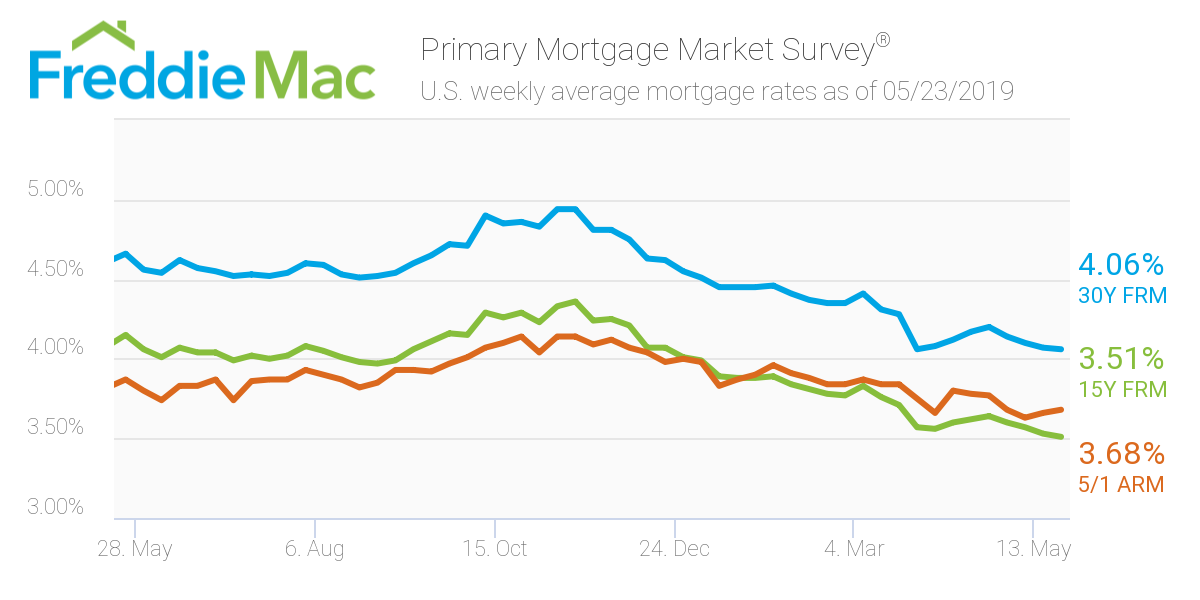

Mortgage interest rates have fallen for the fourth week in a row to match the one-year low set at the end of March, giving way to an uptick in purchase demand, according to the latest Freddie Mac Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage averaged 4.06% for the week ending May 23, 2019, down from last week’s rate of 4.07%. A year ago, the rate was 4.66%.

“Mortgage rates fell for the fourth consecutive week and continued the medium-term trend of lower rates since late 2018,” Freddie Mac Chief Economist Sam Khater said. “The drop in mortgage rates is causing purchase demand to rise and the mix of demand is skewing to the higher end as more affluent consumers are typically more responsive to declines in rates.”

The 15-year FRM averaged 3.51% this week, sliding from last week’s 3.53%. This time last year, the 15-year FRM came in at 4.15%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.68%, slightly rising from last week’s rate of 3.66%. This rate is much lower than the same time period in 2018 when it averaged 3.87%.

The image below highlights this week's changes: