief Economist Sam Khater said. “Lower rates should, however, give a boost to the housing market, which has been on the upswing with both existing and new home sales picking up recently.”

The 15-year FRM averaged 3.46% this week, retreating from last week’s 3.51%. This time last year, the 15-year FRM came in at 4.06%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.6%, declining from last week’s rate of 3.68%. This rate is much lower than the same time period in 2018 when it averaged 3.80%.

The image below highlights this week's changes: