A recent analysis published by Moody’s Investors Services indicates the era of unusually affordable housing has ended, meaning America’s housing affordability has returned to average historical levels.

Although this means homes are no longer cheap on a national basis, LendingTree’s latest affordability report suggests the market is still relatively affordable for most Americans.

According to LendingTree’s data, those who earn America’s median income can still afford a median-priced home in the majority of the nation’s housing markets.

“This is good news, as it means that most metros aren’t prohibitively expensive for the majority of the middle class,” LendingTree writes. “In fact, we found that, on average, a middle-middle class family makes about $450 dollars more a month than what would be necessary to pay for a home priced at the median home value in their area.”

Additionally, LendingTree discovered lower-middle class families can still afford a median-priced home in 34 of the nation’s largest housing markets.

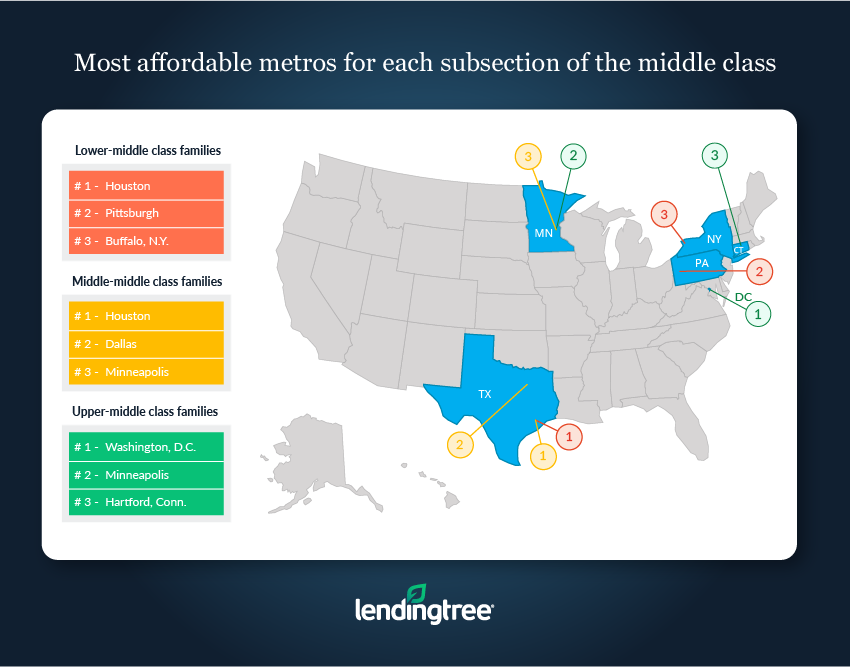

“Houston, Dallas and Minneapolis are the metros where members of the middle-middle class have the easiest time paying for a median priced home,” LendingTree writes. “In these metros, middle-middle class families could afford to pay almost $800 more than what they need to pay in order to purchase a median priced home.”

Unsurprisingly, the report also revealed upper-middle class families earn more than $1,900 above what would be necessary to pay for a median-value home.

“While there is no metro in our study where upper-middle class families cannot afford a median priced home, in Washington, D.C., Minneapolis and Hartford, Connecticut, they can afford to spend about $2,600 more than what they would need to pay for a median priced home,” LendingTree writes.

This image highlights the most affordable metros for each subsection of the middle class:

(Source: LendingTree)

NOTE: In order to determine whether or not a home is affordable, LendingTree assumes a middle-class buyer will be able to afford a 20% down payment and receive a mortgage loan with a rate of 4.6%.