The era of unusually affordable housing has ended, leaving many debt-burdened Americans struggling to afford housing.

This lack of affordability has especially impacted America’s first-time buyers, many who tend to fit in the Millennial category.

With more than $1.5 trillion in student loan debt, new LendingTree research shows an overwhelming majority of first-time homebuyers are considering purchasing “fixer-upper” homes to combat costs.

In fact, 88% of homebuyers that are grappling with student loan debt are now more likely to consider a “fixer-upper” home, according to the online lending marketplace’s data.

“Buyers paying off a student loan balance are more likely to consider purchasing a fixer-upper house than those with other kinds of debt, including personal loans, auto loans and credit cards,” LendingTree writes. “More than a quarter of homebuyers without debt don’t want to purchase a home that requires significant renovations or repairs.”

While purchasing a fixer-upper may seem like a good way to save cash, LendingTree indicates that 48% of homeowners have made major home improvements within the last two years.

Notably, Millennial homeowners are the most likely generation to have improved their home, sitting at nearly 58%. But how can they afford repairs with so much debt?

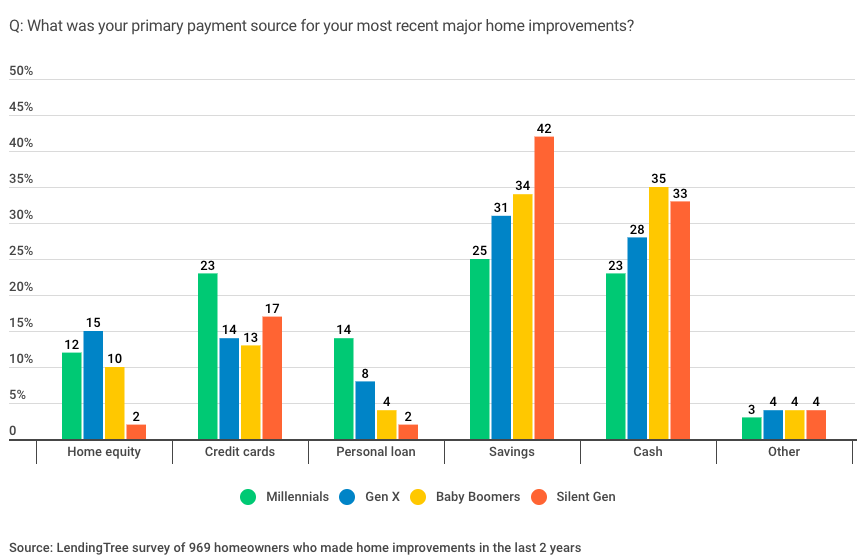

LendingTree's data revealed that 25% of Millennial homeowners are using their savings to finance their recent home improvements .

"Another 23% of Millennials used credit cards to fund their renovations and yet another 23% of the age group used cash,” LendingTree writes. “Older generations are more likely to have used cash and savings for improvement projects.”

Last year, data from Buildfax indicated that within the past five years, home remodeling has increased by about 30%. This percentage is expected to increase in the years to come.

The image below shows the primary payment source for homeowners making renovations:

(Click to enlarge; courtesy of LendingTree)

NOTE: In order to collect data, LendingTree commissioned Qualtrics to collect responses from 2,095 Americans aged 22 and older who are considering purchasing a home within the next two years, as well as 2,002 Americans who currently own a home.