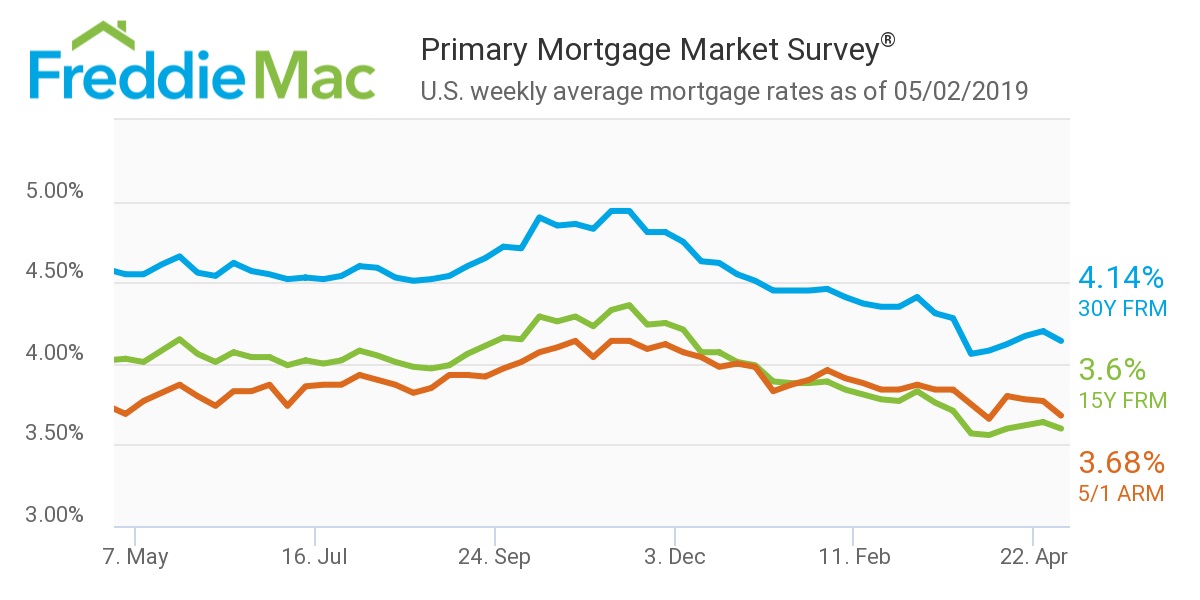

After four weeks of consecutive gains, mortgage interest rates finally reversed course, according to the latest Freddie Mac Primary Mortgage Market Survey.

The 30-year fixed-rate mortgage averaged 4.14% for the week ending May 2, 2019, down from last week’s rate of 4.20%. A year ago, the rate was 4.55%.

Freddie Mac Chief Economist Sam Khater said labor economic data and slightly weaker inflation caused mortgage rates to dip this week.

“Moving into summer, we expect rates to be about a quarter to half a percentage point lower than where they were last year, which is good news for the housing market,” Khater said. “These lower rates combined with solid economic growth, low inflation and rebounding consumer confidence should provide a solid foundation for home sales to continue to improve over the next couple of months.”

The 15-year FRM averaged 3.60% this week, retreating from last week’s 3.64%. This time last year, the 15-year FRM sat significantly higher at 4.03%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.68%, falling backwards from last week’s rate of 3.77%. This rate remains only slightly higher than the same time period in 2018, when it averaged 3.69%.