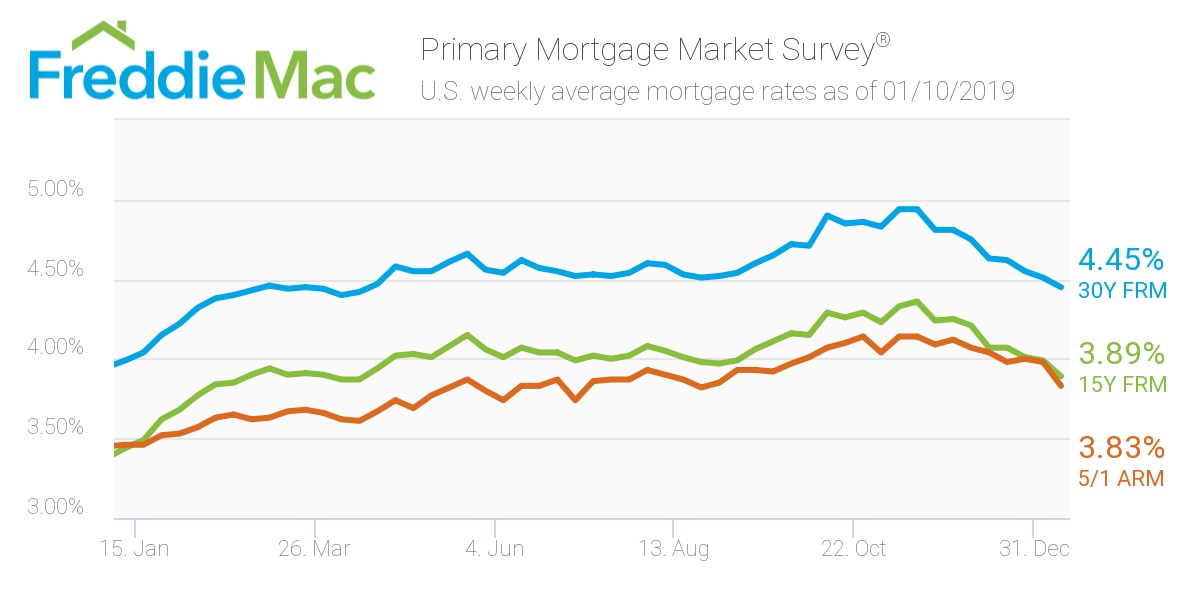

Mortgage rates took a dive across the board, reaching the lowest levels in months, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage declined from 4.51% last week, averaging 4.45% for the week ending Jan. 10, 2019. That being said, this is still an increase from last year’s rate of 3.99%.

“Mortgage rates fell to the lowest level in nine months, and in response, mortgage applications jumped more than 20 %,” Freddie Mac Chief Economist Sam Khater said. “Lower mortgage rates combined with continued income growth and lower energy prices are all positive indicators for consumers that should lead to a firming of home sales.”

(Click to enlarge)

The 15-year FRM averaged 3.89% this week, sliding from last week’s average of 3.99%. Notably, this time last year, the 15-year FRM was 3.44%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.83%, retreating from 3.98% the week before. Once again, the rate remains higher than this time in 2018 when it averaged 3.456%.