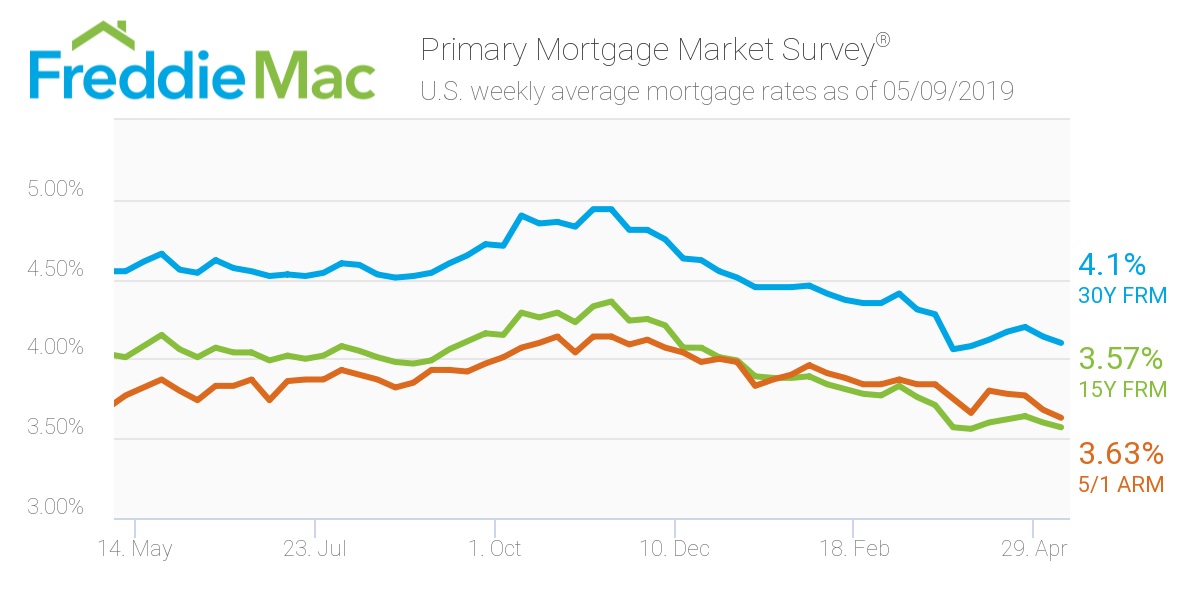

Mortgage interest rates have begun to moderate, giving way to a healthier spring homebuying season, according to the latest Freddie Mac Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage averaged 4.10% for the week ending May 9, 2019, down from last week’s rate of 4.14%. A year ago, the rate was 4.55%.

“Investors wary of the current economic situation due to ongoing trade disputes resorted to the bond market, causing the 10-year treasury yield to decrease,” Freddie Mac Chief Economist Sam Khater said. “A combination of low mortgage rates, a strong job market and modest wage growth should spur homebuyer interest and also serve as an incentive for homeowners looking to refinance this spring.”

The 15-year FRM averaged 3.57% this week, sliding from last week’s 3.60%. This time last year, the 15-year FRM sat significantly higher at 4.01%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.63%, falling from last week’s rate of 3.68%. This rate remains only moderately below the same time period in 2018, when it averaged 3.77%.