Servicemembers are far more likely to opt for a Department of Veterans Affairs mortgage than any other type of loan when buying their first home, a new report from the Consumer Financial Protection Bureau shows.

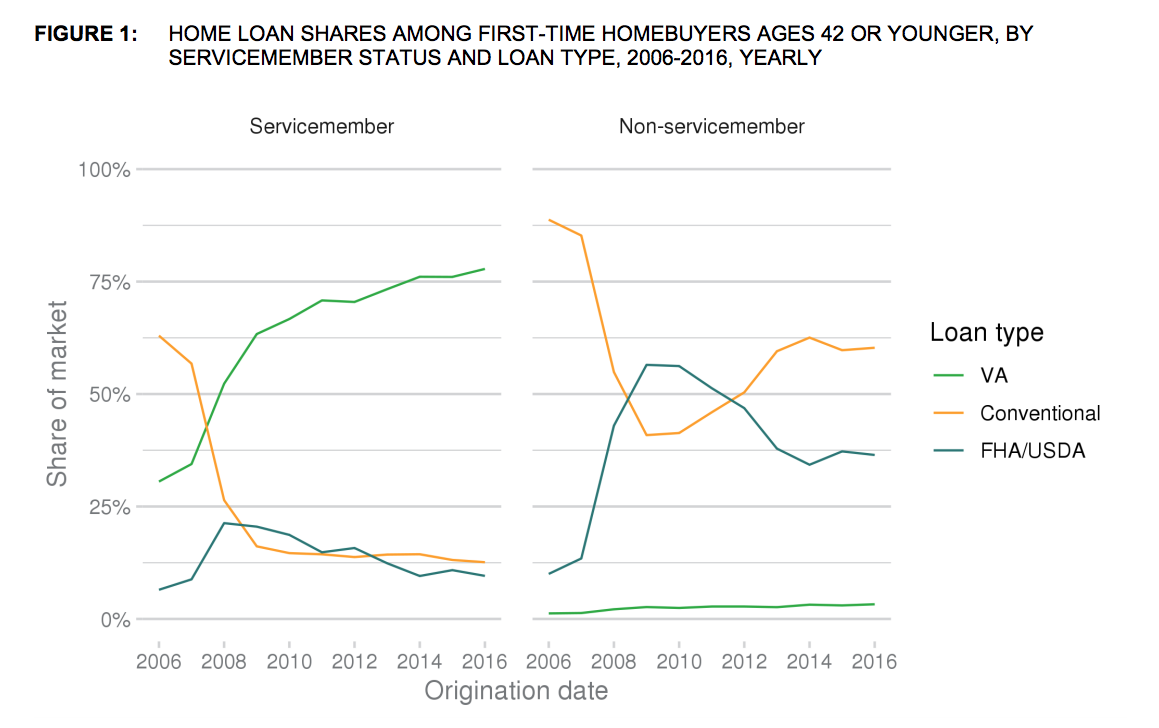

The CFPB report, the first of its kind, looks at mortgages for first-time homebuying servicemembers, shows that in 2007, servicemembers buying their first home used VA loans approximately 30% of the time. By 2016, that figure had risen to 78%, meaning more than three out of four servicemembers bought their first home using a VA loan.

Conversely, with servicemembers increasingly preferring VA loans, their share of conventional mortgages fell precipitously (as seen in the graph below).

(Image courtesy of the CFPB. Click to enlarge.)

“The greater share of VA loans among servicemembers was part of a larger shift away from conventional to government-guaranteed mortgages between 2006 and 2009 for both servicemembers and non-servicemembers,” the CFPB noted in its report.

According to the CFPB, conventional mortgages made up approximately 60% of all loans among first-time homebuying servicemembers in 2006 and 2007, but this share fell all the way to 13% by 2016.

As for why the shift has taken place, the CFPB said that the features of the VA loan, namely “allowing a purchase with no down payment and without mortgage insurance and providing stronger loan-servicing protections than many other mortgages,” make the loan far more attractive than other options among first-time buyers.

Beyond the frequency at which servicemembers are buying their first houses with a VA loan, the median loan amount on those loans is also rising.

According to the CFPB report, the median servicemember first-time homebuyer VA loan amount increased in nominal dollars from $156,000 in 2006 to $212,000 in 2016, which closely tracks with the median value of conventional home loans taken out by non-servicemembers during that same time.

Additionally, early delinquency rates (the share of loans 60 days or more delinquent within one year of origination) have fallen for both prime and non-prime first-time homebuyers using VA loans.

As the CFPB notes, among non-prime borrowers, VA loan delinquency rates for servicemembers peaked in 2007 at approximately 7% before falling to just over 3% in 2016.

Delinquency rates for prime borrowers using VA loans also fell from 2006 through 2016 as the market improved.

To read the CFPB’s full report, click here.