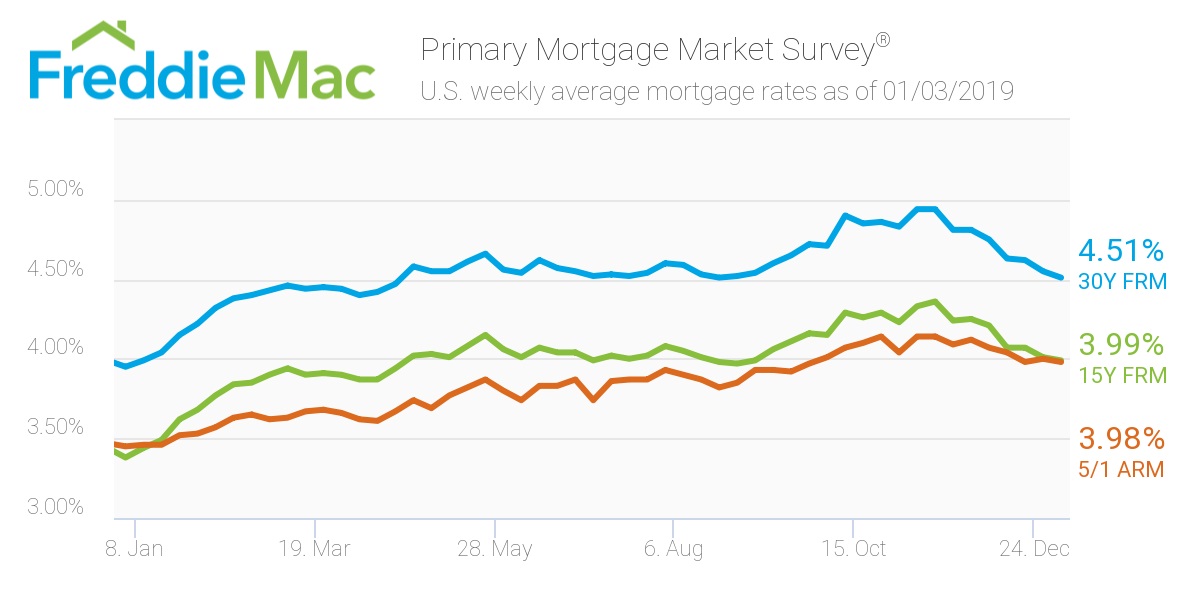

Prospective buyers should have a bit more pep in their step as 2019 begins with comparably low mortgage rates, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the survey, the 30-year fixed rate mortgage declined from 4.55% last week, averaging 4.51% for the week ending Jan. 3, 2019. Notably, this is still an increase from last year’s rate of 3.95%.

Freddie Mac Chief Economist Sam Khater explained that the combination of lower rates and decreases in home prices should get those looking to buy a home excited.

“Low mortgage rates combined with decelerating home price growth should get prospective homebuyers excited to buy,” Khater continued. “However, it will be interesting to see how the recent turmoil in the stock market will affect homebuying activity in the coming months.”

(Click to enlarge)

The 15-year FRM averaged 3.99% this week, retreating from last week’s average of 4.01%. This time last year, the 15-year FRM was 3.38%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.98%, slightly down from 4% the week before. That being said, the rate remains higher than this time in 2018 when it averaged 3.45%.