House flipping is making a comeback, with the number of homes built on spec approaching its 2006 high.

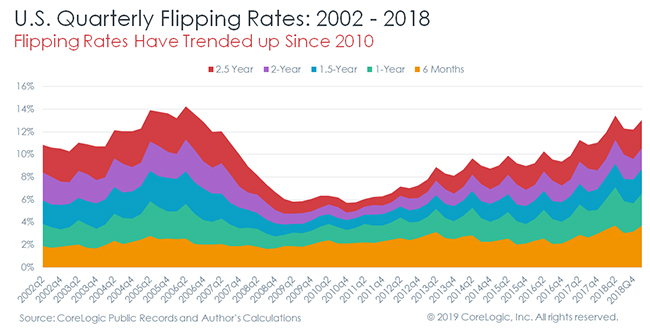

The latest data from CoreLogic reveals that 10.9% of all home sales in the fourth quarter of 2018 were flips, or homes that have been occupied for two years or less. This is the highest rate since the housing bubble days of 2006, when flips comprised 11.4% of home sales. (See chart below; click to enlarge.)

The overzealous speculation of house flippers in the months leading up to the crisis is often cited as a contributing factor to the housing bubble. So should we be worried now that houses built on spec appear to be making a comeback?

The overzealous speculation of house flippers in the months leading up to the crisis is often cited as a contributing factor to the housing bubble. So should we be worried now that houses built on spec appear to be making a comeback?

No, says CoreLogic, citing evidence suggesting that the business is far from what it used to be.

Instead of flipping homes based solely on price speculation, investors are flipping with a focus on adding real value to properties.

And, the data suggests that today’s flippers are more experienced and that they are scoping for deals on older properties where the returns are greater.

CoreLogic said there is a growing number of professional flippers in the market, with the percentage of properties sold by a business entity reaching 41% in Q3 2018 compared with 2005’s low of 11%. This could be a trend attributed to the rise of iBuying companies like Opendoor and Offerpad, which buy homes directly from sellers, fix them up and then list them.

And it seems these flippers know what they’re doing.

“We’ve seen growing signs that flippers are getting increasingly good at buying properties at a discount while the premium they’re selling for has remained mostly constant,” CoreLogic noted. “This is yet more evidence that flipping today is less risky and less speculative than during the 2000s.”

Further, CoreLogic found that returns are greatest in markets where there is a high percentage of flips on older homes.

While these flips may require more cash, the payoff, in the end, is greater.

“Flips undertaken on older homes likely require more capital to bring the home up to market standard than newer homes. Such updates [might] include costly improvements to electrical systems, plumbing, foundations, and roofing,” CoreLogic said, adding that “flippers are likely to reap substantial discounts when buying properties with such deferred maintenance.”

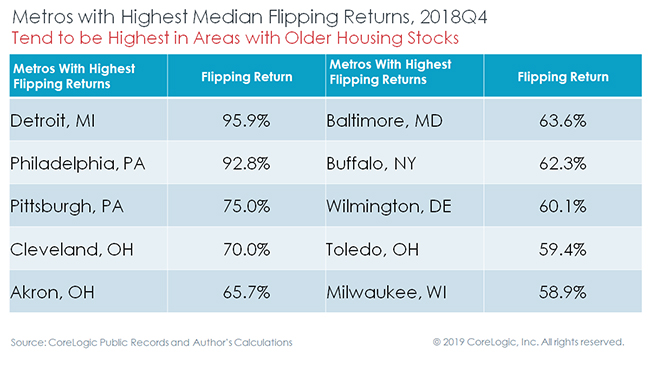

Flippers in the Rustbelt and the lowest part of the Sunbelt saw the greatest returns on their investment, CoreLogic revealed, with those flipping in Detroit, Philadelphia, and Pittsburgh reaping the greatest benefit. Other states with great returns for flippers include Ohio, Maryland, Delaware, Wisconsin, and New York.

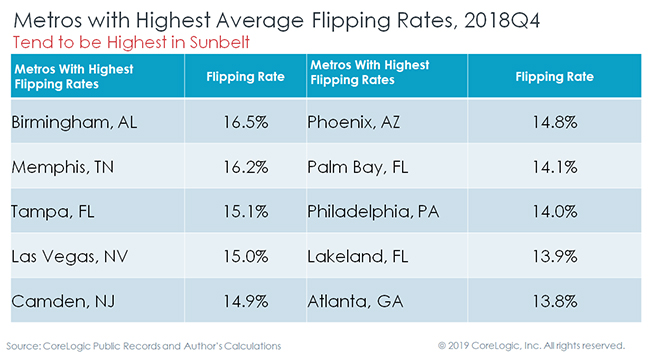

Here is a chart of the cities with the greatest number of flips:

Here is a chart of the markets where flippers are seeing the greatest returns: